Petikan

Berita

Analisis

Pengguna

24/7

Kalendar Ekonomi

Pendidikan

Data

- Nama

- Terkini

- Sblm

Akaun Signal untuk Ahli

Semua Akaun Signal

Semua Peraduan

U.K. Baki Dagangan Dengan Bukan EU (Selepas Pelarasan Bermusim) (Okt)

U.K. Baki Dagangan Dengan Bukan EU (Selepas Pelarasan Bermusim) (Okt)S:--

R: --

S: --

U.K. Baki Dagangan (Okt)

U.K. Baki Dagangan (Okt)S:--

R: --

S: --

U.K. Indeks Industri Perkhidmatan Kadar Bulanan

U.K. Indeks Industri Perkhidmatan Kadar BulananS:--

R: --

S: --

U.K. Kadar Bulanan Pengeluaran Pembinaan (Selepas Pelarasan Bermusim) (Okt)

U.K. Kadar Bulanan Pengeluaran Pembinaan (Selepas Pelarasan Bermusim) (Okt)S:--

R: --

S: --

U.K. Kadar Tahunan Keluaran Industri (Okt)

U.K. Kadar Tahunan Keluaran Industri (Okt)S:--

R: --

S: --

U.K. Baki Dagangan (Selepas Pelarasan Bermusim) (Okt)

U.K. Baki Dagangan (Selepas Pelarasan Bermusim) (Okt)S:--

R: --

S: --

U.K. Baki Dagangan EU (Selepas Pelarasan Bermusim) (Okt)

U.K. Baki Dagangan EU (Selepas Pelarasan Bermusim) (Okt)S:--

R: --

S: --

U.K. Kadar Tahunan Pengeluaran Perkilangan (Okt)

U.K. Kadar Tahunan Pengeluaran Perkilangan (Okt)S:--

R: --

S: --

U.K. Kadar Bulanan KDNK (Okt)

U.K. Kadar Bulanan KDNK (Okt)S:--

R: --

S: --

U.K. Kadar Tahunan KDNK (Selepas Pelarasan Bermusim) (Okt)

U.K. Kadar Tahunan KDNK (Selepas Pelarasan Bermusim) (Okt)S:--

R: --

S: --

U.K. Kadar Bulanan Keluaran Industri (Okt)

U.K. Kadar Bulanan Keluaran Industri (Okt)S:--

R: --

S: --

U.K. Kadar Tahunan Pengeluaran Pembinaan (Okt)

U.K. Kadar Tahunan Pengeluaran Pembinaan (Okt)S:--

R: --

S: --

Perancis Nilai Akhir Kadar Bulanan HICP (Nov)

Perancis Nilai Akhir Kadar Bulanan HICP (Nov)S:--

R: --

S: --

China, Tanah Besar Kadar Pertumbuhan Tahunan Pinjaman Terkumpul (Nov)

China, Tanah Besar Kadar Pertumbuhan Tahunan Pinjaman Terkumpul (Nov)S:--

R: --

S: --

China, Tanah Besar Kadar Tahunan Bekalan Wang M2 (Nov)

China, Tanah Besar Kadar Tahunan Bekalan Wang M2 (Nov)S:--

R: --

S: --

China, Tanah Besar Kadar Tahunan Bekalan Wang M0 (Nov)

China, Tanah Besar Kadar Tahunan Bekalan Wang M0 (Nov)S:--

R: --

S: --

China, Tanah Besar Kadar Tahunan Bekalan Wang M1 (Nov)

China, Tanah Besar Kadar Tahunan Bekalan Wang M1 (Nov)S:--

R: --

S: --

India CPI YoY (Nov)

India CPI YoY (Nov)S:--

R: --

S: --

India Kadar Pertumbuhan Deposit Tahunan

India Kadar Pertumbuhan Deposit TahunanS:--

R: --

S: --

Brazil Kadar Pertumbuhan Industri Perkhidmatan (Okt)

Brazil Kadar Pertumbuhan Industri Perkhidmatan (Okt)S:--

R: --

S: --

Mexico Kadar Tahunan Keluaran Industri (Okt)

Mexico Kadar Tahunan Keluaran Industri (Okt)S:--

R: --

S: --

Rusia Baki Dagangan (Okt)

Rusia Baki Dagangan (Okt)S:--

R: --

S: --

Presiden Fed Philadelphia Henry Paulson menyampaikan ucapan

Presiden Fed Philadelphia Henry Paulson menyampaikan ucapan Kanada Kadar Bulanan Permit Pembinaan (Selepas Pelarasan Bermusim) (Okt)

Kanada Kadar Bulanan Permit Pembinaan (Selepas Pelarasan Bermusim) (Okt)S:--

R: --

S: --

Kanada Kadar Tahunan Jualan Borong (Okt)

Kanada Kadar Tahunan Jualan Borong (Okt)S:--

R: --

S: --

Kanada Kadar Bulanan Inventori Borong (Okt)

Kanada Kadar Bulanan Inventori Borong (Okt)S:--

R: --

S: --

Kanada Kadar Tahunan Inventori Borong (Okt)

Kanada Kadar Tahunan Inventori Borong (Okt)S:--

R: --

S: --

Kanada Kadar Bulanan Jualan Borong (Selepas Pelarasan Bermusim) (Okt)

Kanada Kadar Bulanan Jualan Borong (Selepas Pelarasan Bermusim) (Okt)S:--

R: --

S: --

Jerman Akaun Semasa (Tidak Dilaraskan Mengikut Musim) (Okt)

Jerman Akaun Semasa (Tidak Dilaraskan Mengikut Musim) (Okt)S:--

R: --

S: --

Amerika Syarikat Jumlah Bilangan Pelantar Penerokaan Mingguan

Amerika Syarikat Jumlah Bilangan Pelantar Penerokaan MingguanS:--

R: --

S: --

Amerika Syarikat Jumlah Pelantar Minyak Untuk Minggu Ini

Amerika Syarikat Jumlah Pelantar Minyak Untuk Minggu IniS:--

R: --

S: --

Jepun Tankan Indeks Pertimbangan Iklim Perniagaan Bukan Perkilangan Berskala Besar (Suku 4)

Jepun Tankan Indeks Pertimbangan Iklim Perniagaan Bukan Perkilangan Berskala Besar (Suku 4)--

R: --

S: --

Jepun Indeks Tinjauan Pembuatan Kecil Tankan (Suku 4)

Jepun Indeks Tinjauan Pembuatan Kecil Tankan (Suku 4)--

R: --

S: --

Jepun Tankan Indeks Tinjauan Bukan Pembuatan Besar (Suku 4)

Jepun Tankan Indeks Tinjauan Bukan Pembuatan Besar (Suku 4)--

R: --

S: --

Jepun Indeks Tinjauan Pembuatan Besar Tankan (Suku 4)

Jepun Indeks Tinjauan Pembuatan Besar Tankan (Suku 4)--

R: --

S: --

Jepun Indeks Penghakiman Kemakmuran Industri Pembuatan Kecil Tankan (Suku 4)

Jepun Indeks Penghakiman Kemakmuran Industri Pembuatan Kecil Tankan (Suku 4)--

R: --

S: --

Jepun Indeks Penghakiman Kemakmuran Pembuatan Berskala Besar Tankan (Suku 4)

Jepun Indeks Penghakiman Kemakmuran Pembuatan Berskala Besar Tankan (Suku 4)--

R: --

S: --

Jepun Tankan Kadar Tahunan Perbelanjaan Modal Perusahaan Besar (Suku 4)

Jepun Tankan Kadar Tahunan Perbelanjaan Modal Perusahaan Besar (Suku 4)--

R: --

S: --

U.K. Kadar Tahunan Indeks Harga Kediaman Rightmove (Dis)

U.K. Kadar Tahunan Indeks Harga Kediaman Rightmove (Dis)--

R: --

S: --

China, Tanah Besar Kadar Tahunan Keluaran Industri (Sehingga Tahun) (Nov)

China, Tanah Besar Kadar Tahunan Keluaran Industri (Sehingga Tahun) (Nov)--

R: --

S: --

China, Tanah Besar Kadar Pengangguran Bandar (Nov)

China, Tanah Besar Kadar Pengangguran Bandar (Nov)--

R: --

S: --

Arab Saudi CPI YoY (Nov)

Arab Saudi CPI YoY (Nov)--

R: --

S: --

Zon Euro Kadar Tahunan Keluaran Industri (Okt)

Zon Euro Kadar Tahunan Keluaran Industri (Okt)--

R: --

S: --

Zon Euro Kadar Bulanan Keluaran Industri (Okt)

Zon Euro Kadar Bulanan Keluaran Industri (Okt)--

R: --

S: --

Kanada Kadar Bulanan Jualan Rumah Sedia Ada (Nov)

Kanada Kadar Bulanan Jualan Rumah Sedia Ada (Nov)--

R: --

S: --

Zon Euro Jumlah Aset Rizab (Nov)

Zon Euro Jumlah Aset Rizab (Nov)--

R: --

S: --

U.K. Jangkaan Inflasi

U.K. Jangkaan Inflasi--

R: --

S: --

Kanada Indeks Keyakinan Ekonomi Negara

Kanada Indeks Keyakinan Ekonomi Negara--

R: --

S: --

Kanada Bilangan Rumah Baru Dalam Pembinaan (Nov)

Kanada Bilangan Rumah Baru Dalam Pembinaan (Nov)--

R: --

S: --

Amerika Syarikat Indeks Pekerjaan Pembuatan Fed New York (Dis)

Amerika Syarikat Indeks Pekerjaan Pembuatan Fed New York (Dis)--

R: --

S: --

Amerika Syarikat Indeks Pengilangan Fed New York (Dis)

Amerika Syarikat Indeks Pengilangan Fed New York (Dis)--

R: --

S: --

Kanada Kadar Tahunan CPI Teras (Nov)

Kanada Kadar Tahunan CPI Teras (Nov)--

R: --

S: --

Kanada Kadar Bulanan Pembuatan Pesanan Tidak Diisi (Okt)

Kanada Kadar Bulanan Pembuatan Pesanan Tidak Diisi (Okt)--

R: --

S: --

Kanada Menghasilkan Pesanan Baharu Kadar Bulanan (Okt)

Kanada Menghasilkan Pesanan Baharu Kadar Bulanan (Okt)--

R: --

S: --

Kanada Kadar Bulanan CPI Teras (Nov)

Kanada Kadar Bulanan CPI Teras (Nov)--

R: --

S: --

Kanada Kadar Bulanan Inventori Pembuatan (Okt)

Kanada Kadar Bulanan Inventori Pembuatan (Okt)--

R: --

S: --

Kanada CPI YoY (Nov)

Kanada CPI YoY (Nov)--

R: --

S: --

Kanada Kadar Bulanan CPI (Nov)

Kanada Kadar Bulanan CPI (Nov)--

R: --

S: --

Kanada CPI YoY (Selepas Pelarasan Bermusim) (Nov)

Kanada CPI YoY (Selepas Pelarasan Bermusim) (Nov)--

R: --

S: --

Kanada Kadar Bulanan CPI Teras (Selepas Pelarasan Bermusim) (Nov)

Kanada Kadar Bulanan CPI Teras (Selepas Pelarasan Bermusim) (Nov)--

R: --

S: --

Tiada data yang sepadan

Aliran Pasaran

Indikator Teratas

Pandangan Terkini

Pandangan Terkini

Topik Trending

Kolumnis Top

Maklumat terkini

White Label

Data API

Web Plug-in

Program Afiliate

Lihat Semua

Tiada data

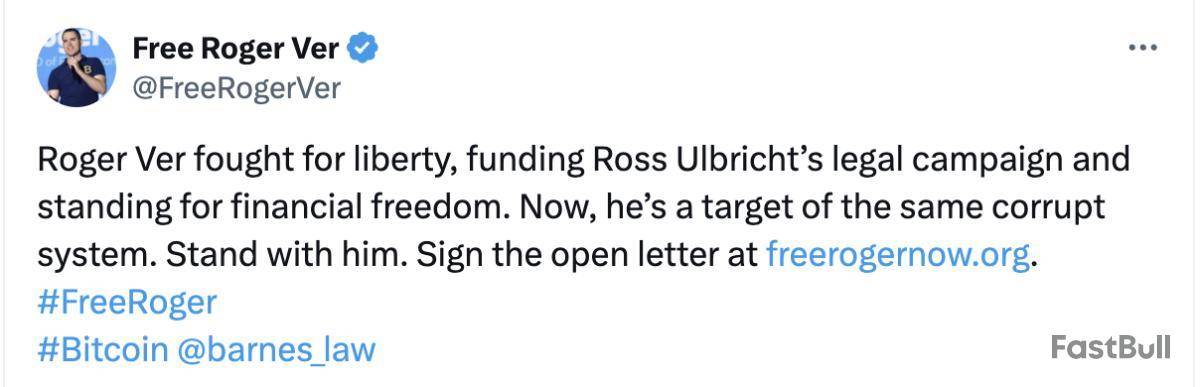

Early Bitcoin adopter Roger Ver has launched a social media campaign pleading with US President Donald Trump to pardon his tax evasion and mail fraud charges, claiming he is the victim of “lawfare” — just like recently pardoned Silk Road founder Ross Ulbricht and Trump himself.

Currently awaiting extradition to the US, Ver says he faces “109 years” behind bars for crimes he did not commit. In his view, US authorities unjustly pursued him.

However, crypto proponents appear divided over whether Ver deserves a pardon. Some argue he did commit these crimes and that his character is what makes him worthy of the sheer size of the punishment.

“No one deserves to spend life in prison for tax evasion,” one X user wrote. “But Roger has definitely earned it.”

Tesla founder Elon Musk feels that Ver’s denouncement of his US citizenship makes him unworthy of a pardon. “Roger Ver gave up his US citizenship. No pardon for Ver,” he posted on Jan. 26. In the moments that followed, the Bitcoin Cash founder’s odds of a pardon plummeted on prediction market Polymarket.

Since then, Ver has released several videos maintaining his innocence and calling upon Trump to pardon him, creating a fierce divide between his supporters and those who feel that Ver’s claims are all for show.

Roger Ver and the case for lawfare

Ver’s Jan. 26 video features dramatized scenes of police sirens, American flags and Ver pining for America from a Spanish apartment. The so-called “Bitcoin Jesus” says he was “born an American. I am an American. And I will die as an American.”

But he isn’t an American, at least not on paper.

Ver renounced his US citizenship in 2014 for a St. Kitts and Nevis passport, citing ideological concerns with the American government.

High-net-worth individuals who give up their US citizenship are subject to a so-called “exit tax” on the value of their assets and businesses. Ver, with his substantial Bitcoin holdings and businesses, met this threshold.

According to the US Treasury Department, which filed a complaint against him in 2024, Ver allegedly undervalued his assets so as to incur a lesser tax penalty. In doing so, he has been accused of attempting to commit tax and mail fraud. The Treasury also claims that firms he owned and operated within the United States, even after leaving, did not pay proper tax.

In a second video, which he released on Jan. 27, Ver claims that the case is not a matter of tax fraud but of political and ideological persecution perpetrated by agents of the US government.

He contends that “lawfare” is to blame for the current charges against him and his past stint in federal prison, and that it’s even the true reason behind his expatriation a decade ago.

Ver asserts that agents from the Bureau of Alcohol, Tobacco and Firearms (ATF) developed a personal vendetta against him after he criticized the ATF and FBI for the bloody Waco siege against the Branch Davidians in 1993. Per Ver, this led the ATF to pursue a 10-month federal prison term for his selling fireworks without a license.

Fear over further persecution from government officials — i.e., lawfare — led Ver to renounce his citizenship and seek to move abroad.

Ver spent the following years as an outspoken crypto advocate. Bitcoin’s ability to facilitate transactions with no central intermediary, and Ver’s eagerness to evangelize it far and wide, once again grabbed the attention of the government, who wished to suppress these findings, he claims.

He said:

Ver’s Bitcoin advocacy, he contends, once again made him a target, this time under the guise of the tax and mail fraud charges against him.

The timing and nature of Ver’s plea coincide with President Trump commuting Ulbricht’s sentence. In numerous replies to his videos on X, Ver’s supporters drew comparisons between him and Ulbricht, saying that if Trump is serious about doing justice to victims of government overreach, he will pardon Ver.

But while the “Free Ross” and “Free Roger” campaigns may look similar at first glance, there are important differences.

Ver does not an Ulbricht make

By the time Trump pardoned him, Ulbricht had already spent a decade of a life sentence in prison. The stakes were high.

Ver, by contrast, has not yet been extradited to the United States and hasn’t seen his first day in court. The 109-year figure claimed by Ver’s PR team — if it is to be believed — appears to be the maximum sentence he could face if found guilty on all counts. Sentencing wouldn’t occur until the conclusion of the trial, and only if Ver is convicted.

Ulbricht also had support from outside the relatively small crypto community. His case was part of the US’ wildly unpopular drug policy. Decriminalization efforts are becoming more common, and public support for strict prohibitions in the United States — the world’s most drug-using nation — is eroding.

Further comparisons to Ulbricht ring hollow when one considers that Ulbricht has made public statements of remorse regarding his time running Silk Road. Ver, conversely, seems intent on denying any wrongdoing, going so far as to blame the entire US government for his problems.

The lawfare argument also falls flat if one considers that Ver could likely avoid going to prison by simply cutting a check.

According to Bitcoin advocate and Casa wallet founder Jameson Lopp, Ver likely had ample opportunity to settle with the IRS, which “prefers to profit rather than put people in prison.” He noted that MicroStrategy CEO Michael Saylor recently settled with the IRS for $40 million just so he could “move on with his life.”

Ver could be refusing to pay simply out of principle. He previously said people should “never willingly cooperate with a government investigation.”

Lopp suggested that maybe Ver just doesn’t have the cash:

What are Ver’s chances of getting a pardon?

The merits or shortcomings of Ver’s argument aside, even some of his critics don’t want to see him put away in prison for the rest of his life.

Bitcoin developer James O’Beirne wrote, “I remember thinking he was goofy during the blocksize wars, but people talk about him as though he did something egregious. If so, what?”

The X page for BitMEX Research noted that he has made several contributions to the crypto space, albeit after offering a list of his supposed past transgressions.

Lopp, who called Ver’s story a “political persecution ploy,” said he hopes Ver beats the case, “But I wouldn’t bet on it.”

Indeed, betting markets like Polymarket don’t seem convinced Ver will get a pardon. At publishing time, the market puts him at just a 14% chance of getting a pardon in Trump’s first 100 days.

Coinbase has launched operations in Argentina after receiving a Virtual Asset Service Provider (VASP) license from Argentina's National Securities Commission, marking its expansion into a market with over 5 million daily crypto users.

The regulatory approval enables Coinbase to provide trading and custody services within Argentina's legal framework, targeting a population grappling with high inflation, currency volatility, and limited access to international markets.

Research commissioned by Coinbase shows that 87% of Argentinians believe crypto can help them achieve greater financial independence, while 76% view it as a solution to inflation and transaction costs.

Matías Alberti, previously of Buenbit and Clara, will lead Coinbase's operations in Argentina.

"Economic freedom is a cornerstone of prosperity, and we are proud to bring secure, transparent, and reliable crypto services to Argentina," said Fabio Plein, Director for the Americas at Coinbase.

The company plans to launch educational initiatives focused on financial literacy and understanding of the crypto ecosystem.

This expansion follows Coinbase's earlier entry into Brazil, strengthening its presence in Latin America.

Binance is facing yet another regulatory storm in France. The country's authorities have now launched a criminal investigation against crypto exchange, alleging tax fraud, money laundering, and illegal operations tied to drug trafficking.

According to a report by Reuters, the investigation, led by France's financial crime unit (JUNALCO), accuses Binance of facilitating money laundering linked to drug trafficking. The case spans between 2019 and 2024.

Alleged Failure in Reporting Suspicious Activities

Prosecutors claim the platform failed to report suspicious activities and operated without necessary approvals in France and other European Union countries. Complaints from users who said they lost money due to misleading communication and unlicensed trading practices fueled the probe. Binance, in a statement, denied all allegations, calling them outdated and vowing to fight the charges.

This is not the first time Binance is at loggerheads with Paris watchdogs. Binance France was investigated by public prosecutors in 2023 over the 'illegal' provision of crypto services before it was licensed.

While defending the crypto exchange Former CEO Changpeng Zhao, Binance dismissed the report, saying the exchange received a surprise visit from the local authorities prior to the investigation. Zhao added that the inspections was usual for banks and also crypto companies.

CZ 🔶 BNB@cz_binanceJun 16, 20234. FUD.

In France, surprise (no advanced notice) on-site inspections of regulated businesses are the norm, for banks, and now for crypto too.

The surprise visit for Binance France happened a couple of weeks ago. It's not "news". Binance France cooperated fully.

Binance also… https://t.co/xdbLc5jXBW

Elsewhere, Zhao pleaded guilty to violating US anti-money laundering laws in 2023, the same year. Consequently, Binance paid a $4.3 billion penalty as part of the settlement.

US prosecutors accused the company of ignoring over 100,000 suspicious transactions linked to criminal activities, including terrorism financing. The company's troubles extend beyond the US and France. Australia's corporate watchdog recently sued Binance for allegedly denying retail customers proper protections.

Binance's Response

Binance has repeatedly claimed it is improving its compliance. The company praised its services, pointing to advancements in anti-money laundering (AML) protocols and enhanced employee training. Binance says it has adopted global standards for Know-Your-Customer (KYC) processes to combat illicit activity.

Despite these assurances, French prosecutors argue that the company's actions have harmed investors. The Financial Action Task Force (FATF) has also warned that cryptocurrency remains a haven for financial crimes, highlighting the risks in the industry.

Binance's mounting legal woes reflect broader challenges in the cryptocurrency world. Interestingly, a wave of bankruptcies in 2022 revealed widespread fraud across major crypto platforms, leaving millions of investors in financial ruin.

The launch of Rivens AI by Zero1 Labs on January 29, 2025, could have implications for the DEAI token. The introduction of a new product often sparks interest and speculation, potentially boosting the token’s price. Additionally, a hackathon with a $20k prize pool follows the launch, which could create further engagement and awareness. If the product meets high expectations, the demand for DEAI might increase. However, any technical issues or low user interest could result in a price stagnation or decline. Pay attention to initial adoption rates. Source

OpenServ’s AMA on January 31, 2025, might shift the SERV token's price. The discussion will cover major updates like the new SDK, tokenomics, and partnerships, which could impact investor confidence. The unveiling of these updates could attract new users and partnerships, leading to increased demand for the token. If the AMA reveals positive news, the token might see an upward trend. Conversely, if there are concerns or unmet expectations, the price could drop. Monitoring community reactions during the AMA will provide further clues. Source

OpenServ@openservaiJan 28, 2025We Need to Talk - AMA This Week!

It’s been a whirlwind start to the year with game-changing updates:

OpenServ Agent Framework SDK

Tokenomics v2

DevNet LIVE

New AI research collaborations

Big Web3/Web2 partnerships/integrations

$100K Hackathon

Tax removal

and a… pic.twitter.com/YF2vCBe488

The public launch of Humans.ai on March 1, 2025, could influence the HEART token's price. This event offers exclusive user skins and benefits for the first 2,000 sign-ups, making it attractive for early adopters. Such perks can boost demand and attention for the platform, potentially affecting market sentiment. If the launch attracts a strong user base, it could lead to increased token usage and value. However, if interest is low, the impact on the token's price might be minimal. Watch for participation numbers and community buzz for insights. Source

Humans.ai@humansdotaiJan 28, 2025Don’t Miss Out!

The wait is almost over - here are our Go Live dates!

Sign up here: https://t.co/wNzEDo2fRx

29 January - Private Beta begins! KOLs get exclusive early access - be the first to hear their thoughts.

24 February - Community Private Beta kicks off! Only… pic.twitter.com/A8lU5CNpI7

DeepSeek, the Chinese open-source AI model making waves in Silicon Valley, is extremely bullish on Bitcoin, predicting a potential peak of between $500,000 and $600,000 by the first quarter of 2026. This bold outlook emerged after the AI was asked to factor in both historical models and on-chain data, alongside a pro-Bitcoin approach from President Trump.

DeepSeek’s Bitcoin Price Prediction

DeepSeek begins by discussing what it calls the “Key Implications of the Crypto Executive Order,” which it believes would change the calculus for both institutional and retail participants. The AI states that “The exploration of a national Bitcoin reserve signals institutional validation of Bitcoin as a strategic asset. If the US government accumulates Bitcoin, it could create a significant supply shock, driving prices higher.”

This comment reflects a view that the market could tighten substantially if large public entities, such as national treasuries, decide to hold Bitcoin in reserve. Furthermore, DeepSeek highlights the possibility that “other nations and institutions could follow suit,” which would add to the upward price pressure if a wave of competitive accumulation were to ensue.

The AI also remarks that by banning CBDCs, the Trump administration would be “effectively positioning Bitcoin and other decentralized cryptocurrencies as the primary alternatives to fiat currencies,” which is a bold departure from the policies adopted or explored by many other jurisdictions that tend to see CBDCs as a means of maintaining control over monetary policy in a digital economy.

DeepSeek believes regulatory clarity is another fundamental driver likely to magnify Bitcoin’s gains. It explicitly points out that the “establishment of a cryptocurrency working group led by David Sacks suggests a pro-innovation regulatory approach” and that such a policy stance is likely to foster a favorable climate for crypto businesses and financial institutions looking for stable guidelines.

The AI argues that this, in turn, could encourage accelerated institutional inflows and broader mainstream acceptance of Bitcoin, especially if companies are assured that the regulatory framework allows them to innovate without fear of sudden legal or compliance obstacles. DeepSeek goes on to address the geopolitical aspects of the executive order by saying, “The US is taking a leadership role in the digital asset space, which could strengthen the dollar’s dominance while simultaneously boosting Bitcoin’s status as a global store of value.”

Delving into the specific timeline, the AI predicts that any news about the realization of thr strategic Bitcoin reserve could trigger a short-lived but potent rally, potentially pushing the price to the $120,000–$130,000 bracket as traders, institutions, and the media absorb the implications of a government-led push for a national Bitcoin reserve and enhanced regulatory clarity.

DeepSeek expects that by the second and third quarters of 2025, as conversations around the working group’s findings gain momentum, institutional investors and retail market participants may exhibit what DeepSeek calls “Institutional FOMO,” leading to a jump in Bitcoin’s price to the $200,000–$250,000 zone.

The AI model then projects that by the end of 2025, the price might rise further, potentially reaching $300,000–$350,000. It points to ongoing speculation about the government’s Bitcoin purchases, or at least the possibility of such purchases, as well as heightened recognition of Bitcoin’s role as a global reserve asset. DeepSeek believes this period would be marked by increased media attention, new financial products enabling Bitcoin exposure, and robust demand from both seasoned and new investors.

The AI’s analysis becomes especially dramatic when it turns to the outlook for 2026, tying the bullish price momentum to three key factors: the aftermath of the 2024 Bitcoin halving, growing interest from major institutions, and direct involvement of the US government. DeepSeek says, “Bitcoin could peak at $500,000-$600,000, as the market enters the euphoria phase,” suggesting that the first quarter of 2026 is the most likely time for such a spike.

DeepSeek stresses that the halving would reduce Bitcoin’s issuance, while strong new demand from large-scale players—possibly guided by the new executive order—could further tighten supply. Yet, DeepSeek warns that after this euphoric peak, the market may correct significantly, potentially falling back to the $250,000–$300,000 range by mid to late 2026 as investors realize profits and speculative excesses unwind.

The AI still anticipates a generally positive long-term picture, asserting that “the long-term outlook remains bullish due to Bitcoin’s growing role in the global financial system,” particularly if the regulatory framework introduced during Trump’s administration remains in place and encourages widespread adoption.

At press time, BTC traded at $102,948.

White Label

Data API

Web Plug-in

Pembuat Poster

Program Afiliate

Risiko kerugian dalam perdagangan instrumen kewangan seperti saham, FX, komoditi, niaga hadapan, bon, ETF dan kripto boleh menjadi besar. Anda mungkin mengalami kerugian keseluruhan dana yang anda depositkan dengan broker anda. Oleh itu, anda harus mempertimbangkan dengan teliti sama ada perdagangan sedemikian sesuai untuk anda berdasarkan keadaan dan sumber kewangan anda.

Tiada keputusan untuk melabur harus dibuat tanpa menjalankan usaha wajar secara menyeluruh sendiri atau berunding dengan penasihat kewangan anda. Kandungan web kami mungkin tidak sesuai dengan anda kerana kami tidak mengetahui keadaan kewangan dan keperluan pelaburan anda. Maklumat kewangan kami mungkin mempunyai kependaman atau mengandungi ketidaktepatan, jadi anda harus bertanggungjawab sepenuhnya untuk sebarang keputusan perdagangan dan pelaburan anda. Syarikat tidak akan bertanggungjawab ke atas kehilangan modal anda.

Tanpa mendapat kebenaran daripada tapak web, anda tidak dibenarkan menyalin grafik, teks atau tanda dagangan tapak web. Hak harta intelek dalam kandungan atau data yang dimasukkan ke dalam laman web ini adalah milik pembekal dan pedagang pertukarannya.

Tidak log masuk

Log masuk untuk mengakses lebih banyak ciri

Keahlian FastBull

Belum lagi

Belian

Log masuk

Daftar