Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

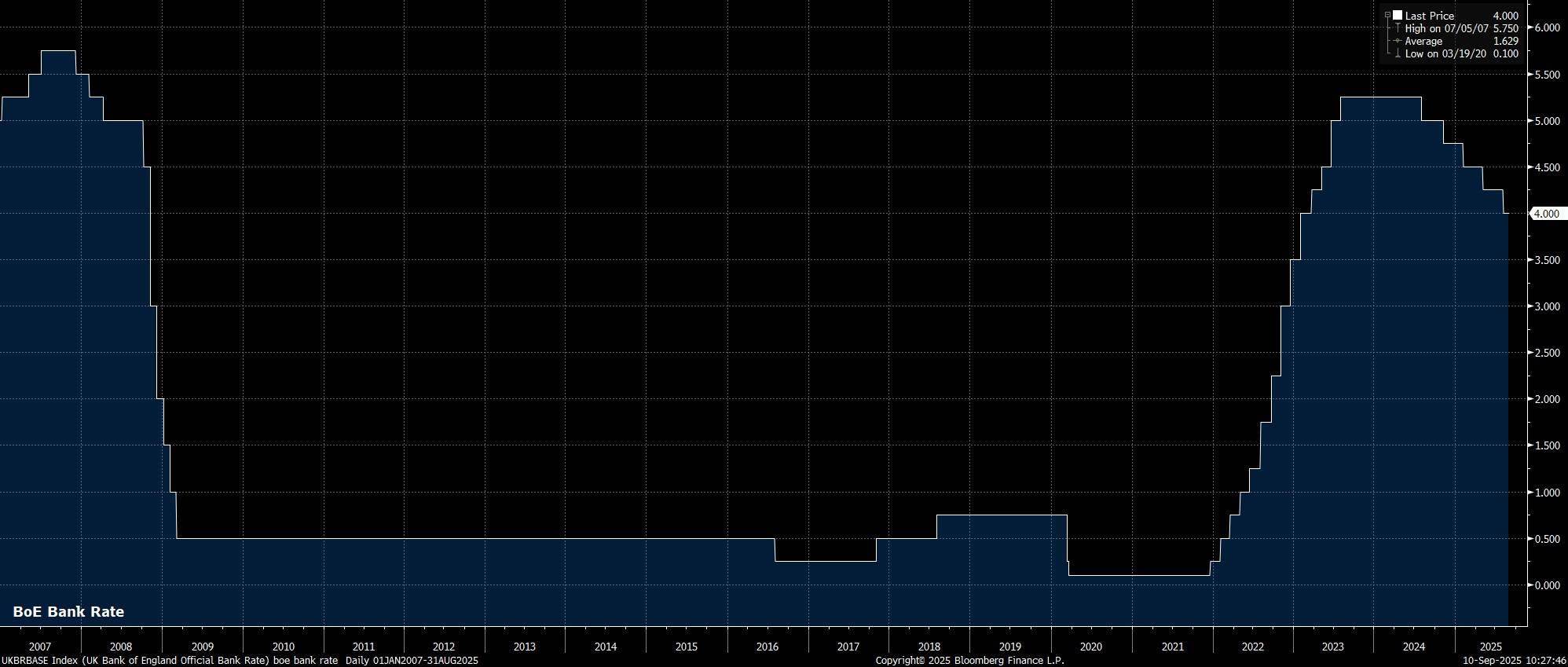

As noted, Bank Rate is set to be maintained at 4.00% at the conclusion of the September MPC confab, after policymakers voted by the narrowest possible margin to deliver a 25bp cut at the prior meeting, in August.

As noted, Bank Rate is set to be maintained at 4.00% at the conclusion of the September MPC confab, after policymakers voted by the narrowest possible margin to deliver a 25bp cut at the prior meeting, in August. Money markets, per the GBP OIS curve, price no chance of any rate moves this time around, while discounting just 10bp of easing by year-end. The next 25bp cut isn't fully discounted until next March.

However, in keeping with almost all MPC decisions this cycle, the call to stand pat this time around is unlikely to be a unanimous vote.

A 7-2 vote in favour of holding Bank Rate steady seems to be the most plausible outcome, with external members Dhingra and Taylor dissenting in favour of a 25bp cut. Dhingra, owing to her typically uber-dovish policy stance, and Taylor owing to his initial vote for a 50bp reduction last time out, as well as recent commentary indicating his preference for ‘four to five' cuts being delivered this year (we've thus far had 3, in total).

In any case, no matter the vote split, the MPC's policy guidance is likely to be unchanged from that issued last time out, and the language with which participants have become familiar this cycle. Consequently, the statement is likely to reiterate that the MPC will take a ‘gradual and careful' approach in terms of future rate reductions, while also repeating that the pace of future rate reductions will remain ‘data-dependent'.

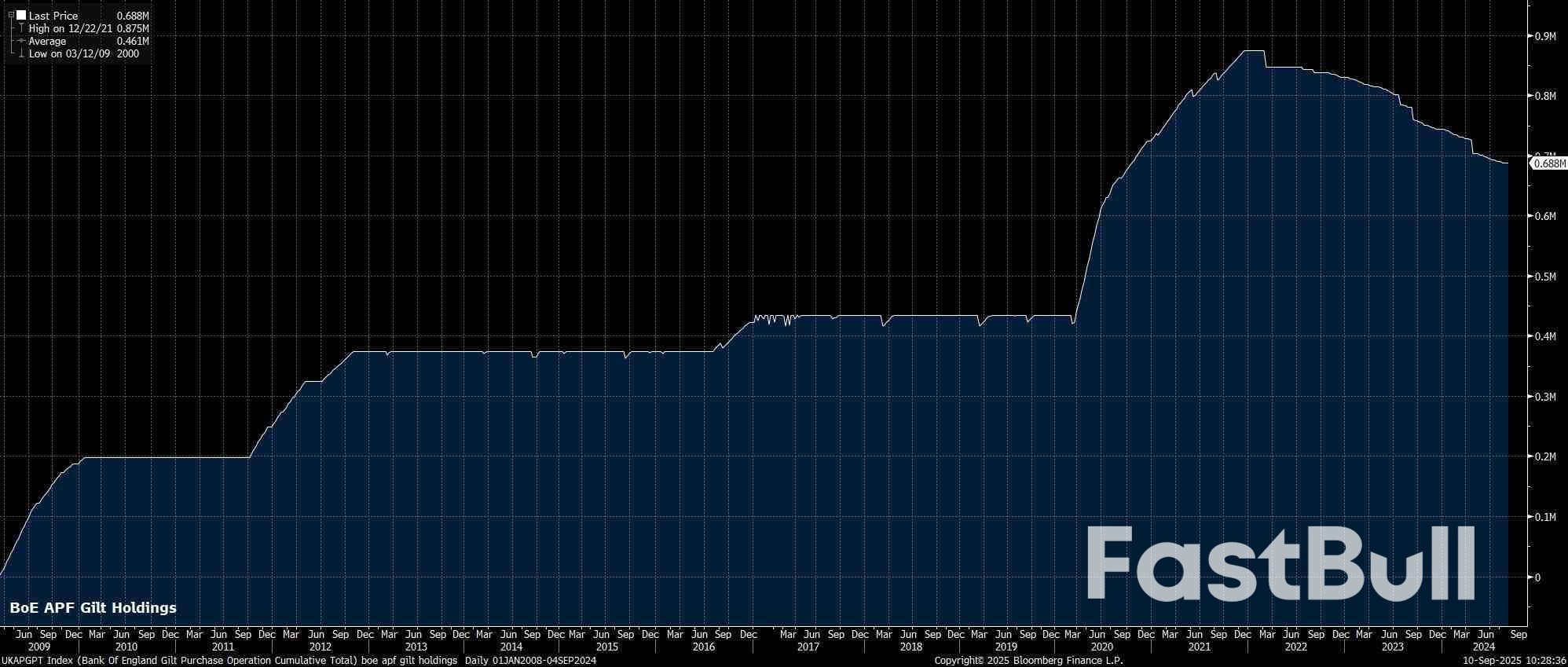

With the rate decision itself, and accompanying policy statement, both relatively predictable, the main area of intrigue around the September MPC decision will be the annual review into the Bank's balance sheet.For the last three years, the MPC has been reducing holdings in the Asset Purchase Facility (APF), which now comprises only Gilts, by £100bln per annum, with that pace split between the passive run-off of maturing securities which haven't been replaced in the portfolio, and active sales of Gilts from within the APF.

While those active sales have proceeded relatively smoothly, at least in terms of their reception by market participants, the Bank's own research points to the active sale process adding a premium of as much as 25bp onto the 10-year Gilt yield, and likely a higher premium further out the curve. In addition, these active sales also result in the Bank crystallising a loss on its holdings, for which it must be indemnified by HM Treasury, while also prompting a much steeper Gilt curve, compared to DM peers, as active sales take place in a market where demand for long Gilts is already waning significantly.With all that in mind, and with the tightening impact of quantitative tightening (QT), to at least some extent, offsetting any easing impulse from ongoing Bank Rate reductions, the MPC are likely to trim the overall QT envelope this time out.

Maturing Gilts in the APF would passively reduce the size of the Bank's holdings by around £50bln in the twelve months from the upcoming review, with the question then coming down to the amount of active sales that the MPC would seek to conduct. Anything greater than the 2024/25 amount of £13bln seems implausible, which likely leaves the overall reduction will land at around £60bln over the next 12 months. Ending active Gilt sales would be a pragmatic option to ensure market stability, though tilting sales increasingly towards shorter maturities to avoid a disorderly rise in long-end yields seems a more plausible choice.

Turning to other matters, with there being no new economic forecasts due this time around, there is also no post-meeting press conference scheduled. That said, Governor Bailey may make some media remarks, though these are likely to be very much in keeping with recent comments, namely that rates remain on a ‘downward path', but that the MPC should neither cut too quickly, nor too much.Taking a step back, besides the aforementioned balance sheet developments, the September MPC decision is unlikely to offer especially much by way of fresh information on the outlook for Bank Rate.

Still, by retaining the ‘gradual and careful' guidance, the MPC will clearly retain an easing bias, and a preference to deliver rate cuts at a predictable, quarterly pace. As such, the next 25bp cut is still likely to come at the November meeting, though the release of the September CPI report, due 22nd October, may threaten such a call, if headline inflation rises north of the MPC's projected 4% peak.

A gauge tracking emerging market equities rose on Wednesday, with a Federal Reserve interest rate cut all but sealed for this month, while Polish assets came under pressure as Russia's war in Ukraine spilled into its territory.

The zlotyweakened 0.4% against the euro, underperforming regional peers, while Warsaw's stocks fell 2%.

Poland said it had shot down Russian drones that entered its airspace during an attack on western Ukraine — the first time a NATO member has engaged militarily inthe conflict.

Since Russia's invasion of Ukraine in 2022, drones have periodically strayed into NATO territory, including Romania and Poland, but had not previously been intercepted.

Ukraine's international bonds edged lower, while the Russian roubleweakened to a more than five-month low.

"We're going to see more incidents like this partly because it's war. Poland has a very strong lobby and the economy speaks for itself and continues to do well and it's politically in a good place, So it's in a very strong position," said Jonathan Young, CEO of CEEMENA-focused investment firm Gryphon Holdings.

"You're obviously going to get this kind of short-term reaction to what happened overnight but I wouldn't be reading too much into it."

Meanwhile, an Israeli airstrike on Qatar that targeted Hamas leaders rocked markets in the Middle East. Stocks in Dohafell 0.4%, while Saudi Arabia'sand Dubai'sindexes slipped more than 0.2% each.

Tel Aviv stocks, however, bucked the trend, hitting a record high for a second straight session.

Emerging markets shook off a week of political churn in countries including Turkey, Argentina, Thailand, Indonesia and Nepal, as a looming Federal Reserve rate cut kept risk appetite alive. The MSCI EM equity gauge was on track for a second straight weekly gain, with CME's FedWatch tool showing a 25 bp cut fully priced and odds of 50 bp creeping higher.

"A lot of EM countries don't have deep stock markets, but they have big economies. If the Fed cuts and the dollar is weak, there will then spillover effects into these stock markets, but the longer-term view is what's the economy looking like," Young added.

Hungary's central bank was due to publish August minutes on Wednesday after holding rates steady for an 11th straight month, with headline inflation still above its 2%–4% target band. The high carry has kept the forint in favour, powering one of central and eastern Europe's strongest year-to-date gains.

In Asia, Chinese stocks,,were in the green, tracking broader Asian markets, after data showed the country's producer deflation eased in August as Beijing stepped up efforts to curb price competition, while consumer prices fell at their fastest rate in six months.

USD/JPY held stubbornly within the tight 146.90–149.00 range despite the recent NFP-driven turbulence that caused a flash drop to 146.29. However, with the sideways move now stretching into its eighth consecutive week and the clock ticking down to today’s release of the US Producer Price Index (PPI) for August, a shift in sentiment may be just around the corner.

The data may reveal whether input costs continue to squeeze producers’ margins, strengthening the case for sticky inflation as the labor market shows stronger signs of cooling. From a technical perspective, traders remain indecisive: the RSI is hovering just below its neutral 50 mark, while the MACD is muted between its zero and red signal lines. Price action is also limited near the 20- and 50-day simple moving averages (SMAs).

As a result, traders may prefer to stay on the sidelines unless a clear break occurs. A sustainable move below the 146.90 floor could open the door to the 145.55 support level. Further declines might then target 144.35, followed by the 142.70 floor.

On the flip side, buyers may wait for a decisive rebound above the 200-day SMA at 148.60 and the 149.00 zone. If that resistance gives way, the pair could advance toward the 151.00 level, which the bulls failed to secure in July. Slightly higher, the tentative resistance trendline connecting the May and July highs could cap gains near 151.75.

In short, USD/JPY remains in wait-and-see mode for the second straight month. A move above 148.60 or below 146.90 could set the next directional course.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up