Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)A:--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Bitcoin’s price moves to the upside saw some resistance at the $86,000 level, and the asset has slipped south by around a grand.

Most altcoins have also taken a breather after the weekend gains, aside from SOL, which continues its gradual ascent.BTC Dominance Above 60%

The primary cryptocurrency began the previous trading week on the wrong foot, with its price dumping twice to a five-month low of just over $74,000. This came after the rising political tension between the US and essentially the rest of the world.

After Trumpeased offthe tariffs against every other nation except for China on Wednesday, BTC went on the run and skyrocketed past $83,000. This rally was also supported by favorable US CPI data.

The asset faced some more volatility by the end of the trading week, due to new moves on the China-US Trade War front, but managed to recover the losses by the weekend and entered it at $83,000. It actually climbed on Saturday and Sunday morning to an 11-daypeakof $86,000 where it faced a rejection.

As of now, BTC trades at just under $85,000, which marks a 12.7% weekly surge. Its market cap has risen above $1.680 trillion on CG, while its dominance over the alts is at 60.5% there and 63.4% on TradingView. Such high levels were last seen back in 2021.OM Crashes

The big news from the altcoin space today came from Mantra, as the project’s native token crashed by over 90% at one point. The CEO explained that the painful market moves ‘were triggered by reckless forced closures initiated by centralized exchanges on OM account holders.’

Most larger-cap alts are also slightly in the red, but nothing close to the OM decline. XRP, BNB, DOGE, ADA, TON, and LINK have marked minor losses, while TRX and SOL are up by around 3% each. As a result, TRX trades above $0.25, while SOL is close to $135.

ETH has gained just over 1% over the past 24 hours, and stands above $1,600.

The total crypto market cap has failed to overcome the $2.9 trillion obstacle and is down by $20 billion since yesterday.

New York, April 14, 2025 (GLOBE NEWSWIRE) — On April 15, Bitcoin Thunderbolt officially launched. It’s a native upgrade, jointly initiated by Satoshi-era miners, Bitcoin whales, and early contributors including the Nubit team. Thunderbolt is a soft fork to the Bitcoin base layer, and marks the most significant technical shift in the last 10 years. At its core are two key upgrades: UTXO Bundling, which dramatically boosts onchain throughput by compressing transaction data; and the OP_CAT feature, a long-awaited opcode that brings native programmability to Bitcoin.

The launch has already drawn massive attention from the Bitcoin community. Many long-time users and miners say it fixes problems that have been holding Bitcoin back. “I’ve been following this technology upgrade since last year,” commented a veteran Bitcoin miner with nearly 10 years of experience. “I honestly didn’t expect it to happen this fast. A real soft fork, live and running, it feels like a new era for Bitcoin has just begun.”

To access Thunderbolt, users need a Boosting Code, a special invite distributed through eligible partners and communities. Boosting Codes are tied to rare Bitcoin rewards and early-bird access. Nubit, as one of the core contributors, is actively coordinating early access through its community channels, where users can also apply for Boosting Codes. The first round is already claimed, and future waves are expected to be even more competitive.

As more people join, Thunderbolt is quickly becoming the official Bitcoin standard, contributed by the collective effort of miners, Bitcoin core developers, and early adopters who believe in Bitcoin’s future. Transactions are instant, and the network runs smoothly on top of Bitcoin Core. Bitcoin feels faster, easier, and more ready for real-world use cases.

The upgrade is also drawing strong interest from institutions. One early success story comes from a small, retailer-focused mining pool that was counted by Nubit as a test partner for Bitcoin Thunderbolt. After integrating, its hashrate jumped from 800 TH/s to 16.97 EH/s, placing it among the top 10 pools globally. As adoption grows, Bitcoin Thunderbolt is setting a new technical standard for how Bitcoin is used, built on, and scaled.

As more people join, Thunderbolt is quickly becoming the official Bitcoin standard, contributed by the collective effort of miners, Bitcoin core developers, and early adopters who believe in Bitcoin’s future. Transactions are instant, and the network runs smoothly on top of Bitcoin Core. It’s a groundbreaking shift from the slow, clunky experience many users were used to. Now, Bitcoin feels faster, easier, and more ready for real-world use cases.

Christopher Stiff

hedguecrypto@gmail.com

Many people believed that XRP's recent spike above the pivotal psychological level of $2 was a possible breakout signal. The most recent retracement, though back below the 100 EMA, raises the possibility that the bullish momentum was premature. Weakening indicators are emerging as the asset currently trades at $2.11 after being rejected by the 100-day exponential moving average.

The deteriorating volume profile is among the most obvious warning signs. Due to a lack of strong buyer follow-through, trading volume has continuously trended lower since the spike that lifted XRP above the $2 threshold. It implies that the rally was primarily speculative and unsupported by long-term capital inflow or investor confidence. The approaching pre-death cross, a technical signal created when the 50 EMA is poised to cross below the 100 EMA, is contributing to the bearish mood. Chart by TradingView">

It still indicates growing bearishness in the short- to midterm trend, albeit not as severely as a 50/200 EMA death cross may. When XRP was last in the vicinity of such a formation, it entered a protracted period of consolidation. On-chain data further exacerbates the issue. Beginning on April 13, there was a sharp decline in the number of transactions on the XRP Ledger, with the number of transactions approaching zero.

This type of network activity collapse poses serious issues for a utility-driven token such as XRP, which relies on high transaction throughput to support its value and usefulness in international transactions. XRP is currently in a risky position. Support is located around $2.00 and $1.95, while any sustained recovery requires breaking the resistance at $2.24-$2.25 with great conviction and volume.

XRP may be about to confirm a bearish trend continuation, which would push sentiment lower and trigger the pre-death cross scenario unless there is a noticeable volume reversal and a rebound above the 100 EMA.

Bitcoin is holding down the fort as the US trade war rages on into the third week of April.

BTC price action attempts to overcome a long-term resistance trend line without success as trade war concerns dictate traders’ expectations.

Tariffs are the key macroeconomic topic of the week as risk assets brace for potential surprise headlines.

Bitcoin ETFs lost almost $800 million in a week, while Strategy indicates it has purchased the dip.

Despite tariff pressures, the weakness of the US dollar could be a blessing in disguise for Bitcoin and risky assets.

Global M2 money supply is at an all-time high and rising — will Bitcoin follow history and replicate its past?

Bulls battle a key BTC price resistance line

With traders on the lookout for tariff-related volatility this week, BTC price analysis is zooming out.

closed last week up 6.7%, data from Cointelegraph Markets Pro and TradingView confirms.

Next, however, comes the real test — breaking beyond a downward-sloping trend line that has capped the upside for months.

Crypto Caesar@CryptoCaesarTAApr 12, 2025$BTC - #Bitcoin: I’m watching this chart closely. We might be ready. pic.twitter.com/Dtv1jkrzkP

“Rejected at key resistance, following the trendline perfectly,” popular trader Bitbull wrote in his latest post on the topic on X.

Fellow trader and analyst Rekt Capital is also eyeing the trend line as a breakout proves hard to confirm.

“Bitcoin has Daily Closed above the Downtrend. Thus, breakout confirmation is underway,” he told X followers at the weekend.

Popular trader AK47 on X posted separate upside and downside BTC price targets depending on the outcome of the trend line retest.

“$BTC might push to $88K—but don’t get too comfy,” he cautioned.

Tariff talk keeps markets on edge

A quieter week for US macroeconomic data leaves initial jobless claims as the highlight while the ongoing trade war continues to dominate.

With China particularly in focus, risk assets and crypto face flash volatility should more surprises involving trade tariffs surface.

The weekend saw snap relief in that respect as US President Donald Trump announced a pause on tariffs for key tech products. As a result, Bitcoin climbed to eleven-day highs above $86,000.

Subsequent indications that the measures would be temporary then put renewed pressure on stocks’ futures, while retreated to circle $84,000 at the time of writing.

“We think the ‘tariff exemptions’ announced this weekend were originally intended to be temporary,” trading resource The Kobeissi Letter wrote in part of an X reaction.

Kobeissi suggested that markets had originally considered the move as a signal that the trade war might end completely, only to be disappointed a day later.

“Bonds will likely still rally along with stocks, but uncertainty has only grown. The bond market is king,” it added.

Continuing, trading firm Mosaic Asset agreed that bonds may have been crucial in altering policy trajectory last week.

“It’s the volatility in other areas of the markets like currencies and Treasury bonds that might have forced a quick pivot on trade and tariff policy,” it summarized in the latest edition of its regular newsletter, “The Market Mosaic,” on April 13.

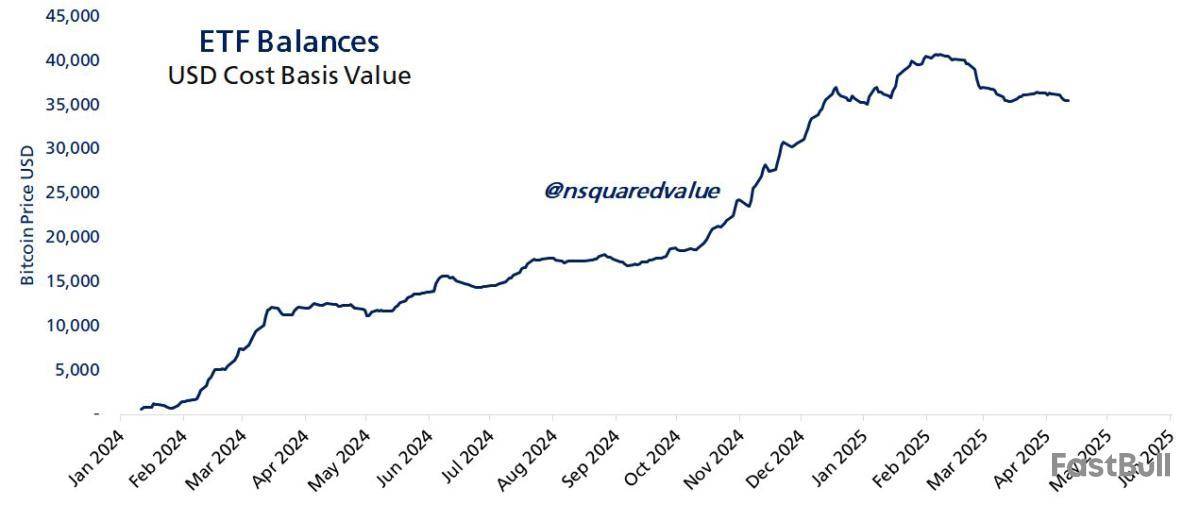

Bitcoin ETF outflow “barely registers”

A sign of just how turbulent last week came in the form of net flows from the US spot Bitcoin exchange-traded funds (ETFs).

In one of the worst weeks ever for the ETF products since their debut in early 2024, total outflows passed $750 million.

For network economist Timothy Peterson, however, there is little to worry about.

Zooming out, he noted that even a nine-figure drawdown such as this makes hardly any difference to the overall investment pool that the ETFs have created in little more than a year.

“Last week, US Bitcoin ETFs had their 5th worst week ever (in terms of outflows). Over $700 million. Yet it barely registers as a blip on the chart,” he told X followers.

Among major investors seeking to “buy the dip,” meanwhile, is business intelligence firm Strategy (formerly MicroStrategy), whose co-founder Michael Saylor hinted that it was upping its BTC exposure this weekend.

“No Tariffs on Orange Dots,” he wrote in an X post alongside a chart of Strategy’s acquisitions.

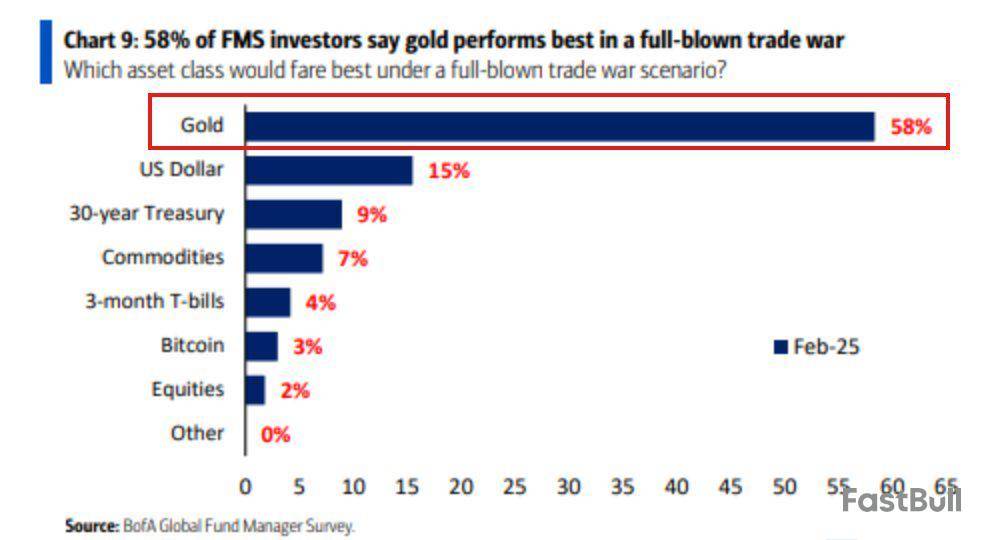

However, whether Bitcoin will emerge as an attractive proposition for the institutional investor cohort while trade war uncertainty continues is dubious.

A survey by Bank of America in late March showed that respondents overwhelmingly favored gold as a volatility hedge, with 58% choosing it.

“This compares to just 9% for 30-year Treasury Bonds and 3% for Bitcoin,” Kobeissi wrote while reporting on the findings.

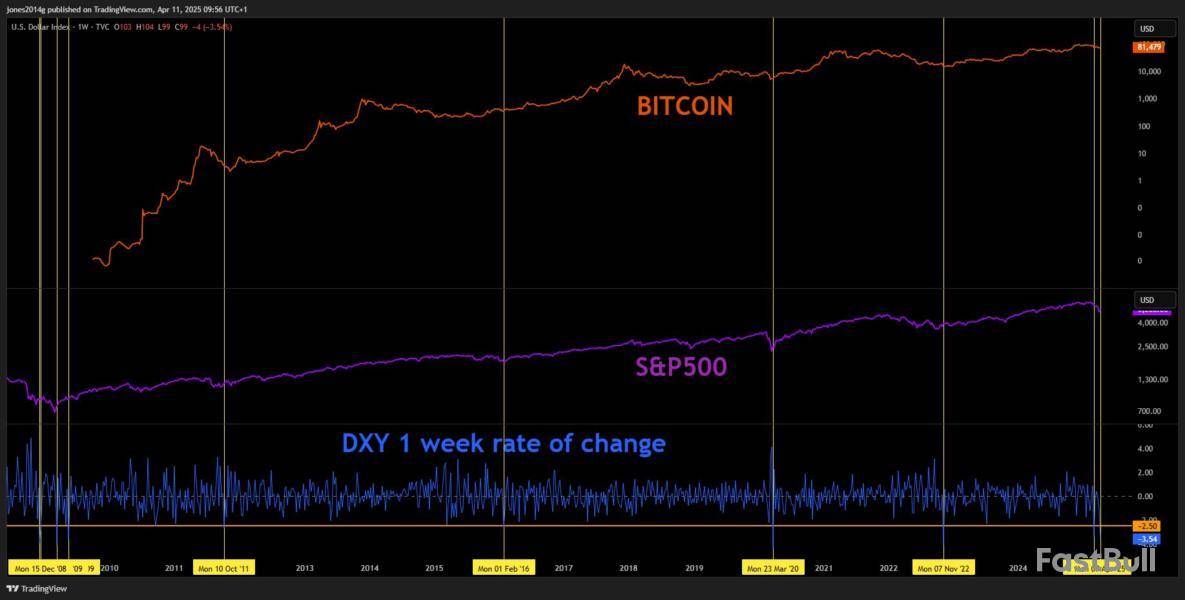

Dollar dive gives risk assets hope of relief

The US dollar may yet provide some light at the end of the tunnel for wary risk-asset traders this week.

The trade war has taken its toll on the greenback, and when measured against major trading partner currencies, its weakness is plain to see.

The US dollar index (DXY) fell to three-year lows last week and, at the time of writing, is challenging those lows once more.

David Ingles@DavidInglesTVApr 14, 2025Markets selling dollar even lower Monday. DXY fell through 100 and also the 2023 low over last few hours, now at lowest in 3 years pic.twitter.com/MJ8wvvJuY2

While far from constant, Bitcoin’s relationship with dollar strength tends to show that gains occur after major DXY losses — albeit with a delay of several months.

To that end, popular analytics account Bitcoindata21 is eyeing a repeat of events from 2017, resulting in all-time highs at the end of the year.

Another chart uploaded to X at the weekend showed the relationship between DXY, Bitcoin and the S&P 500, providing ideal conditions for a long-term bottom in the latter.

The last time such a signal came was around one month before the pit of the Bitcoin bear market in late 2022.

“I got 99 problems but the DXY aint 1,” Bitcoindata21 summarized.

A bull market rebound in the making?

On longer timeframes, an equally promising trend is playing out for Bitcoin bulls.

The global M2 money supply, with which Bitcoin price action is positively correlated, is seeking to break out beyond all-time highs.

“Global M2 has remained at an ATH for 3 days in a row,” popular analyst Colin Talks Crypto noted in a dedicated X post on the phenomenon this weekend.

The post refers to a chain reaction in which sharp moves in global M2 spark copycat behavior for Bitcoin once the latency period expires.

Before that, however, there may be a final opportunity to “buy the dip.”

“Global M2 (with a 108-day offset) doesn't show a blast-off for another ~2 1/2 weeks, and actually shows a slow bleed into next week until around April 16th or 17th,” Colin Talks Crypto acknowledged.

Earlier this month, the analyst predicted a “big M2 influx” incoming, with a corresponding BTC price rebound beginning in May.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

TL;DR

‘You Are Already Late’

The official resolution of the years-long lawsuit between Ripple and the US Securities and Exchange Commission (SEC) seems just around the corner. Several days ago, the two partiesfileda joint motion to hold the appeal and cross-appeal on their case, while the company will not submit its appellate brief on April 16 (as previously expected).

This wasn’t considered a big surprise and triggered little-to-no price volatility for Ripple’s native token, XRP. After all, CEO Brad Garlinghouse previouslyannouncedthat the regulator had dropped its appeal against the firm, describing the move as “a resounding victory.”

The final agreement now depends on the Commission’s approval and could be just a matter of time. If given the green light, the SEC and Ripple will be able to finalize the settlement terms and close the lawsuit that has been ongoing since December 2020.

One X user who recently touched upon the potential end of the case is All Things XRP. They warned the community that closing this chapter might not act as a price catalyst for Ripple’s cross-border token:

“You are already late. That’s priced in.”

They claimed a substantial rally could occur after other potential developments surrounding Ripple, such as inking important deals with other entities. Over the past months, there has been rising speculation that the company plans to shake hands with Cardano.

Most recently, Ripple spent over $1.2 billion to acquire prime brokerage giant Hidden Road, which many analysts believe could be a game-changer for XRP’s future price trajectory.

Another factor that may play a role is the possible approval of a spot XRP ETF in the US, which would enhance the asset’s legitimacy among institutions and perhaps increase their adoption levels.

Well-known companies racing to roll out such an investment vehicle include Grayscale, Bitwise, 21Shares, Franklin Templeton, and others. According to Polymarket, the product’s odds of seeing the light of day before the end of 2025 are just south of 80%.XRP Price Outlook

Ripple’s native cryptocurrency currently hovers at around $2.12, which represents a solid 28% increase on a weekly scale.

Analysts remain optimistic that a further pump could be on the way. Ali Martinez recently assumed that XRP trades within an ascending triangle, with key resistance at $2.22. He believes a breakout above that level might ignite a rally to as high as $2.40.

For their part, CRYPTOWZRD suggested that a jump beyond $2.2050 “should offer a further upside move” and push XRP to $2.33 or higher. On the contrary, the analyst argued that $2.070 is “the next bearish location.”

One of the most-talked-about events of the weekend in the broader crypto ecosystem was the massive crash of Mantra (OM), a Real-World Asset (RWA) protocol. Taking to its official X page, Binance exchange has explained the real reason behind the project’s failures. This update was necessary as some community members tried to indict Binance for the project's failure.

Binance on what crashed Mantra

As Binance exchange revealed, Mantra crashed because of cross-exchange liquidations. The top trading platform noted that it had implemented a number of risk control measures, including reducing leverage levels regarding the OM token.

The trading platform said it has been issuing warnings since January regarding changes in the Mantra OM token's tokenomics. This flag appears on the project’s spot trading page, designed to give users a direct update on what to expect.

Binance Customer Support@BinanceHelpDeskApr 14, 2025Binance is aware that $OM, the native token of MANTRA, has experienced significant price volatilities. Our initial findings indicate that the developments over the past day are a result of cross-exchange liquidations.

Since October of last year, Binance has implemented various…

In just about an hour, the price of OM dropped by over 90%, going from $6.31 to a low of $0.7 at press time. The token also recorded a massive liquidation of $74.52 million in the past 24 hours, displacing Ethereum from second place.

As part of its update, Binance said it is still monitoring the situation with Mantra and will take appropriate actions to protect its community.

Warnings never stop

The digital currency ecosystem has many fraudulent entities, which has forced top projects like Binance, Shiba Inu and Ripple Labs to always issue warnings to their communities.

Many are still getting scammed. While the Mantra team was accused of controlling 90% of the OM token supply, sources of scams generally differ per project.

One of the most common avenues to defraud people is using AI deepfakes to mimic a known project or personality. Ripple executives and Charles Hoskinson, Cardano’s founder, are known to raise alarms against these trends.

By Elsa Ohlen

The direction of Bitcoin and smaller cryptocurrencies was mixed at the start of the week but lacked any significant moves, even as a rise in stocks followed fresh tariff news from the White House.

Bitcoin was trading flat at $84,424 over the past 24 hours, according to CoinDesk data. It held steady over the weekend, ranging from about $83,000 and $85,000, as President Donald Trump announced an exemption from tariffs for smartphones and computers.

Ether and XRP, the world's second and fourth largest cryptos by market value, also held relatively steady. XRP was down 1.5% to $2.12 while Ether rose 0.7% to 1,625.

Futures tracking U.S. benchmark indexes rose, with the S&P 500 up 1.1% early Monday.

"With Trump's 'on-again-off-again' tariff threats, the market is starting to feel 'headline fatigue,' and realizing that he isn't going to destroy the wealth of his support base in the long run. The result is that investors are comfortable accumulating BTC [bitcoin] above the $73k technical support," wrote John Glover, chief investment officer of Ledn, a digital asset financial services company.

Glover continues to watch for a level below $73,000 as it could open up a rapid downward move to $62,500. The upside target, however, is about $133,000, "so I really like the risk/reward for those buying BTC in the mid-$70k's," Glover wrote.

Write to Elsa Ohlen at elsa.ohlen@barrons.com

This content was created by Barron's, which is operated by Dow Jones & Co. Barron's is published independently from Dow Jones Newswires and The Wall Street Journal.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up