Faster Charts

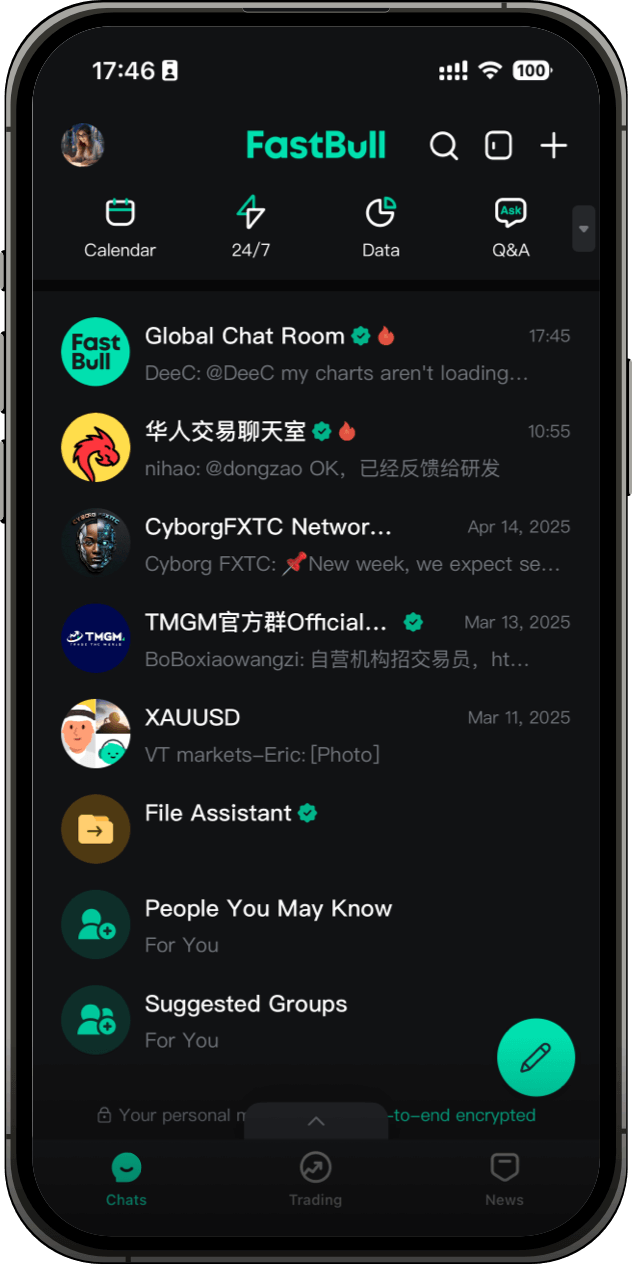

Chat Faster

About FastBull

FastBull is a technology innovator for the Internet of Finance. We have established editorial and translation teams in many regions and will continue to work on content localization in various countries. We also have great R&D and product teams. Our team members are equipped with excellent technical skills and will keep delivering top-notch software experiences for our customers in the future.

Advertising

ad@fastbull.com

Partnership

cooperation@fastbull.com

Feedback

service@fastbull.com