Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

U.K. CBI Retail Sales Expectations Index (Mar)

U.K. CBI Retail Sales Expectations Index (Mar)A:--

F: --

P: --

U.S. Building Permits Revised MoM (SA) (Feb)

U.S. Building Permits Revised MoM (SA) (Feb)A:--

F: --

P: --

Mexico Retail Sales MoM (Jan)

Mexico Retail Sales MoM (Jan)A:--

F: --

P: --

U.S. Building Permits Revised YoY (SA) (Feb)

U.S. Building Permits Revised YoY (SA) (Feb)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. FHFA House Price Index (Jan)

U.S. FHFA House Price Index (Jan)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Jan)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Jan)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Jan)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Jan)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Jan)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Jan)A:--

F: --

P: --

U.S. FHFA House Price Index MoM (Jan)

U.S. FHFA House Price Index MoM (Jan)A:--

F: --

U.S. FHFA House Price Index YoY (Jan)

U.S. FHFA House Price Index YoY (Jan)A:--

F: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Jan)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Jan)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Jan)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Jan)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index YoY (Jan)

U.S. S&P/CS 10-City Home Price Index YoY (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Mar)

U.S. Conference Board Consumer Expectations Index (Mar)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Mar)

U.S. Conference Board Present Situation Index (Mar)A:--

F: --

P: --

U.S. New Home Sales Annualized MoM (Feb)

U.S. New Home Sales Annualized MoM (Feb)A:--

F: --

U.S. Richmond Fed Manufacturing Composite Index (Mar)

U.S. Richmond Fed Manufacturing Composite Index (Mar)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Mar)

U.S. Conference Board Consumer Confidence Index (Mar)A:--

F: --

U.S. Richmond Fed Manufacturing Shipments Index (Mar)

U.S. Richmond Fed Manufacturing Shipments Index (Mar)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Mar)

U.S. Richmond Fed Services Revenue Index (Mar)A:--

F: --

P: --

U.S. Annual Total New Home Sales (Feb)

U.S. Annual Total New Home Sales (Feb)A:--

F: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

Australia Weighted CPI YoY (Feb)

Australia Weighted CPI YoY (Feb)A:--

F: --

P: --

Australia Weighted CPI YoY (SA) (Feb)

Australia Weighted CPI YoY (SA) (Feb)A:--

F: --

P: --

Australia CPI MoM (SA) (Feb)

Australia CPI MoM (SA) (Feb)A:--

F: --

P: --

U.K. Retail Prices Index YoY (Feb)

U.K. Retail Prices Index YoY (Feb)--

F: --

P: --

U.K. Core Retail Prices Index YoY (Feb)

U.K. Core Retail Prices Index YoY (Feb)--

F: --

P: --

U.K. CPI MoM (Feb)

U.K. CPI MoM (Feb)--

F: --

P: --

U.K. Core CPI YoY (Feb)

U.K. Core CPI YoY (Feb)--

F: --

P: --

U.K. CPI YoY (Feb)

U.K. CPI YoY (Feb)--

F: --

P: --

U.K. Retail Prices Index MoM (Feb)

U.K. Retail Prices Index MoM (Feb)--

F: --

P: --

U.K. Core CPI MoM (Feb)

U.K. Core CPI MoM (Feb)--

F: --

P: --

France Unemployment Class-A (Feb)

France Unemployment Class-A (Feb)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Brazil Current Account (Feb)

Brazil Current Account (Feb)--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Feb)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Feb)--

F: --

P: --

U.S. Durable Goods Orders MoM (Excl.Transport) (Feb)

U.S. Durable Goods Orders MoM (Excl.Transport) (Feb)--

F: --

P: --

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Feb)

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Feb)--

F: --

P: --

U.S. Durable Goods Orders MoM (Feb)

U.S. Durable Goods Orders MoM (Feb)--

F: --

P: --

UK Chancellor of the Exchequer Reeves announces Spring Budget Statement

UK Chancellor of the Exchequer Reeves announces Spring Budget Statement U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. Yield--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Feb)

China, Mainland Industrial Profit YoY (YTD) (Feb)--

F: --

P: --

Turkey Trade Balance (Feb)

Turkey Trade Balance (Feb)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Feb)

Euro Zone M3 Money Supply (SA) (Feb)--

F: --

P: --

Euro Zone 3-Month M3 Money Supply YoY (Feb)

Euro Zone 3-Month M3 Money Supply YoY (Feb)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Feb)

Euro Zone Private Sector Credit YoY (Feb)--

F: --

P: --

Euro Zone M3 Money Supply YoY (Feb)

Euro Zone M3 Money Supply YoY (Feb)--

F: --

P: --

South Africa PPI YoY (Feb)

South Africa PPI YoY (Feb)--

F: --

P: --

Mexico Trade Balance (Feb)

Mexico Trade Balance (Feb)--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

No matching data

US

US VN

VN TW

TW US

US VN

VN TW

TWLatest Views

Latest Views

Trending Topics

To quickly learn market dynamics and follow market focuses in 15 min.

In the world of mankind, there will not be a statement without any position, nor a remark without any purpose.

Inflation, exchange rates, and the economy shape the policy decisions of central banks; the attitudes and words of central bank officials also influence the actions of market traders.

Money makes the world go round and currency is a permanent commodity. The forex market is full of surprises and expectations.

Top Columnists

Enjoy exciting activities, right here at FastBull.

The latest breaking news and the global financial events.

I have 5 years of experience in financial analysis, especially in aspects of macro developments and medium and long-term trend judgment. My focus is maily on the developments of the Middle East, emerging markets, coal, wheat and other agricultural products.

BeingTrader chief Trading Coach & Speaker, 8+ years of experience in the forex market trading mainly XAUUSD, EUR/USD, GBP/USD, USD/JPY, and Crude Oil. A confident trader and analyst who aims to explore various opportunities and guide investors in the market. As an analyst I am looking to enhance the trader’s experience by supporting them with sufficient data and signals.

Latest Update

Risk Warning on Trading HK Stocks

Despite Hong Kong's robust legal and regulatory framework, its stock market still faces unique risks and challenges, such as currency fluctuations due to the Hong Kong dollar's peg to the US dollar and the impact of mainland China's policy changes and economic conditions on Hong Kong stocks.

HK Stock Trading Fees and Taxation

Trading costs in the Hong Kong stock market include transaction fees, stamp duty, settlement charges, and currency conversion fees for foreign investors. Additionally, taxes may apply based on local regulations.

HK Non-Essential Consumer Goods Industry

The Hong Kong stock market encompasses non-essential consumption sectors like automotive, education, tourism, catering, and apparel. Of the 643 listed companies, 35% are mainland Chinese, making up 65% of the total market capitalization. Thus, it's heavily influenced by the Chinese economy.

HK Real Estate Industry

In recent years, the real estate and construction sector's share in the Hong Kong stock index has notably decreased. Nevertheless, as of 2022, it retains around 10% market share, covering real estate development, construction engineering, investment, and property management.

Hongkong, China

Ho Chi Minh, Vietnam

Dubai, UAE

Lagos, Nigeria

Cairo, Egypt

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

English

English Español

Español العربية

العربية Bahasa Indonesia

Bahasa Indonesia Bahasa Melayu

Bahasa Melayu Tiếng Việt

Tiếng Việt ภาษาไทย

ภาษาไทย Français

Français Italiano

Italiano Türkçe

Türkçe Русский язык

Русский язык 简中

简中 繁中

繁中Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up

Hongkong, China

Ho Chi Minh, Vietnam

Dubai, UAE

Lagos, Nigeria

Cairo, Egypt

White Label

Data API

Web Plug-ins

Affiliate Program

President Donald Trump waves after announcing Federal Reserve board member Jerome Powell as his nominee for chair of the Federal

President Donald Trump waves after announcing Federal Reserve board member Jerome Powell as his nominee for chair of the Federal Reserve in 2017. (Photo by Jabin Botsford/The Washington Post via Getty Images) · The Washington Post via Getty Images

President Trump once again turned up the pressure on the Federal Reserve, saying Wednesday evening on social media that the central bank would "be much better off" lowering interest rates as tariffs go into effect.

The comments on Truth Social came after the Fed held interest rates steady Wednesday for the second meeting in a row and maintained a prior prediction for two rate cuts at some point this year.

What the central bank did change, however, was its outlook on inflation (higher) and economic growth (lower), with Fed Chair Jerome Powell saying that a driving reason for the change was uncertainty stemming from Trump's plans for an aggressive slate of new tariffs on top of new duties already imposed on China, Canada, and Mexico.

The president has promised to unveil "reciprocal" tariffs on many countries April 2, which he has taken to calling "liberation day."

"The Fed would be MUCH better off CUTTING RATES as U.S.Tariffs start to transition (ease!) their way into the economy," Trump said in his post on Truth Social. "Do the right thing. April 2nd is Liberation Day in America!!!"

President Donald Trump waves after announcing Federal Reserve board member Jerome Powell as his nominee for chair of the Federal Reserve in 2017. (Photo by Jabin Botsford/The Washington Post via Getty Images) · The Washington Post via Getty Images

Powell did not shy away from the impact of Trump’s tariffs during a highly anticipated press conference Wednesday.

The Fed chairman said in no uncertain terms that Trump's trade agenda would be likely to drive up prices, even amid considerable uncertainty about exactly how much — and whether the price changes would be "transitory."

In just one example Wednesday afternoon during a question about price stability, Powell said that inflation had previously neared the Fed's key goal but now "I do think with the arrival of the tariff inflation, further progress may be delayed."

Some analysts raised questions about the Fed's unchanged overall prediction of two cuts this year even as Trump's trade policy has roiled markets and cut back projections of economic growth for the remainder of the year.

"We continue to think that Fed officials are underestimating the extent to which tariffs are likely to push up inflation," Capitol Economics said in a note immediately after Wednesday's decision but before the press conference.

At other points in his press conference Wednesday, Powell also said that the exact effects of tariffs on prices were uncertain, may never be exactly known, and could even be temporary.

He called the price effects of tariffs potentially "transitory" — reusing a much-scrutinized word that was deployed by the Fed and other economic officials in 2021 as prices started to rise during Joe Biden's presidency.

Ethereum (ETH) is currently trading at $2014, having successfully broken through the $1950 resistance level, which has now turned into a key support zone. The $2000 level is crucial in determining whether ETH continues its upward trajectory or faces a pullback. If this support holds, buyers may gain momentum to push the price higher. However, failure to maintain this level could trigger a deeper retracement.

Key Support and Resistance Levels

If Ethereum (ETH) remains above the $2000 support, bullish momentum may build, driving the price toward $2150, a critical resistance point. A decisive break above $2150 could spark a further rally, sending ETH toward the $2225 resistance level.

At $2225, some traders may take profits, leading to a temporary pullback. However, if buyers sustain their pressure, Ethereum (ETH) could maintain its bullish momentum, setting the stage for a long-term uptrend.

If ETH fails to hold $2000, increased selling pressure could drive it back to the $1950 support zone. A break below this level may result in further downside movement, with ETH potentially sliding to $1800, a crucial support area.

Should bearish momentum persist, Ethereum (ETH) could experience a more extended decline, testing even lower levels before stabilizing.

However, Ethereum’s (ETH) next move largely depends on how it reacts to the $2000 support level. A strong rebound from this zone could fuel a rally toward $2150 and $2225, while a breakdown might trigger a decline to $1800. Traders should monitor these levels closely as ETH prepares for its next significant move.

(Bloomberg) -- Oil erased gains as global markets were buffeted by mixed signals from the Federal Reserve and Donald Trump.

Brent traded below $71 a barrel, with US equity futures also reversing an earlier increase. Fed Chair Jerome Powell acknowledged the high degree of uncertainty from the US president’s policies, but said the central bank is in no hurry to cut rates.

Trump, meanwhile, said the Fed should reduce borrowing costs, splitting with policymakers weighing the economic cost of his tariff push. New Fed projections showed lower growth forecasts but higher inflation estimates. The Treasury market boosted its bets on lower rates.

Crude remains markedly below its mid-January peak, as a confluence of bearish factors pressures prices. While the escalating trade war threatens to hit energy demand as tariffs and counter levies are imposed, OPEC and its allies are set to raise output from April, contributing to weaker global balances.

“US tariff news is likely to keep oil prices volatile,” said Giovanni Staunovo, a commodity analyst at UBS Group AG. “That said, we retain our moderately constructive outlook for crude prices.”

US inventories of gasoline, meanwhile, fell last week to the lowest since the start of the year, while distillates — a category that includes diesel — also sank, allaying concerns about consumption. Crude stockpiles rose less than flagged in an industry report, while levels dropped at the Cushing, Oklahoma, hub.

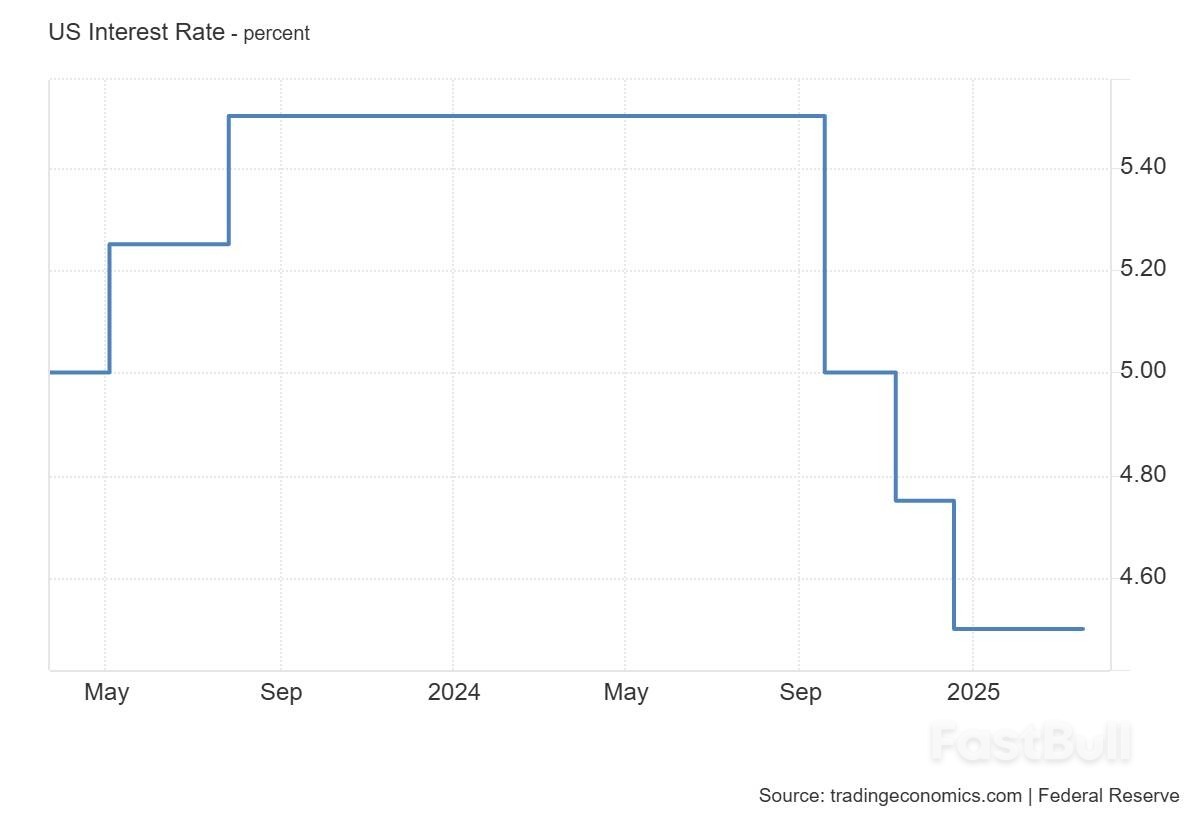

After the recent Federal Open Market Committee meeting, the US Federal Reserve, yesterday, announced its plan to keep its federal funds rate unchanged at 4.25%-4.5%. Every FOMC meeting influences Bitcoin prices, sometimes causing major swings. In the last 24 hours, the price of BTC has seen a rise of 3.1%. This report looks at past rate hikes, how Bitcoin reacted and what traders can expect going forward. Ready? Dive in!

In April 2022, the Fed funds interest rate was as low as 0.5%. It was in May 2022 that the US Fed decided to revisit its interest rate policy. The primary reason was that the inflation rate had reached as high as 8.6% in May 2022. In June, the inflation rate touched a peak of 9.1% - the highest in a decade.

Between May 2022 and July 2023, the US Fed consistently pushed the interest rate upwards. By July 2023, it had reached as high as 5.5%. The level remained unchanged until August 2024.

In August 2024, the inflation rate fell to 2.5%. In fact, between June 2022 and June 2023, the rate declined consistently.

It was in September 2024 that the US Fed reversed its stance on the interest rate policy. In September, the interest rate was reduced from 5.5% to 5%. In November, it was lowered to 4.75%. In December, for the third time in 2024, it was brought down to 4.5%.

In the March 2024 FOMC meeting, the US Fed decided to keep the interest rate unchanged at 5.5%. Initially, the Bitcoin market reacted positively, pushing the price to a new ATH. In April 2024, the market moved sideways, trading within a range of $71K and $61K.

In the May 2024 FOMC meeting, the Fed showed no interest in making any changes. The BTC market showed small signs of recovery.

In the June 2024 FOMC meeting, even though the Fed acknowledged the moderation in inflation, they decided to keep the interest rate unchanged. At one point in June 2024, the BTC price dropped as low as $58,360.67.

In the July 2024 FOMC meeting also, the Fed refrained from making changes. The BTC market plummeted sharply after the meeting. At one point on August 5, it dropped to a low of $48,919.60.

In the September 2024 meeting, the Fed reversed its interest rate policy. It reduced the rate by 25 basis points to 5%. Within ten days of the meeting, the Bitcoin price climbed by 10%. This marked the beginning of a new bull run in the market.

In the November 2024 meeting, the Fed implemented another 25 basis point reduction. November 2024 was a fantastic month for BTC. A favourable macroeconomic and political environment, fueled by Donald Trump’s victory in the US presidential election, contributed to Bitcoin’s steep growth.

In the December 2024 meeting, the Fed reduced the interest rate to 4.5%. It was the third and final reduction implemented by the Fed in 2024. In December, the BTC price touched a new ATH of 108K.

In the January 2025 FOMC meeting, the Fed returned to its “wait and watch” policy. It kept the interest rate unchanged at 4.5%. By January 2025, the Bitcoin market lost the bullish momentum, which had helped the asset reach its ATH of $109K.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.