FastBull

Finance Summit Dubai 2025

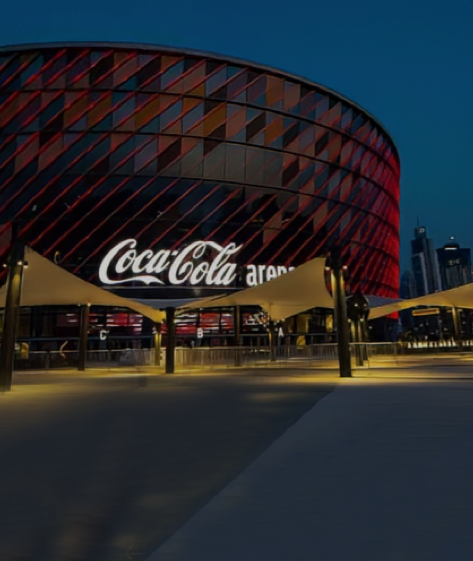

Global Vision, Leading Financial Frontiers April 16-17, 2025,10am - 6pm UTC+4 Coca-Cola Arena丨Dubai

FastBull

Finance Summit Dubai 2025

Global Vision, Leading Financial Frontiers April 16-17, 2025,10am - 6pm UTC+4 Coca-Cola Arena丨DubaiThe FastBull Finance Summit is a premier event focused on the depth and breadth of global finance, emphasizing areas such as forex and blockchain financial technology.

The summit has invited economist Jim Rogers as a keynote speaker and will bring together numerous industry experts and renowned KOLs to discuss market trends, innovative thinking, and cutting-edge strategies, providing attendees with an unparalleled summit experience.

"Learn about the world. Go and see the world. You will be much better prepared for the future."