Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

U.K. CBI Retail Sales Expectations Index (Mar)

U.K. CBI Retail Sales Expectations Index (Mar)A:--

F: --

P: --

U.S. Building Permits Revised MoM (SA) (Feb)

U.S. Building Permits Revised MoM (SA) (Feb)A:--

F: --

P: --

Mexico Retail Sales MoM (Jan)

Mexico Retail Sales MoM (Jan)A:--

F: --

P: --

U.S. Building Permits Revised YoY (SA) (Feb)

U.S. Building Permits Revised YoY (SA) (Feb)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. FHFA House Price Index (Jan)

U.S. FHFA House Price Index (Jan)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Jan)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Jan)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Jan)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Jan)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Jan)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Jan)A:--

F: --

P: --

U.S. FHFA House Price Index MoM (Jan)

U.S. FHFA House Price Index MoM (Jan)A:--

F: --

U.S. FHFA House Price Index YoY (Jan)

U.S. FHFA House Price Index YoY (Jan)A:--

F: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Jan)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Jan)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Jan)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Jan)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index YoY (Jan)

U.S. S&P/CS 10-City Home Price Index YoY (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Mar)

U.S. Conference Board Consumer Expectations Index (Mar)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Mar)

U.S. Conference Board Present Situation Index (Mar)A:--

F: --

P: --

U.S. New Home Sales Annualized MoM (Feb)

U.S. New Home Sales Annualized MoM (Feb)A:--

F: --

U.S. Richmond Fed Manufacturing Composite Index (Mar)

U.S. Richmond Fed Manufacturing Composite Index (Mar)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Mar)

U.S. Conference Board Consumer Confidence Index (Mar)A:--

F: --

U.S. Richmond Fed Manufacturing Shipments Index (Mar)

U.S. Richmond Fed Manufacturing Shipments Index (Mar)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Mar)

U.S. Richmond Fed Services Revenue Index (Mar)A:--

F: --

P: --

U.S. Annual Total New Home Sales (Feb)

U.S. Annual Total New Home Sales (Feb)A:--

F: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

Australia Weighted CPI YoY (Feb)

Australia Weighted CPI YoY (Feb)A:--

F: --

P: --

Australia Weighted CPI YoY (SA) (Feb)

Australia Weighted CPI YoY (SA) (Feb)A:--

F: --

P: --

Australia CPI MoM (SA) (Feb)

Australia CPI MoM (SA) (Feb)A:--

F: --

P: --

U.K. Retail Prices Index YoY (Feb)

U.K. Retail Prices Index YoY (Feb)--

F: --

P: --

U.K. Core Retail Prices Index YoY (Feb)

U.K. Core Retail Prices Index YoY (Feb)--

F: --

P: --

U.K. CPI MoM (Feb)

U.K. CPI MoM (Feb)--

F: --

P: --

U.K. Core CPI YoY (Feb)

U.K. Core CPI YoY (Feb)--

F: --

P: --

U.K. CPI YoY (Feb)

U.K. CPI YoY (Feb)--

F: --

P: --

U.K. Retail Prices Index MoM (Feb)

U.K. Retail Prices Index MoM (Feb)--

F: --

P: --

U.K. Core CPI MoM (Feb)

U.K. Core CPI MoM (Feb)--

F: --

P: --

France Unemployment Class-A (Feb)

France Unemployment Class-A (Feb)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Brazil Current Account (Feb)

Brazil Current Account (Feb)--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Feb)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Feb)--

F: --

P: --

U.S. Durable Goods Orders MoM (Excl.Transport) (Feb)

U.S. Durable Goods Orders MoM (Excl.Transport) (Feb)--

F: --

P: --

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Feb)

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Feb)--

F: --

P: --

U.S. Durable Goods Orders MoM (Feb)

U.S. Durable Goods Orders MoM (Feb)--

F: --

P: --

UK Chancellor of the Exchequer Reeves announces Spring Budget Statement

UK Chancellor of the Exchequer Reeves announces Spring Budget Statement U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. Yield--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Feb)

China, Mainland Industrial Profit YoY (YTD) (Feb)--

F: --

P: --

Turkey Trade Balance (Feb)

Turkey Trade Balance (Feb)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Feb)

Euro Zone M3 Money Supply (SA) (Feb)--

F: --

P: --

Euro Zone 3-Month M3 Money Supply YoY (Feb)

Euro Zone 3-Month M3 Money Supply YoY (Feb)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Feb)

Euro Zone Private Sector Credit YoY (Feb)--

F: --

P: --

Euro Zone M3 Money Supply YoY (Feb)

Euro Zone M3 Money Supply YoY (Feb)--

F: --

P: --

No matching data

US

US VN

VN TW

TW US

US VN

VN TW

TWLatest Views

Latest Views

Trending Topics

To quickly learn market dynamics and follow market focuses in 15 min.

In the world of mankind, there will not be a statement without any position, nor a remark without any purpose.

Inflation, exchange rates, and the economy shape the policy decisions of central banks; the attitudes and words of central bank officials also influence the actions of market traders.

Money makes the world go round and currency is a permanent commodity. The forex market is full of surprises and expectations.

Top Columnists

Enjoy exciting activities, right here at FastBull.

The latest breaking news and the global financial events.

I have 5 years of experience in financial analysis, especially in aspects of macro developments and medium and long-term trend judgment. My focus is maily on the developments of the Middle East, emerging markets, coal, wheat and other agricultural products.

BeingTrader chief Trading Coach & Speaker, 8+ years of experience in the forex market trading mainly XAUUSD, EUR/USD, GBP/USD, USD/JPY, and Crude Oil. A confident trader and analyst who aims to explore various opportunities and guide investors in the market. As an analyst I am looking to enhance the trader’s experience by supporting them with sufficient data and signals.

Latest Update

Risk Warning on Trading HK Stocks

Despite Hong Kong's robust legal and regulatory framework, its stock market still faces unique risks and challenges, such as currency fluctuations due to the Hong Kong dollar's peg to the US dollar and the impact of mainland China's policy changes and economic conditions on Hong Kong stocks.

HK Stock Trading Fees and Taxation

Trading costs in the Hong Kong stock market include transaction fees, stamp duty, settlement charges, and currency conversion fees for foreign investors. Additionally, taxes may apply based on local regulations.

HK Non-Essential Consumer Goods Industry

The Hong Kong stock market encompasses non-essential consumption sectors like automotive, education, tourism, catering, and apparel. Of the 643 listed companies, 35% are mainland Chinese, making up 65% of the total market capitalization. Thus, it's heavily influenced by the Chinese economy.

HK Real Estate Industry

In recent years, the real estate and construction sector's share in the Hong Kong stock index has notably decreased. Nevertheless, as of 2022, it retains around 10% market share, covering real estate development, construction engineering, investment, and property management.

Hongkong, China

Ho Chi Minh, Vietnam

Dubai, UAE

Lagos, Nigeria

Cairo, Egypt

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

English

English Español

Español العربية

العربية Bahasa Indonesia

Bahasa Indonesia Bahasa Melayu

Bahasa Melayu Tiếng Việt

Tiếng Việt ภาษาไทย

ภาษาไทย Français

Français Italiano

Italiano Türkçe

Türkçe Русский язык

Русский язык 简中

简中 繁中

繁中Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up

Hongkong, China

Ho Chi Minh, Vietnam

Dubai, UAE

Lagos, Nigeria

Cairo, Egypt

White Label

Data API

Web Plug-ins

Affiliate Program

US PCE inflation up next, but will consumption data matter more?UK budget and CPI in focus after hawkish BoE decision.Euro turns to flash PMIs for bounce as rally runs out of steam.Inflation numbers out of Tokyo and Australia also on the agenda.

The cryptocurrency sphere has experienced continuous pressure over the last 95 days due to significant BTC price fluctuations. As altcoin holders grapple with diminishing values, the impending implementation of tariffs by Donald Trump on April 2 looms large, raising concerns about its effects on the crypto market.

In recent communications, Trump hinted at a potentially positive outcome, suggesting that April 2 could be a turning point. Previously, he had maintained that tariff flexibility was off the table; however, he has revisited this stance, proposing a mutual approach to tariff negotiations.

This change in tone has garnered a positive reception, particularly as the EU has deferred retaliatory actions. The market has priced in adverse scenarios, making any form of tariff leniency beneficial for cryptocurrency valuations. Such developments indicate a potential for recovery in the sector.

As discussions progress, the intersection of trade policy and cryptocurrency dynamics could set the stage for notable shifts, impacting market confidence and investment strategies moving forward.

Reports indicate SHIB exchange reserves are at unprecedented lows, impacting the cryptocurrency landscape as of March 21, 2025.

The decline in SHIB reserves could influence market stability, though recent price trends show upward movement despite the absence of senior developer comments.

Recent reports suggest SHIB reserves on exchanges have reached historic lows, yet market prices remain stable. Data analysis tools have offered this evidence, though direct sources have not confirmed.

The Shiba Inu community and developers have not shared official updates about exchange reserves. Recent metrics indicate market resilience, showing a 1.2% 24-hour increase despite reserve concerns.

The decline in reserves may have limited immediate effects on SHIB holders. Continued market activity presents a confident front, while exchanges maintain operational norms.

Without official commentary, financial analysts observe a cautiously optimistic outlook. Market movements suggest changes in trader behavior might affect cryptocurrency trends.

Similar reserve levels have previously hinted at market consolidations. Past occurrences showed varied outcomes based on market conditions and trader activity.

Experts recommend monitoring trends to predict future outcomes. Historical data indicates price dynamics may stabilize if trader activity supports the existing market framework.

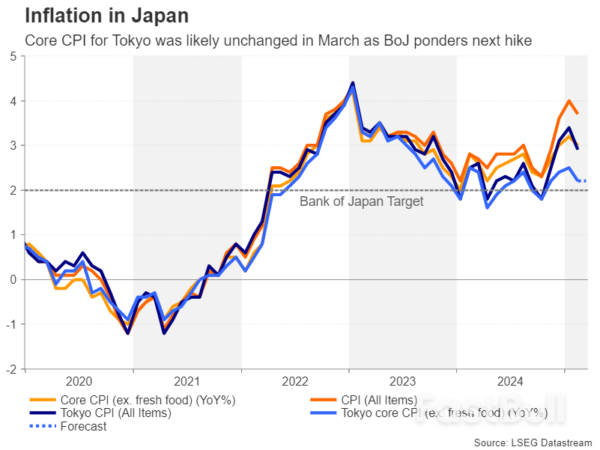

Just when it appeared that the yen scare could be easing, Japan has reported an uptick in core inflation.

Data released early Friday showed Japan's core inflation, which stripes out prices for fresh food, rose 3% year-on-year in February, moderating from January's 3.2% but beating the consensus forecast for 2.9%. The headline consumer price index eased to 3.7% from 4%.

Overall, both indices remained well above the Bank of Japan's 2% inflation target, validating the central bank chief Haruhiko Kuroda's declaration of victory over decades of deflation. Notably, since November, Japan’s headline inflation has been running hotter than that of the U.S.—almost 100 basis points (bps) higher now.

The sticky inflation, plus wage hikes from the shunto wage negotiations, have bolstered calls for BOJ rate hikes. In other words, a potential yen rally, known to destabilize risk assets, including cryptocurrencies, is back on the table.

As of writing, the dollar-yen (USD/JPY) pair traded at 149.22, having bounced nearly 300 pips in a sign of renewed yen weakness since March 11, according to data source TradingView.

That said, the narrowing or declining U.S.-Japan 10-year bond yield spread supports yen strength. Japanese yields have been rising across the curve, offering bullish cues to the yen. As of writing, Japan’s 10-year bond yield held above 1.5%, and the 30-year yield was above 2.5%, both at multi-decade highs.

A renewed yen strength could translate into risk aversion, the likes of which we saw in August last year.

The largest altcoin Ethereum (ETH) has been lagging behind Bitcoin and its market for a long time as it struggles to combat the declines it has experienced.

Leaving investors disappointed with its poor performance, ETH's supply on cryptocurrency exchanges has dropped to very low levels.

Cryptocurrency analysis platform Santiment said in its latest assessment that ETH supply on exchanges has fallen to its lowest level since November 2015.

“Thanks to the many DeFi and staking options, Ethereum holders have reduced the available supply on exchanges to almost 8.97 million. This is the lowest level in nearly 10 years (November 2015). There is 16.4% less ETH on exchanges compared to just 7 weeks ago.”

Santiment said that ETH has been rapidly leaving crypto exchanges, with exchange balances 16.4% lower since the end of January.

This is considered a signal that investors are moving ETH to cold storage wallets for long-term holding and that the Ethereum price will increase in the future.

At this point, analysts note that a significant drop in ETH supply on exchanges is commonly known as a supply shock and signals a potential price increase. However, the price increase will only occur if demand remains strong or increases to outweigh the decreasing supply.

While the decline in exchange supply gives investors hope for ETH, analyst Scott Melker, nicknamed “The Wolf of All Streets”, stated that ETH is at a critical crossroads and said, “Either Ethereum bounces from here and these levels become a generational bottom, or everything is over for ETH.”

The EUR/USD pair is trending downward, approaching 1.0829 on Friday as investors evaluate the latest developments in US Federal Reserve monetary policy.

On Wednesday, the Federal Reserve held its current interest rate and overall monetary policy framework unchanged. However, the central bank signalled that two rate cuts could be expected later this year. In its commentary, the Fed highlighted growing risks to economic recovery, employment stability, and inflation trends.

Fed Chair Jerome Powell downplayed concerns about the inflationary impact of tariffs imposed by the Trump administration, describing them as temporary. Powell also emphasised that the Fed would not rush into further rate cuts, reinforcing a cautious approach to monetary easing.

Adding to market uncertainty, Trump’s retaliatory tariffs – targeting countries that have imposed duties on US goods – are set to take effect on 2 April. Over the past 24 hours, the US dollar has strengthened amid fears of slowing global economic growth and escalating trade tensions. These factors have reinforced risk-averse sentiment among investors.

On the H4 chart, EUR/USD declined to 1.0815, followed by a correction to 1.0860. A further decline towards 1.0765 is highly likely, with this level remaining the primary target. The MACD indicator supports this scenario. Its signal line is below zero, sloping sharply downward, indicating potential new lows.

On the H1 chart, EUR/USD broke through the 1.0864 level and formed a bearish wave structure, reaching 1.0815. Today, a corrective move towards 1.0860 (testing from below) is likely. Once this correction concludes, the pair could resume its downward trajectory, targeting 1.0811. This movement marks the third wave of the downtrend. After reaching this level, another retracement towards 1.0864 is possible. The Stochastic oscillator supports this outlook, with its signal line below 20 and trending upward towards the 50 level.

The EUR/USD pair remains under pressure as the Fed’s cautious stance and global trade tensions bolster the US dollar. Technical indicators suggest further downside potential, with key support levels at 1.0765 and 1.0811. Investors should monitor upcoming economic data and trade developments for additional insights into the pair’s direction.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.