Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

A federal judge ruled that Federal Reserve Governor Lisa Cook can remain in her role while challenging President Trump’s attempt to fire her over alleged mortgage fraud.

Copper held steady above $9,900 a ton on the London Metal Exchange, with traders weighing supply risks in Indonesia and signs that deflationary pressures are easing in China’s industrial economy.

Prices for the bellwether industrial metal have traded in a narrow range this week, even after Freeport McMoRan Inc announced that it has suspended operations at its massive mine in Indonesia’s Grasberg minerals district after an incident left some workers trapped. Seven workers who could not evacuate are believed to be safe, and crews are clearing paths to them, it said.

The operation is the world’s second-largest copper mine, and a prolonged outage could quickly tighten the market, compounding longer-running supply constraints that have bolstered prices this year.

“Lost days do not necessarily have an immediate impact on global supply,” Bernard Dahdah, an analyst at Natixis, said in an emailed note. “That said, longer outages that run for weeks are much harder to compensate.”

On the demand side, data released Wednesday that showed China’s factory deflation eased for the first time in six months, in a tentative sign of progress in the government’s campaign to ease overcapacity in key industrial sectors.

China is in its third straight year of deflation for the first time since it started to transition away from central planning in the late 1970s. Nine straight quarters of economy-wide price declines reflect a mismatch between supply and demand, weighing on the balance sheets of companies and pushing down the earnings of both households and the government.

Copper prices were up 0.2% $9,929 a ton on the London Metal Exchange as of 11:08 a.m. local time. Aluminum, nickel and lead were also flat, while zinc and tin rose.

Asia's diesel markets remained thinly discussed on the trading window, though market structures went back to a softening trend and some spot offers did emerge from refiners.

More October refiner spot sales surfaced in line with earlier expectations, though some private negotiations could be ongoing.

The front-month diesel east-west price spreads narrowed slightly, reflecting the decline in ICE gasoil futures prices ahead of the contract expiry on Thursday.

Refining margins (GO10SGCKMc1) reversed gains and declined back to one-week lows of around $19.2 a barrel.

Cash differentials (GO10-SIN-DIF) slipped slightly to 86 cents per barrel, amid mixed buying and selling activities on the trading window.

Jet fuel markets continued to weaken further because of ample supply talks.

Regrade (JETREG10SGMc1) widened further to around $2 a barrel.

- U.S. crude, gasoline and distillate stocks rose last week, market sources said, citing American Petroleum Institute figures on Tuesday.

- Middle distillates inventories slipped slightly to 2.188 million barrels for the week ended September 8, according to industry information service S&P Global Commodity Insights.

- Petronas is trying to achieve a 90% operating rate by the end of this year at the crude unit for its Pengarang refinery, Ahmad Adly Alias, the firm's vice president for refining, marketing and trading told Reuters on the sidelines of the APPEC industry event on Wednesday.

- Oil prices rose on Wednesday after Israel attacked Hamas leadership in Qatar and U.S. President Donald Trump asked Europe to impose tariffs on buyers of Russian oil buyers, though a weak market outlook capped further gains.

- An executive with Thai energy firm Bangchak Corp said on Wednesday there is no sign yet of details on the country's expected mandate for sustainable aviation fuel usage.

- Crude oil loadings from the Caspian Pipeline Consortium (CPC) marine terminal at Yuzhnaya Ozereyevka near Novorossiisk port were holding steady at around 1.6 million barrels per day so far in September, in line with a provisional export schedule, two traders familiar with the matter said on Tuesday.

- Southeast Asia is positioned to export biofuels to other markets such as Europe as production capacity exceeds demand in the region, a senior executive with Malaysian state oil and gas company Petronas said on Wednesday.

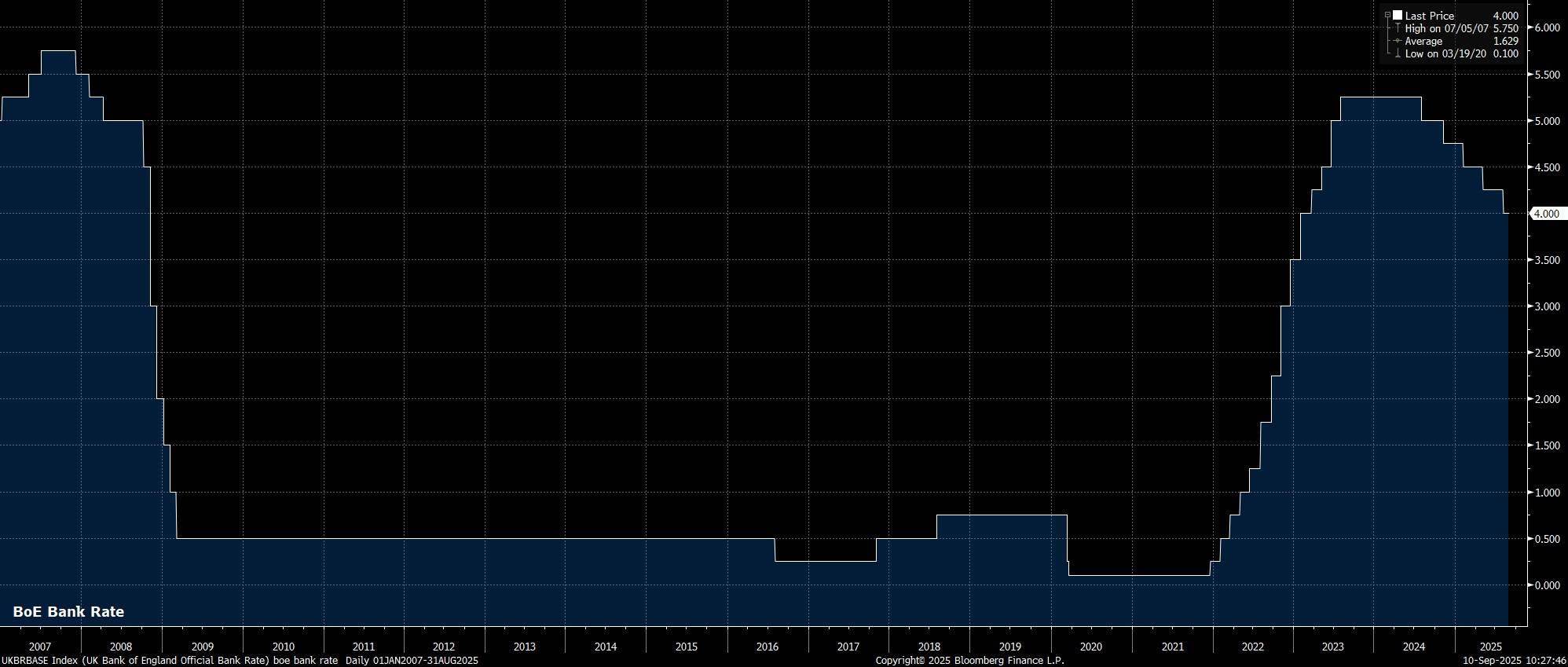

As noted, Bank Rate is set to be maintained at 4.00% at the conclusion of the September MPC confab, after policymakers voted by the narrowest possible margin to deliver a 25bp cut at the prior meeting, in August. Money markets, per the GBP OIS curve, price no chance of any rate moves this time around, while discounting just 10bp of easing by year-end. The next 25bp cut isn't fully discounted until next March.

However, in keeping with almost all MPC decisions this cycle, the call to stand pat this time around is unlikely to be a unanimous vote.

A 7-2 vote in favour of holding Bank Rate steady seems to be the most plausible outcome, with external members Dhingra and Taylor dissenting in favour of a 25bp cut. Dhingra, owing to her typically uber-dovish policy stance, and Taylor owing to his initial vote for a 50bp reduction last time out, as well as recent commentary indicating his preference for ‘four to five' cuts being delivered this year (we've thus far had 3, in total).

In any case, no matter the vote split, the MPC's policy guidance is likely to be unchanged from that issued last time out, and the language with which participants have become familiar this cycle. Consequently, the statement is likely to reiterate that the MPC will take a ‘gradual and careful' approach in terms of future rate reductions, while also repeating that the pace of future rate reductions will remain ‘data-dependent'.

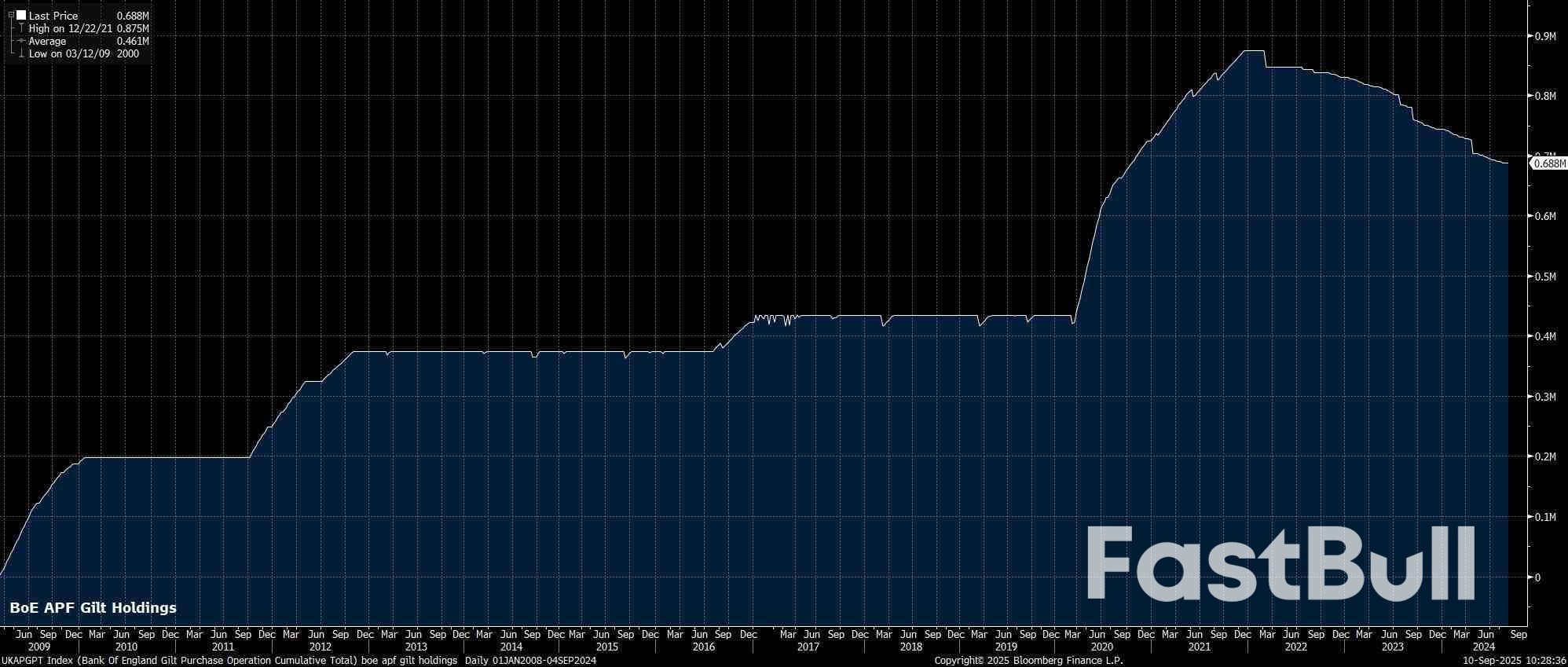

With the rate decision itself, and accompanying policy statement, both relatively predictable, the main area of intrigue around the September MPC decision will be the annual review into the Bank's balance sheet.For the last three years, the MPC has been reducing holdings in the Asset Purchase Facility (APF), which now comprises only Gilts, by £100bln per annum, with that pace split between the passive run-off of maturing securities which haven't been replaced in the portfolio, and active sales of Gilts from within the APF.

While those active sales have proceeded relatively smoothly, at least in terms of their reception by market participants, the Bank's own research points to the active sale process adding a premium of as much as 25bp onto the 10-year Gilt yield, and likely a higher premium further out the curve. In addition, these active sales also result in the Bank crystallising a loss on its holdings, for which it must be indemnified by HM Treasury, while also prompting a much steeper Gilt curve, compared to DM peers, as active sales take place in a market where demand for long Gilts is already waning significantly.With all that in mind, and with the tightening impact of quantitative tightening (QT), to at least some extent, offsetting any easing impulse from ongoing Bank Rate reductions, the MPC are likely to trim the overall QT envelope this time out.

Maturing Gilts in the APF would passively reduce the size of the Bank's holdings by around £50bln in the twelve months from the upcoming review, with the question then coming down to the amount of active sales that the MPC would seek to conduct. Anything greater than the 2024/25 amount of £13bln seems implausible, which likely leaves the overall reduction will land at around £60bln over the next 12 months. Ending active Gilt sales would be a pragmatic option to ensure market stability, though tilting sales increasingly towards shorter maturities to avoid a disorderly rise in long-end yields seems a more plausible choice.

Turning to other matters, with there being no new economic forecasts due this time around, there is also no post-meeting press conference scheduled. That said, Governor Bailey may make some media remarks, though these are likely to be very much in keeping with recent comments, namely that rates remain on a ‘downward path', but that the MPC should neither cut too quickly, nor too much.Taking a step back, besides the aforementioned balance sheet developments, the September MPC decision is unlikely to offer especially much by way of fresh information on the outlook for Bank Rate.

Still, by retaining the ‘gradual and careful' guidance, the MPC will clearly retain an easing bias, and a preference to deliver rate cuts at a predictable, quarterly pace. As such, the next 25bp cut is still likely to come at the November meeting, though the release of the September CPI report, due 22nd October, may threaten such a call, if headline inflation rises north of the MPC's projected 4% peak.

A gauge tracking emerging market equities rose on Wednesday, with a Federal Reserve interest rate cut all but sealed for this month, while Polish assets came under pressure as Russia's war in Ukraine spilled into its territory.

The zlotyweakened 0.4% against the euro, underperforming regional peers, while Warsaw's stocks fell 2%.

Poland said it had shot down Russian drones that entered its airspace during an attack on western Ukraine — the first time a NATO member has engaged militarily inthe conflict.

Since Russia's invasion of Ukraine in 2022, drones have periodically strayed into NATO territory, including Romania and Poland, but had not previously been intercepted.

Ukraine's international bonds edged lower, while the Russian roubleweakened to a more than five-month low.

"We're going to see more incidents like this partly because it's war. Poland has a very strong lobby and the economy speaks for itself and continues to do well and it's politically in a good place, So it's in a very strong position," said Jonathan Young, CEO of CEEMENA-focused investment firm Gryphon Holdings.

"You're obviously going to get this kind of short-term reaction to what happened overnight but I wouldn't be reading too much into it."

Meanwhile, an Israeli airstrike on Qatar that targeted Hamas leaders rocked markets in the Middle East. Stocks in Dohafell 0.4%, while Saudi Arabia'sand Dubai'sindexes slipped more than 0.2% each.

Tel Aviv stocks, however, bucked the trend, hitting a record high for a second straight session.

Emerging markets shook off a week of political churn in countries including Turkey, Argentina, Thailand, Indonesia and Nepal, as a looming Federal Reserve rate cut kept risk appetite alive. The MSCI EM equity gauge was on track for a second straight weekly gain, with CME's FedWatch tool showing a 25 bp cut fully priced and odds of 50 bp creeping higher.

"A lot of EM countries don't have deep stock markets, but they have big economies. If the Fed cuts and the dollar is weak, there will then spillover effects into these stock markets, but the longer-term view is what's the economy looking like," Young added.

Hungary's central bank was due to publish August minutes on Wednesday after holding rates steady for an 11th straight month, with headline inflation still above its 2%–4% target band. The high carry has kept the forint in favour, powering one of central and eastern Europe's strongest year-to-date gains.

In Asia, Chinese stocks,,were in the green, tracking broader Asian markets, after data showed the country's producer deflation eased in August as Beijing stepped up efforts to curb price competition, while consumer prices fell at their fastest rate in six months.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up