Markets

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

[California Governor Criticizes Trump At Munich Security Conference: "He's Setting America Back To The 19th Century!"] California Governor Gavin Newsom, Speaking At The Munich Security Conference In Germany On February 13, Vehemently Criticized The Trump Administration's Environmental Policies, Calling Them An Attempt To "set America Back To The 19th Century." He Also Urged Patience, Noting That "he'll Be Out Of Office In Three Years." The Democratic Governor, Speaking During A Climate Policy Discussion, Said That In The Field Of Environmental And Climate Protection, The United States Has Never Had "such A Destructive President."

[Bitcoin Deposit Recovery, 7,886.76 Btc Net Inflow To Cex In The Last 24 Hours] February 14Th, According To Coinglass Data, The Past 24 Hours Saw A Total Net Inflow Of 7,886.76 Btc On Cex. The Top Three Cex Exchanges By Inflow Are As Follows:· Binance, Inflow Of 8,112.59 Btc;· Coinbase Pro, Inflow Of 1,515.63 Btc;· Bitfinex, Inflow Of 1,011.62 Btc.Furthermore, Kraken Saw An Outflow Of 3,915.55 Btc, Ranking First In The Outflow List

[Shanghai Composite Index Rises 25.58% In Year Of The Snake; Institutions Predict Post-Holiday Tech Sector Rebound] The Lunar New Year Of The Snake Has Come To A Close. Looking At The Whole Year (February 5, 2025 To February 13, 2026), The Market Only Experienced Short-term Fluctuations In Early April Last Year, Followed By A Steady Upward Trend. The Shanghai Composite Index Rose By 25.58%, The Shenzhen Component Index By 38.84%, The ChiNext Index By 58.73%, And The STAR Market Composite Index By 64.20%. In The Last Week Of The Year Of The Snake, The Market Still Showed Obvious Sector Rotation Characteristics, With No Clear Leading Sector Emerging. Many Institutions Believe That After The Spring Festival Holiday, From The Perspectives Of Event Catalysts And Calendar Effects, The Tech Sector, Represented By AI, Is Expected To Return

[Wang Yi Meets With US Secretary Of State Rubio] Wang Yi, Member Of The Political Bureau Of The CPC Central Committee And Foreign Minister, Met With US Secretary Of State Rubio On The Sidelines Of The Munich Security Conference On March 13. Wang Yi Stated That President Xi Jinping And President Trump Have Provided Strategic Guidance For The Development Of China-US Relations. We Should Work Together To Implement The Important Consensus Reached By The Two Heads Of State, Making 2026 A Year In Which China And The US Move Towards Mutual Respect, Peaceful Coexistence, And Win-win Cooperation. Dialogue Is Better Than Confrontation, Cooperation Is Better Than Conflict, And Win-win Is Better Than Zero-sum In China-US Relations. As Long As We Uphold An Attitude Of Equality, Respect, And Mutual Benefit, Both Sides Can Find Ways To Resolve Each Other's Concerns And Properly Manage Differences. Both Sides Should Work Together To Continuously Expand The List Of Cooperation And Reduce The List Of Issues, So That China-US Relations Can Embark On A Stable, Healthy, And Sustainable Development Track, Sending A More Positive Message To The World

Witkoff And Kushner Will Then Participate In Trilateral Talks With Representatives From Russia And Ukraine In The Afternoon -Source Briefed On The Matter

USA Delegation Including Envoys Steve Witkoff And Jared Kushner Will Meet With The Iranians On Tuesday Morning -Source Briefed On The Matter

Two Sets Of Diplomatic Negotiations, On Ukraine And Iran, Are Set To Take Place In Geneva On Tuesday -Source Briefed On The Matter

US Military Preparing For Possibility Of Carrying Out Sustained, Weeks-Long Operations Against Iran, If Required, Two US Officials Tell Reuters

On Friday (February 13), In Late New York Trading, S&P 500 Futures Ultimately Fell 0.03%, Dow Futures Rose 0.01%, And NASDAQ 100 Futures Fell 0.05%. Russell 2000 Futures Rose 1.18%

On Friday (February 13), At The Close Of Trading In New York (05:59 Beijing Time On Saturday), The Offshore Yuan (CNH) Was Quoted At 6.9012 Against The US Dollar, Down 31 Points From The Close Of Trading In New York On Thursday. The Yuan Traded Within A Range Of 6.8973-6.9109 During The Day. This Week, The Offshore Yuan Rose By Approximately 290 Points, An Increase Of About 0.4%. It Had Previously Risen To 6.8912 In Pre-market Trading On February 12

The U.S. Department Of Homeland Security (Dhs) Subpoenaed Google, Meta, Reddit, And Discord Regarding Immigration And Customs Enforcement (ICE) Tracking Issues

Spot Silver Rose About 3% On Friday. In Late New York Trading On Friday (February 13), Spot Silver Rose 2.84% To $77.4269 Per Ounce, Down 0.50% For The Week. Before The Plunge At 00:00 Beijing Time On December 13, It Held Steady Near Its Intraday High Of $86.3058, And Stabilized At Lower Levels After The Plunge. Comex Silver Futures Rose 1.98% To $77.180 Per Ounce, Up 0.45% For The Week. Comex Copper Futures Rose 0.02% To $5.8465 Per Pound, Down 1.61% For The Week. Spot Platinum Rose 3.11% To $2067.45 Per Ounce, Down 1.74% For The Week. Spot Palladium Rose 4.53% To $1696.15 Per Ounce, Down 0.67% For The Week

Germany Current Account (Not SA) (Dec)

Germany Current Account (Not SA) (Dec)A:--

F: --

U.S. Existing Home Sales Annualized MoM (Jan)

U.S. Existing Home Sales Annualized MoM (Jan)A:--

F: --

U.S. Existing Home Sales Annualized Total (Jan)

U.S. Existing Home Sales Annualized Total (Jan)A:--

F: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

U.S. 30-Year Bond Auction Avg. Yield

U.S. 30-Year Bond Auction Avg. YieldA:--

F: --

P: --

ECB Chief Economist Lane Speaks

ECB Chief Economist Lane Speaks U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Jan)

China, Mainland Outstanding Loans Growth YoY (Jan)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Jan)

China, Mainland M2 Money Supply YoY (Jan)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Jan)

China, Mainland M1 Money Supply YoY (Jan)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Jan)

China, Mainland M0 Money Supply YoY (Jan)A:--

F: --

P: --

Euro Zone Employment Prelim QoQ (SA) (Q4)

Euro Zone Employment Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Euro Zone GDP Revised YoY (Q4)

Euro Zone GDP Revised YoY (Q4)A:--

F: --

P: --

Euro Zone Trade Balance (SA) (Dec)

Euro Zone Trade Balance (SA) (Dec)A:--

F: --

Euro Zone Employment YoY (SA) (Q4)

Euro Zone Employment YoY (SA) (Q4)A:--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Dec)

Euro Zone Trade Balance (Not SA) (Dec)A:--

F: --

Russia Key Rate

Russia Key RateA:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Retail Sales MoM (Dec)

Brazil Retail Sales MoM (Dec)A:--

F: --

P: --

U.S. Real Income MoM (SA) (Jan)

U.S. Real Income MoM (SA) (Jan)A:--

F: --

U.S. Core CPI YoY (Not SA) (Jan)

U.S. Core CPI YoY (Not SA) (Jan)A:--

F: --

P: --

U.S. Core CPI MoM (SA) (Jan)

U.S. Core CPI MoM (SA) (Jan)A:--

F: --

P: --

U.S. CPI MoM (Not SA) (Jan)

U.S. CPI MoM (Not SA) (Jan)A:--

F: --

P: --

U.S. CPI MoM (SA) (Jan)

U.S. CPI MoM (SA) (Jan)A:--

F: --

P: --

U.S. CPI YoY (Not SA) (Jan)

U.S. CPI YoY (Not SA) (Jan)A:--

F: --

P: --

U.S. Core CPI (SA) (Jan)

U.S. Core CPI (SA) (Jan)A:--

F: --

P: --

U.S. Cleveland Fed CPI MoM (SA) (Jan)

U.S. Cleveland Fed CPI MoM (SA) (Jan)A:--

F: --

P: --

Russia CPI YoY (Jan)

Russia CPI YoY (Jan)A:--

F: --

P: --

U.S. Cleveland Fed CPI MoM (Jan)

U.S. Cleveland Fed CPI MoM (Jan)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Saudi Arabia CPI YoY (Jan)

Saudi Arabia CPI YoY (Jan)--

F: --

P: --

Japan GDP QoQ (SA) (Q4)

Japan GDP QoQ (SA) (Q4)--

F: --

P: --

Japan GDP Annualized QoQ (SA) (Q4)

Japan GDP Annualized QoQ (SA) (Q4)--

F: --

P: --

Japan Real GDP QoQ (Q4)

Japan Real GDP QoQ (Q4)--

F: --

P: --

Japan Nominal GDP Prelim QoQ (Q4)

Japan Nominal GDP Prelim QoQ (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Feb)

U.K. Rightmove House Price Index YoY (Feb)--

F: --

P: --

Japan Industrial Output Final YoY (Dec)

Japan Industrial Output Final YoY (Dec)--

F: --

P: --

Japan Industrial Output Final MoM (Dec)

Japan Industrial Output Final MoM (Dec)--

F: --

P: --

Euro Zone Industrial Output MoM (Dec)

Euro Zone Industrial Output MoM (Dec)--

F: --

P: --

Euro Zone Industrial Output YoY (Dec)

Euro Zone Industrial Output YoY (Dec)--

F: --

P: --

Euro Zone Total Reserve Assets

Euro Zone Total Reserve Assets--

F: --

P: --

Canada New Housing Starts (Jan)

Canada New Housing Starts (Jan)--

F: --

P: --

Canada Manufacturing New Orders MoM (Dec)

Canada Manufacturing New Orders MoM (Dec)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Dec)

Canada Manufacturing Unfilled Orders MoM (Dec)--

F: --

P: --

Canada Manufacturing Inventory MoM (Dec)

Canada Manufacturing Inventory MoM (Dec)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Jan)

Canada Trimmed CPI YoY (SA) (Jan)--

F: --

P: --

RBA Monetary Policy Meeting Minutes

RBA Monetary Policy Meeting Minutes U.K. 3-Month ILO Employment Change (Dec)

U.K. 3-Month ILO Employment Change (Dec)--

F: --

P: --

U.K. Unemployment Claimant Count (Jan)

U.K. Unemployment Claimant Count (Jan)--

F: --

P: --

U.K. Unemployment Rate (Jan)

U.K. Unemployment Rate (Jan)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Dec)

U.K. 3-Month ILO Unemployment Rate (Dec)--

F: --

P: --

Germany CPI Final YoY (Jan)

Germany CPI Final YoY (Jan)--

F: --

P: --

Germany CPI Final MoM (Jan)

Germany CPI Final MoM (Jan)--

F: --

P: --

Germany HICP Final YoY (Jan)

Germany HICP Final YoY (Jan)--

F: --

P: --

Germany HICP Final MoM (Jan)

Germany HICP Final MoM (Jan)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Dec)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Dec)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Dec)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Dec)--

F: --

P: --

U.K. Labor Productivity (Q3)

U.K. Labor Productivity (Q3)--

F: --

P: --

South Africa Unemployment Rate (Q4)

South Africa Unemployment Rate (Q4)--

F: --

P: --

No matching data

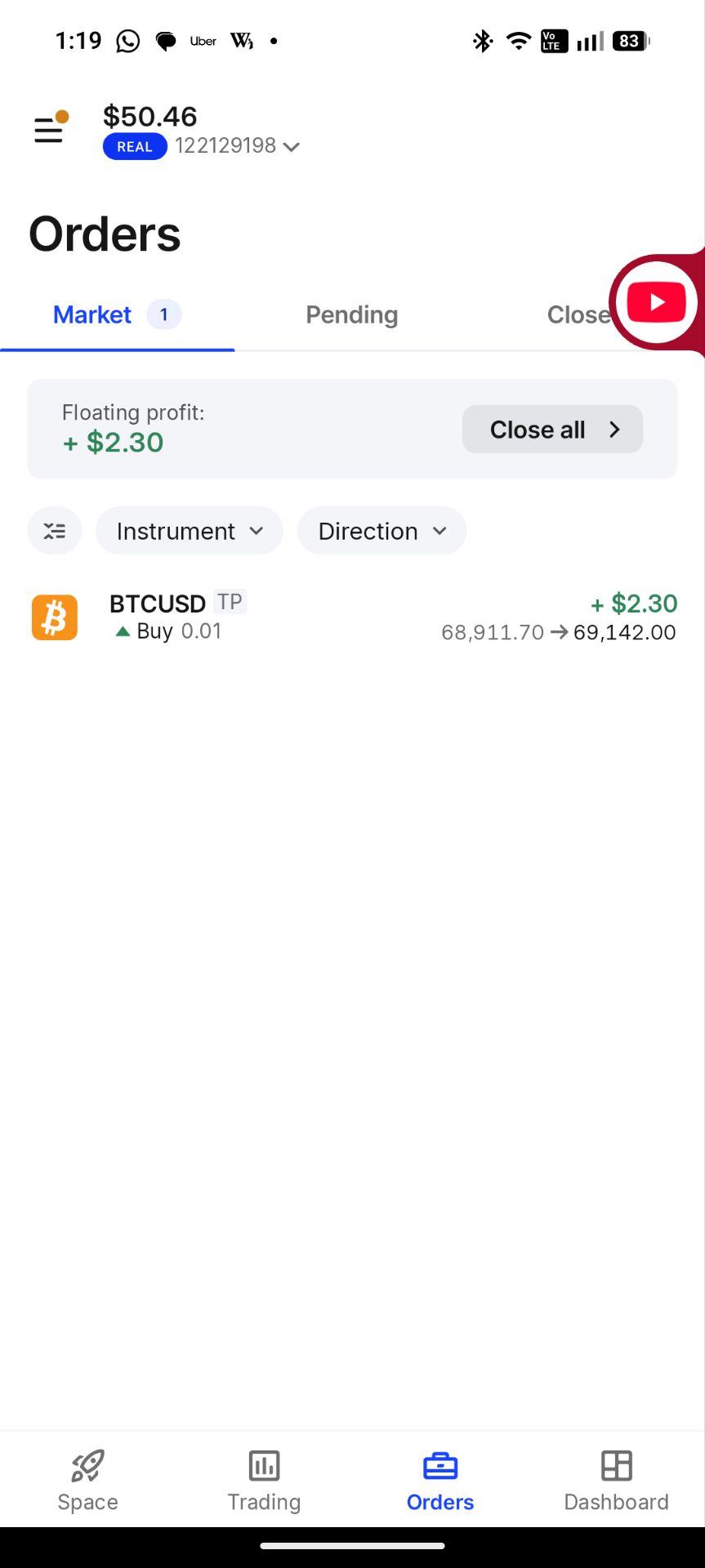

[Analyst: Bitcoin Continues To Fluctuate At High Levels, And Intraday Trading Becomes A Challenge] According To Analyst Army On X, According To Today's Bitcoin Daily Analysis, A Small Positive Line With A Long Upper Shadow And A Short Lower Shadow Appeared, And The Trading Volume Was Twice That Of The Previous Day, Indicating That The Upper Pressure Was Large, And It Is Still In A High-level Oscillation State. The MA30 Line Shows An Upward Trend, But The MACD Indicates That The Upward Momentum Has Weakened Above The Zero Axis. Intraday Trading Fluctuates Violently, Especially In The Late Trading Hours Of The US Stock Market, Which Often Falls. For Contract Traders, This Fluctuation Is Both An Opportunity And A Challenge. The Daily Level Is Expected To Continue To Fluctuate At A High Level. Although There Is Still Room For Growth, The Risk Of A Sharp Decline Is Low. At Present, The Focus Is On The Altcoin Market. The Daily Pressure Level Is 92,000 To 109,800, And The Support Level Is Between 87,270 And 75,700. From The Hourly Level, The Current Price Has Fallen Back To The 2-hour MA30 Line. If It Falls Below, It May Touch The 4-hour Level Support And Rebound Again. Short-term Operations Are Recommended To Go Long At 87,420 And Go Short At 62,000. The Liquidation Heat Map Shows That There Are A Large Number Of Short Orders To Be Liquidated In The 92500 To 93450 Area, While There Are A Large Number Of Long Orders Providing Support In The 89350 To 86500 Area

Quick access to 24/7

Quick access to more editor-selected real-time news

Exclusive video for free

FastBull VIPject team is dedicated to create exclusive videos

Follow More Symbols

You can add more symbols to your watchlist.

More comprehensive macro data and economic indicators

More comprehensive historical data on indicators to help analyze macro markets

Member-only Database

Comprehensive forex, commodity, and equity market data

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up