Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Jera Co., Japan’s largest LNG buyer and power utility, is expanding its footprint in Southeast Asia to meet growing regional electricity demand...

China's and Canada's leaders met on Friday for the first formal sitdown in eight years as the two nations look to reset ties strained over trade and security issues.

President Xi Jinping met with Canada's Prime Minister Mark Carney on the sidelines of the Asia Pacific Economic Community meeting in Gyeongju, South Korea. Carney said he welcomed an invitation for him to visit China extended by Xi.

Xi said at the start of their meeting, "In recent times, after mutual efforts, China-Canada ties have shown a recovery and improvement trend. This aligns with both countries' mutual interest."

"Our countries have a long history of engagement," Carney said, noting the recent 55th anniversary of the establishment of diplomatic ties with Communist-ruled China. "In recent years we have not been as engaged," he said, in oblique reference to the tensions between the two Pacific nations.

"Distance is not the way to solve problems, not the way to serve our people with people-centered growth," the prime minister said. "Pragmatic and constructive engagement is."

Xi, for his part, said that "China is willing to work with Canada to push China-Canada ties to return to the correct track of being healthy, stable and sustainable as soon as possible."

Canada's relationship with China plummeted when China detained two Canadians, Michael Kovrig and Michael Spavor, in apparent retaliation for Canada's arrest of Huawei executive Meng Wanzhou on a US extradition warrant.

The two men were released in 2021, but ties didn't dramatically improve — with allegations swirling in Canada that China had interfered in previous elections and Beijing continuing to block imports of Canadian beef and pet food, among other goods.

Former leader Justin Trudeau spoke briefly to Xi in late 2023, with that exchange the first time they had spoken since Xi chastised Trudeau in public for allegedly leaking details of a prior meeting.

China hiked tariffs on Canadian canola in August in the latest round of their ongoing trade war, but since then the pace of bilateral contact has picked up, with Carney meeting Chinese Premier Li Qiang last month in New York and Foreign Minister Anita Anand traveling to Beijing earlier this month to meet her Chinese counterpart, Wang Yi.

Earlier this week, Carney downplayed expectations for immediate tariff relief, saying the meeting would be "the start of a broader discussion."

He said there were some areas where the two sides could make quick progress, such as easing travel restrictions on each other's citizens. But the goal will also be to set conditions for longer-term progress on trickier matters, he added.

"We're starting from a very low base and we can move quite substantially before we start to get to sensitive areas," Carney told reporters on Monday.

Canada currently has steep tariffs on Chinese electric vehicles, steel and aluminum products, which were imposed in 2024 in an effort to match US policies.

Carney is seeking to balance his security interests, which overlap with Washington, against his country's economic wellbeing, which is being tested by Trump's aggressive trade war. His Asia tour is part of his recently announced goal to double Canada's exports to markets outside the US within a decade to net an extra C$300 billion ($215 billion) in trade.

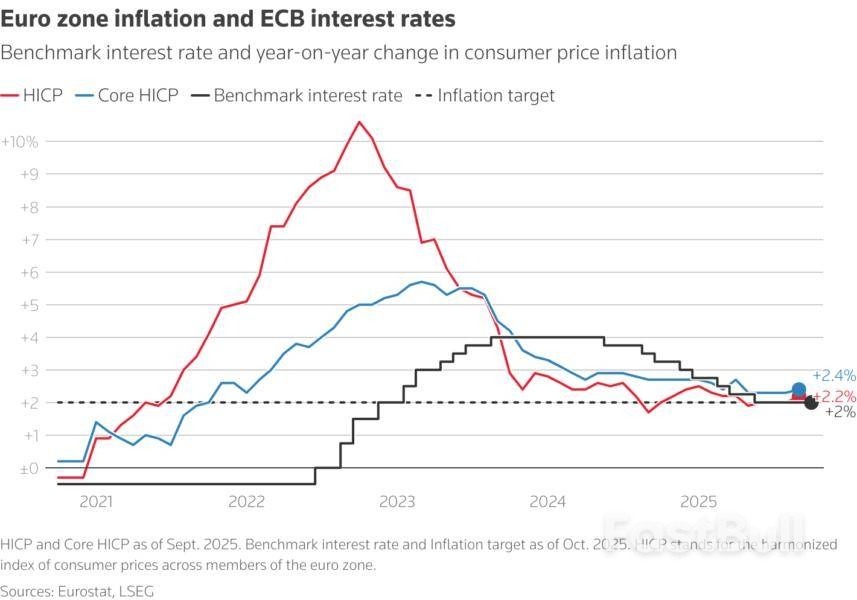

The European Central Bank must be careful in interpreting the inflation projections it will receive in December and avoid erratic policy decisions, according to Governing Council member Martins Kazaks.

While a first glimpse of estimated price trends in 2028 will help officials assess whether the ECB is still on track to its 2% target, elevated uncertainty means the likelihood of revisions is unusually high, the governor of Latvia's central bank said in an interview. He added that steadiness is a virtue policymakers should uphold.

"The 2028 forecast will be very important to look at, to see where inflation dynamics are going, but I would not overestimate the importance," Kazaks said. "Uncertainty remains high and is unlikely to disappear, so forecasts will come with a very large margin of error."

The ECB held its deposit rate at 2% on Thursday and President Christine Lagarde reiterated that policy continues to be in a "good place." While she refused to be drawn on whether December may see another cut — adding to eight so far this cycle — her assessment of the economy signaled that the bar may be high.

"If we see that we need to move, then we move — but we don't need to be jumpy," said Kazaks. "The steadiness of our policy decisions is an advantage."

In September, the ECB predicted inflation rates of 1.7% next year and 1.9% in 2027. An update is due in December, when economists will add 2028 to the outlook, with the magnitude and direction of revisions still very much unclear.

Kazaks's comments are in line with those of Austria's Martin Kocher, who also played down the significance of the 2028 forecasts.

"The 2028 projection is of course a projection that is far out into the future," he told Bloomberg Television. "So putting too much weight on this projection, on this single data point, I think would not be appropriate."

In this situation, it was reasonable to wait for new data and especially for our comprehensive business cycle forecast in December, which includes an estimate of inflation in 2028 for the first time.

Heightened uncertainty is one reason why Kazaks concurs with Lagarde on rates being in a "good place."

"We are practically at around 2%, inflation expectations are well anchored, and we have the credibility to keep them there," he said. "The market understands our steady-hand approach, and that gives us time to really monitor the situation."

Traders aren't betting on any more rate cuts this year and see a less than 50% chance of one materializing by September 2026. Economists predict borrowing costs will remain on hold all the way through 2027.

Kazaks argued that since the last Governing Council meeting in September, the economy has "more or less developed within the confines of the baseline," while threats to the outlook have become more manageable.

"Inflation risks are more balanced," he said. "Risks to growth as well because some — including those related to trade — have diminished for now. But I would still say they're tilted somewhat to the downside. Growth is quite weak and vulnerable rather than solid, and uncertainty is very high."

FintechZoom.com Bitcoin ETF has become a focal point for investors seeking data-driven insights into cryptocurrency-linked funds. As Bitcoin ETFs gain mainstream traction, FintechZoom provides timely analysis on performance, risk exposure, and market sentiment. This article explores how its reports guide investors in understanding opportunities and challenges in today’s Bitcoin ETF landscape.

A Bitcoin ETF, or exchange-traded fund, allows investors to gain exposure to Bitcoin’s price movements without directly owning the cryptocurrency. Traded on traditional exchanges, it mirrors the performance of Bitcoin while offering the convenience of regulated market access. FintechZoom.com Bitcoin ETF coverage explains this mechanism in depth, helping readers understand how institutional and retail investors participate.

Unlike direct crypto ownership, a Bitcoin ETF simplifies investing by removing wallet management and security challenges. FintechZoom.com investments often highlight how this structure appeals to investors who want diversification with reduced operational complexity. It bridges the gap between traditional finance and the growing fintechzoom.com cryptocurrency ecosystem.

Platforms such as fintechzoom.com bitcoin provide insights into how ETFs differ from direct holdings or fintechzoom.com bitcoin mining, emphasizing transparency, liquidity, and accessibility. As fintechzoom.com bitcoin stock coverage expands, investors are increasingly using ETF data to compare traditional assets with emerging digital markets like fintechzoom.com bitcoin price trends.

Bitcoin ETFs have gained momentum as investors seek exposure to the crypto market without the operational complexity of direct ownership. FintechZoom.com Bitcoin ETF analysis highlights consistent capital inflows and the growing role of institutional participation. These products often mirror fintechzoom.com bitcoin price movements, allowing traders to benefit from market rallies while enjoying regulatory transparency.

Data featured on fintechzoom.com investments suggests that Bitcoin ETFs performed strongly during major bull cycles, aligning with rising fintechzoom.com bitcoin stock interest among diversified portfolios. However, profitability depends heavily on entry timing and market cycles. FintechZoom.com cryptocurrency reports show that ETFs can also outperform direct holdings when fees and custodial risks are considered.

| Year | Bitcoin ETF Avg. Return | Spot Bitcoin Return |

|---|---|---|

| 2023 | +42% | +38% |

| 2024 | +31% | +29% |

Compared to fintechzoom.com bitcoin mining or direct token holding, ETFs simplify exposure while maintaining profit potential. Yet, investors should remember that gains are still driven by Bitcoin’s volatility and broader market demand.

Despite the accessibility benefits, the risks of a Bitcoin ETF remain significant. FintechZoom.com Bitcoin ETF reviews frequently cite high price swings linked to spot market fluctuations. The same volatility that creates opportunity can also result in short-term losses.

Fintechzoom.com bitcoin insights emphasize that investors should assess each fund’s management fee and tracking method. In periods of uncertainty, fintechzoom.com bitcoin and fintechzoom.com bitcoin stock often move together, intensifying market pressure. Understanding these elements is key to managing portfolio exposure effectively within fintechzoom.com cryptocurrency investments.

FintechZoom.com has become a recognized source for cryptocurrency and investment insights, especially regarding the fintechzoom.com bitcoin etf. The platform offers updates on market trends, expert commentary, and ETF fund performance, helping readers interpret market data through a financial journalism lens. Its reports combine fundamental and technical views, often referencing fintechzoom.com bitcoin stock behavior and institutional sentiment.

Investors evaluating fintechzoom.com investments often appreciate its accessibility and timely analysis. The site compiles information from multiple exchanges and asset managers, presenting a wide perspective on digital asset performance. However, users should still cross-reference data with official ETF filings and other credible sources to ensure accuracy.

Transparency and data reliability are essential for investor confidence. While fintechzoom.com bitcoin etf reports often highlight new opportunities, investors should remember that opinions expressed by analysts do not eliminate the inherent risks of a Bitcoin ETF. The best approach is to use FintechZoom as one data point among many in constructing a broader investment strategy.

Overall, fintechzoom.com cryptocurrency analysis provides valuable context for market participants but should be complemented with independent research and professional advice before making major portfolio decisions. For long-term investors, the key is distinguishing between short-term sentiment and enduring structural trends within fintechzoom.com bitcoin markets.

The leading Bitcoin ETFs often mentioned on fintechzoom.com bitcoin etf updates include BlackRock’s IBIT and Fidelity’s FBTC. These funds attract strong inflows and offer low fees, but performance still depends on overall bitcoin market trends.

FintechZoom.com is a widely used platform for fintech and cryptocurrency coverage. While its data is timely, investors should cross-check fintechzoom.com investments information with official ETF disclosures before acting.

Bitcoin ETFs provide a regulated entry point into digital assets, removing wallet and custody issues. However, investors should understand the volatility and other risks of a bitcoin ETF before committing capital.

Several spot Bitcoin ETFs have already received approval in major markets, and fintechzoom.com bitcoin coverage tracks future proposals closely. Further approvals depend on regulatory reviews and evolving market maturity.

FintechZoom.com Bitcoin ETF analysis offers investors valuable insight into returns, volatility, and market behavior. While the platform delivers timely updates, decisions should rely on diversified research. Overall, fintechzoom.com bitcoin etf coverage helps bridge traditional investing with the fast-evolving cryptocurrency landscape, providing informed guidance for market participants.

Key points:

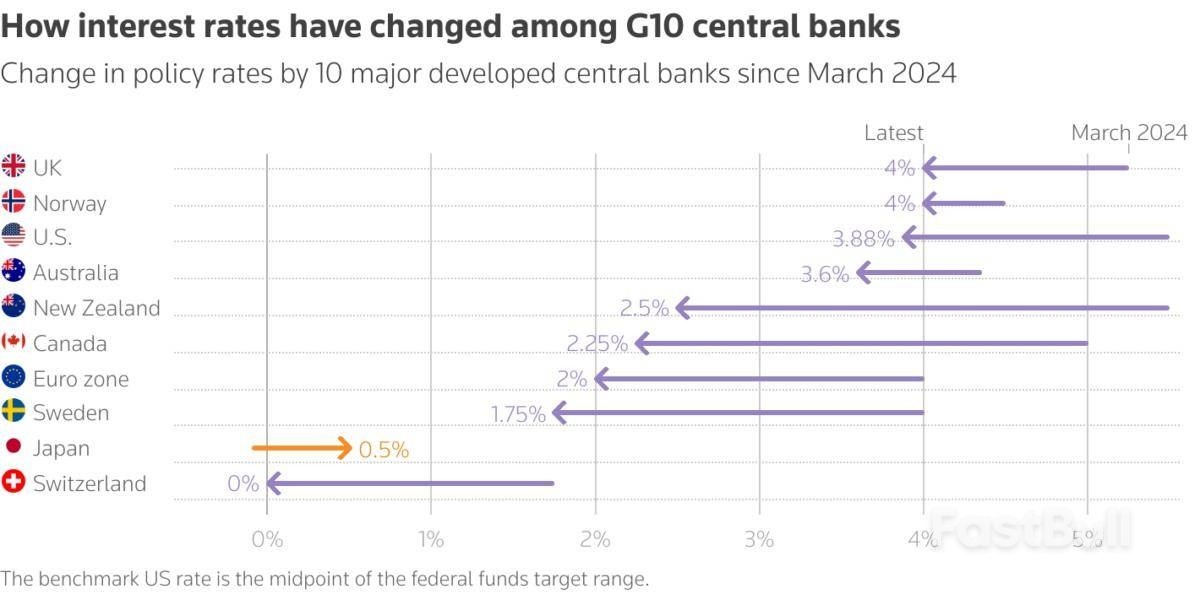

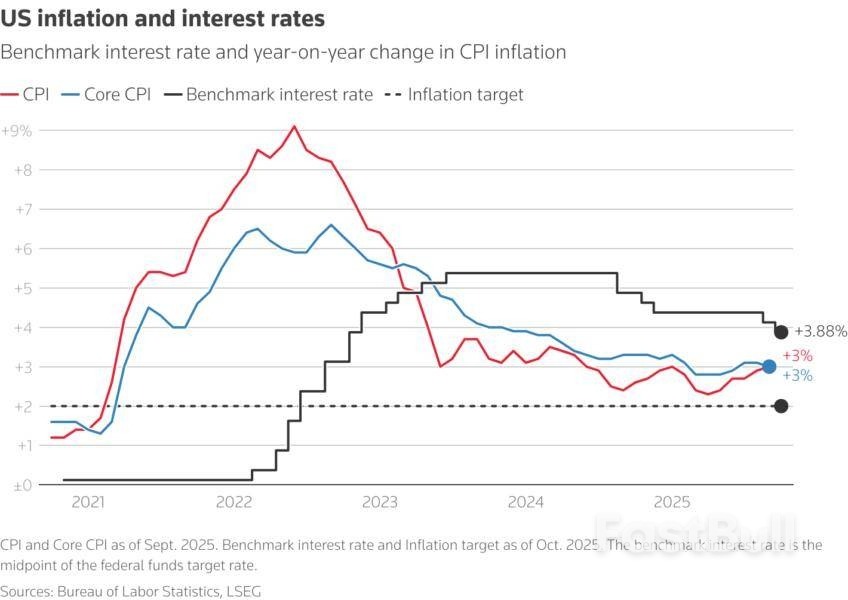

The U.S. Federal Reserve has moved back into line with other major rate setters after it cut rates by a quarter point on Wednesday but pushed back against market bets that it would keep going as the Washington shutdown fogs up its forecasting lens.

The Bank of Japan and European Central Bank left rates unchanged on Thursday.

Here's where 10 major central banks stand after the latest round of meetings:

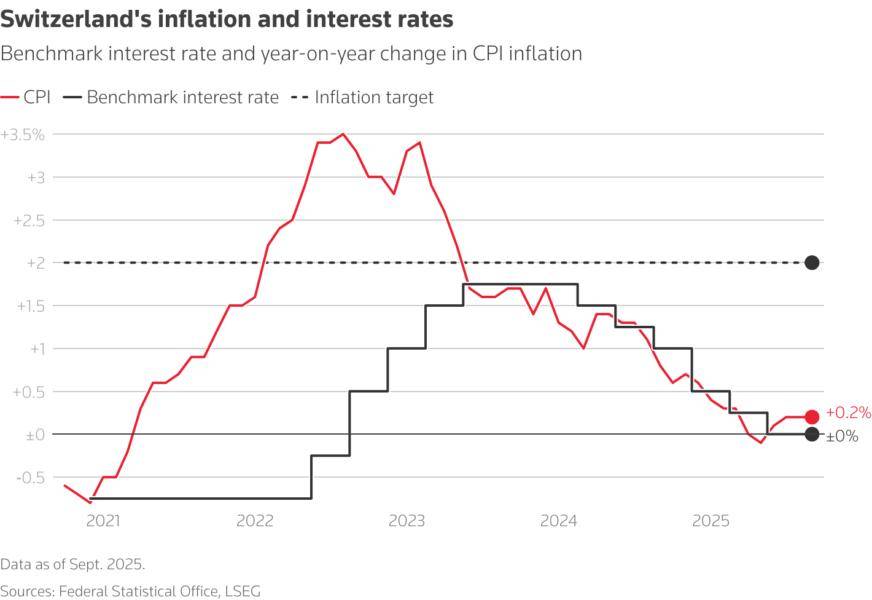

The Swiss National Bank cut its key rate to 0% in June and is widely expected to hold steady with markets pricing a long pause.

In its first set of minutes detailing its rate setting discussions, published last week, the SNB quashed market speculation that it would return to negative rates to stop the strong francpushing the sluggish economy into deflation.

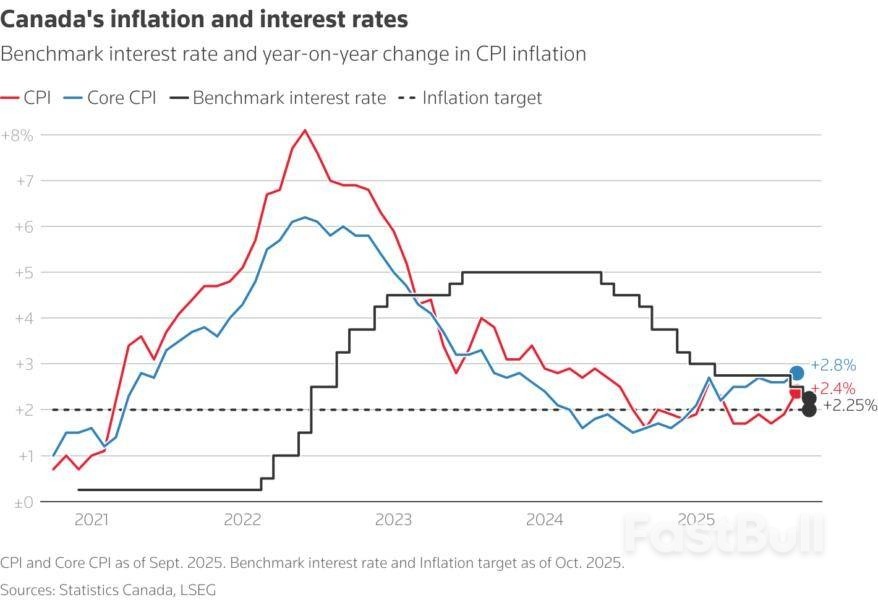

The Bank of Canada, battling an economic slowdown exacerbated by U.S. tariffs and the inflationary impact of the trade war, cut rates to a more than three-year low of 2.25% on Wednesday.

It also sent strong signals that easing ends here and traders see more than 60% odds on the BoC standing pat until December 2026.

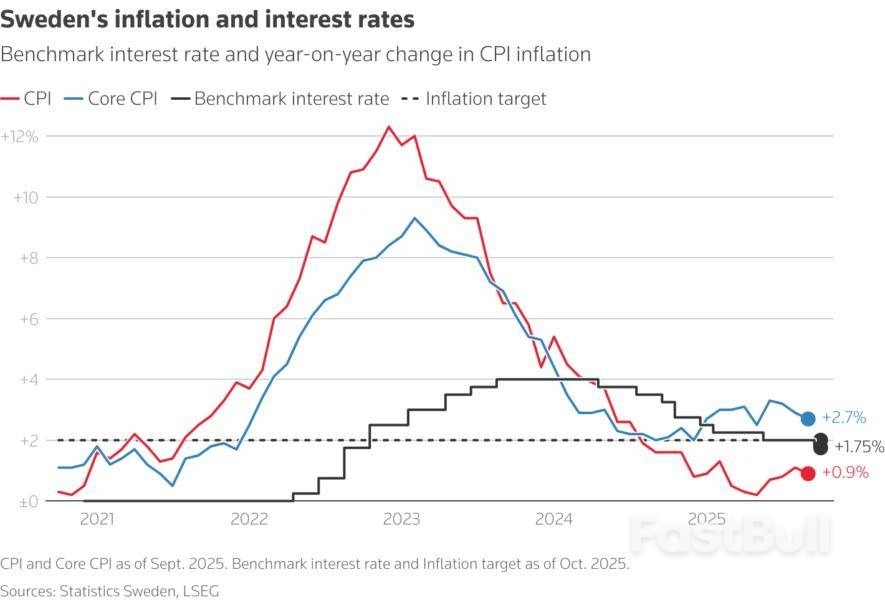

Money markets price in less than a one in five chance of further easing before 2026 as domestic inflation stays sticky, which has sent traders piling in to Sweden's crown. The currency has risen 15% against the dollar year-to-date. (0#SEKIRPR)

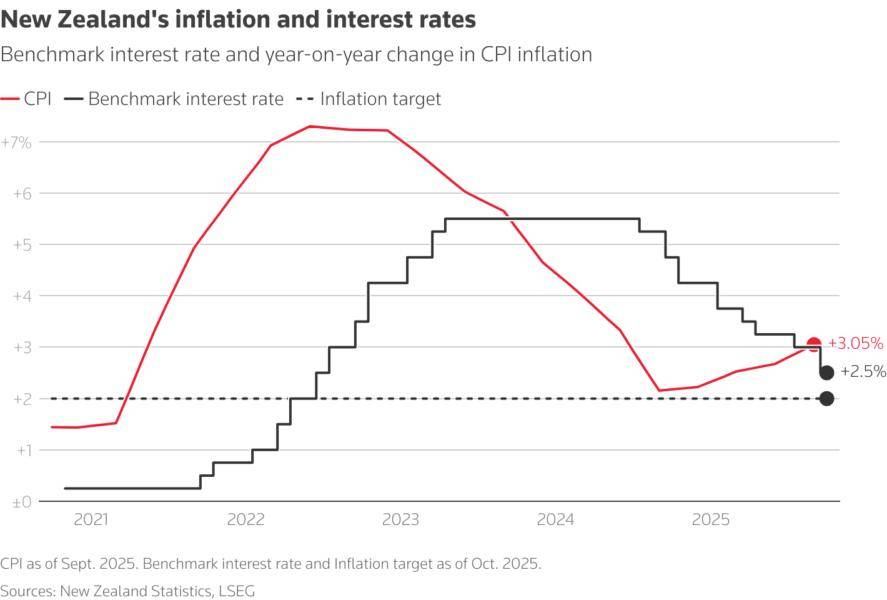

The Reserve Bank of New Zealand cut rates by a punchy 50 basis points (bps) to 2.5% this month in an attempt to prop up a frail economy.

Markets see a good chance of a further cut in late November, though inflation sitting at the top of the RBNZ's 1-3% target band could be a complication.

The ECB on Thursday matched traders' expectations and held the bloc's main deposit rate at 2% for a third straight meeting.

Traders viewed this ECB easing cycle as almost over, pricing in less than a 50% chance of further easing by July 2026.

The Fed on Wednesday executed a widely flagged 25 bps cut but pushed back against market bets for more by warning that data gaps caused by the U.S. government shutdown were clouding its forecasting lens.

"If you're driving in the fog you slow down," Chair Jerome Powell said in his post-announcement press conference.

The rate cut drew dissent from two policymakers, with Stephen Miran again calling for a deeper reduction and Kansas City Fed President Jeffrey Schmid favoring no cut given above-target inflation.

Traders price a 70% probability of a 25 bps December cut, down from 84% ahead of Wednesday's decision.

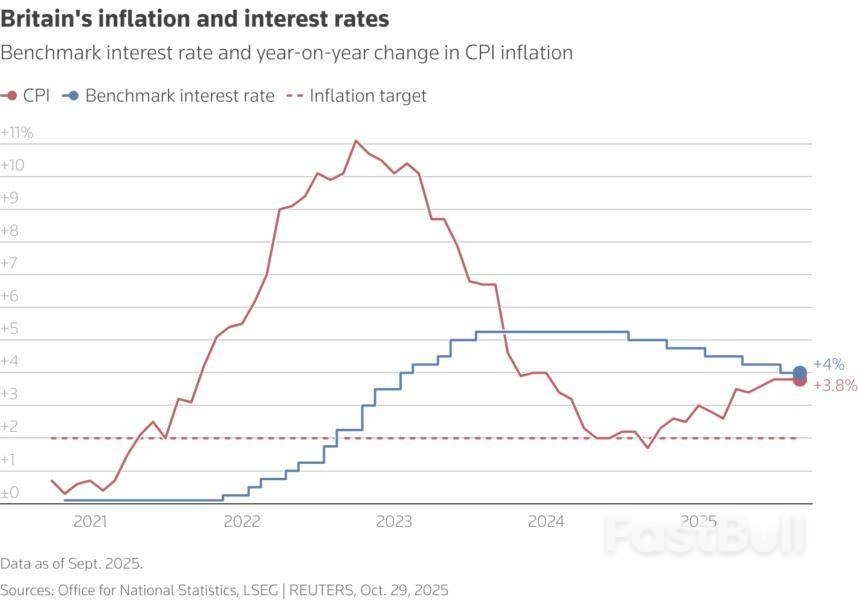

The Bank of England is another major rate setter that is signalling cautious moves from here as it kept rates unchanged at its last meeting and said inflation risks remained high.

Traders expect another hold on November 6 but markets price a 60% chance of a December cut after above-target UK inflation at least held steady in September.

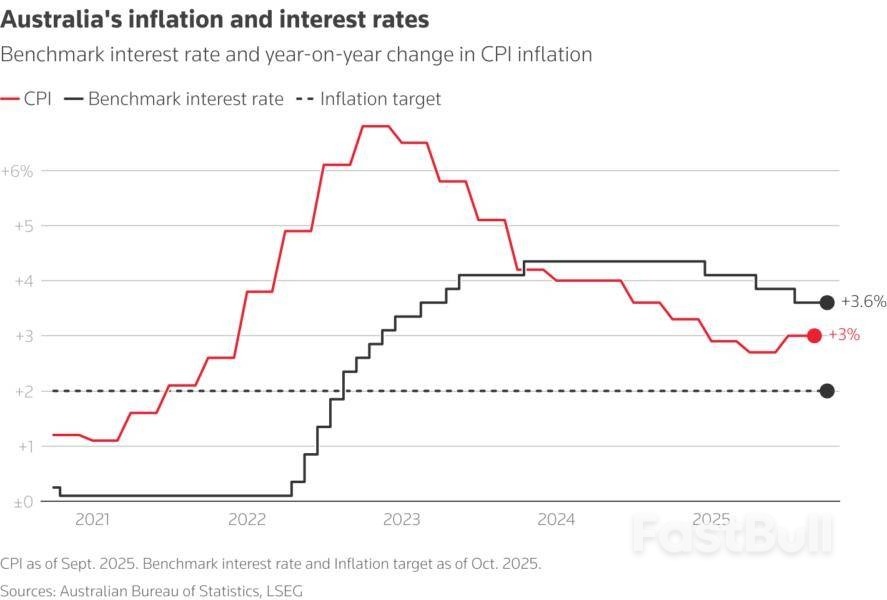

The Reserve Bank of Australia has cut rates by 75 bps since February but hotter-than-expected inflation encouraged it to hold rates steady and turn more hawkish in September.

That trend has continued, pushing expectations for the next cut forward to at least February 2026. (0#AUDIRPR).

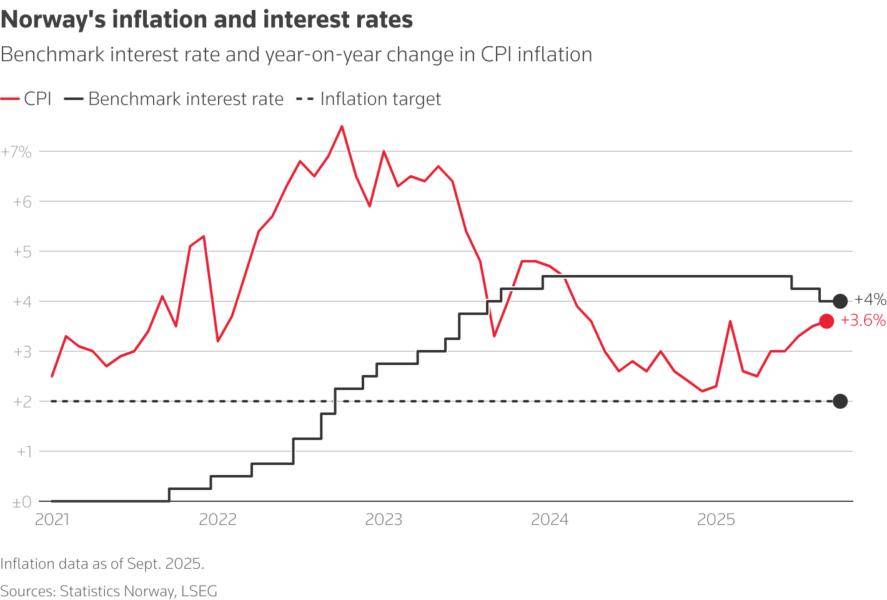

Norway's central bank eased borrowing costs by 25 bps to 4.0% in September but signalled further cuts were less likely because underlying inflation was rising. That has helped the crown keep powering higher against the dollar, with a 12% gain for the year so far (0#NOKIRPR).

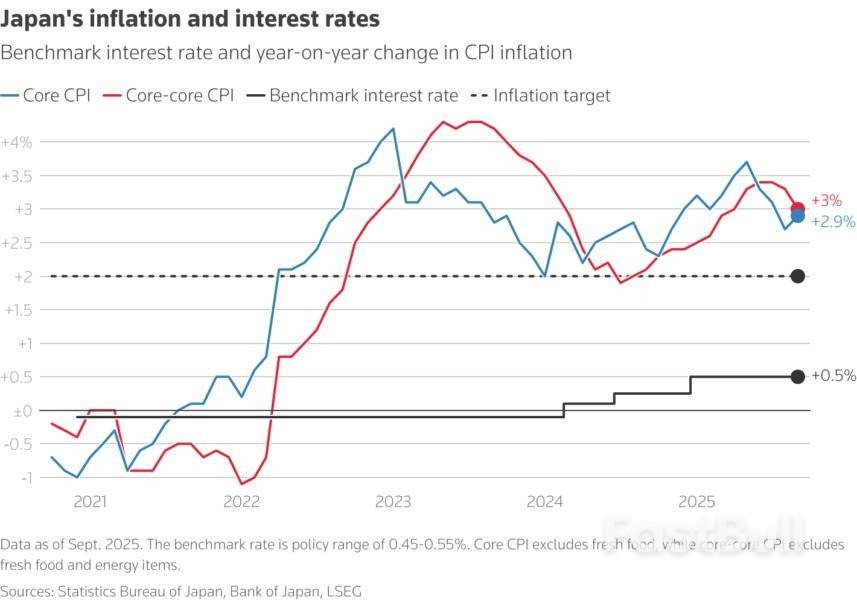

The Bank of Japan, the sole central bank in hiking mode, kept rates steady on Thursday but repeated its pledge to keep increasing borrowing costs if the economy moves as it projects, shifting investor focus to December's meeting.

The yenweakened after the announcement.

U.S. Treasury Secretary Scott Bessent this week called for speedier BOJ rate hikes to avoid weakening the currency too much.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up