Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Broadcom Inc. is stepping into a new chapter in its AI journey, securing significant victories with two major AI ASIC programs.

JPMorgan’s Harlan Sur highlights that Broadcom has "recently won OpenAI's first and second generation AI ASIC programs," positioning it as OpenAI's fourth major AI ASIC partner.

Alongside this, Broadcom has also added a fifth major AI ASIC customer, both expected to ramp up in 2026, further solidifying its leadership in the AI space.

Why Broadcom? The Power Of Advanced Chip Design

What sets Broadcom apart in the fiercely competitive AI landscape is its state-of-the-art chip technology.

Sur emphasizes that Broadcom's 2nm/3nm AI ASIC reference platform, developed over the past 24 months, played a crucial role in these wins. This platform, which includes the industry's first 3D SOIC (chip stacking) initiatives, "was instrumental in likely winning these two new programs" by maximizing transistor density and performance while lowering power consumption.

Read Also: Comparing Broadcom With Industry Competitors In Semiconductors & Semiconductor Equipment Industry

Google, Meta: Strong Pipeline Of AI Revenue

Broadcom's momentum doesn't stop with OpenAI. The company is also ramping up its AI initiatives with tech giants Google’s parent Alphabet Inc and Meta Platforms Inc .

Sur notes that Broadcom is on track to ramp Google’s next-gen 3nm TPU AI processor by the end of this year, with expected revenues of over $8 billion this year and $10 billion next year.

On Meta, Sur predicts, "Meta will be Broadcom's next multi-billion dollar customer," contributing significantly to Broadcom’s AI revenue growth in the coming years.

The Bigger Picture: A $150 Billion AI Opportunity

Broadcom is positioning itself to tap into what Sur describes as a "$150B+ AI semiconductor opportunity over the next 5 years," driven by the strong demand for custom chip designs among large cloud companies and OEMs.

With the AI market growing at an expected rate of 30-40% per year, Broadcom’s recent wins with OpenAI and the fifth major customer are set to be key contributors to this massive revenue potential.

As Broadcom continues to secure high-profile AI partnerships and advance its chip technology, it is poised for significant growth in the AI semiconductor market.

With a strong pipeline and a solid revenue outlook, Broadcom remains a key player to watch in the AI space.

Read Next:

Photo: Piotr Swat/Shutterstock.com

Latest Ratings for AVGO

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Truist Securities | Maintains | Buy | |

| Mar 2022 | JP Morgan | Maintains | Overweight | |

| Mar 2022 | Morgan Stanley | Maintains | Overweight |

View More Analyst Ratings for AVGO

View the Latest Analyst Ratings

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Alphabet Inc.’s Google has agreed to a deal with California to fund newsrooms in the state, thereby putting an end to proposed legislation that would have required tech giants to pay for news content. However, the deal has been met with criticism from journalist unions.

What Happened: The deal, announced on Wednesday, involves a $250 million commitment over five years from Google and the state, with the majority of the funds going to California newsrooms. The agreement also includes the launch of an artificial intelligence “accelerator” to support journalists’ work, CNN reported.

This arrangement effectively puts an end to the California Journalism Preservation Act, a bill that would have compelled technology companies, including Google and Meta Platforms Inc. , to pay news organizations for the distribution of their content online.

State assembly member Buffy Wicks described the deal as a way for California to continue championing the crucial role of journalism in democracy. California Governor Gavin Newsom also praised the deal, calling it “a major breakthrough in ensuring the survival of newsrooms.”

However, the agreement faced immediate backlash from journalist unions, who labeled it “disastrous.” The Media Guild of the West and The NewsGuild-CWA criticized the deal, arguing it was made without their involvement and questioning its effectiveness.

Why It Matters: The deal comes at a time when the journalism industry is grappling with significant challenges, including the shift of advertising dollars and audiences away from traditional publications.

The deal also includes the establishment of a “National AI Innovation Accelerator,” which some journalist groups have warned could pose a threat to the future of their industry.

A recent report revealed that more than half of Fortune 500 companies have flagged AI as a major risk, marking a 473.5% surge in warnings amid growing concerns about the potential risks associated with artificial intelligence.

Meanwhile, OpenAI, the maker of ChatGPT, recently forged a content partnership with Condé Nast, incorporating content from brands like Vogue and The New Yorker into its products. This move was seen as a way to ensure that as AI plays a larger role in news discovery and delivery, it maintains accuracy, integrity, and respect for quality reporting.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This week marks 20 years since Alphabet GOOGL went public with the holding company being one of the most innovative firms of the 21st Century.

Formerly known as Google, the iconic search engine pioneer has evolved to cloud computing, ad-based video and music streaming, autonomous vehicle production, and healthcare developments among other endeavors.

Alphabet has also made significant investments in artificial intelligence and machine learning technologies through its Google research team Brain.

Lucrative acquisitions have fueled Alphabet’s growth with its stock up +19% year to date and skyrocketing over +6,000% since going public in 2004 which has dwarfed the gains of the S&P 500 and Nasdaq.

Alphabet’s Acquisition History

Along the way to being a tech behemoth, Alphabet has acquired over 200 companies with the largest being the $12.5 billion acquisition of Motorola Mobility in 2012. This acquisition was aimed at accelerating innovation and choice in mobile computing and played a crucial role in implementing the Google Android ecosystem, the largest rival to Apple’s AAPL iPhone iOS.

Other Lucrative Acquisitions

Where 2 Technologies (Acquired in 2004 for an estimated $400 million and led to the creation of Google Maps)

YouTube (Acquired in 2006 for $1.65 billion) - Video and music streaming platform

DoubleClick (Acquired in 2007 for $3.1 billion and implemented into Google Marketing)

Waze (Acquired in 2013 for $966 million) -Traffic and navigation app

Nest Labs (Acquired in 2014 for $3.2 billion) - Smart home products

DeepMind (Acquired in 2014 for $500 million and merged with Brain in regards to AI development)

Twitch (Acquired in 2014 for $970 million) - Live streaming platform for gamers

Looker (Acquired in 2019 for $2.6 billion to provide business intelligence software and data analytics in Google Cloud)

Fitbit (Acquired in 2019 for $2.1 billion) - Wearable fitness devices and app

Mandiant (Acquired in 2022 for $5.4 billion) - Independent cybersecurity services also implemented in Google Cloud

Stock Split History

Alphabet’s brilliant performance has led to the company splitting its stock twice in its history, the most recent being a 20-1 stock split in July of 2022.

The first stock split was a 2-1 split in March of 2014. This split also created two classes for shareholders, Class C shares with no voting rights under the ticker symbol GOOG and Class A for shareholders with voting rights under the new ticker symbol GOOGL.

Image Source: Macrotrends

Growth Trajectory

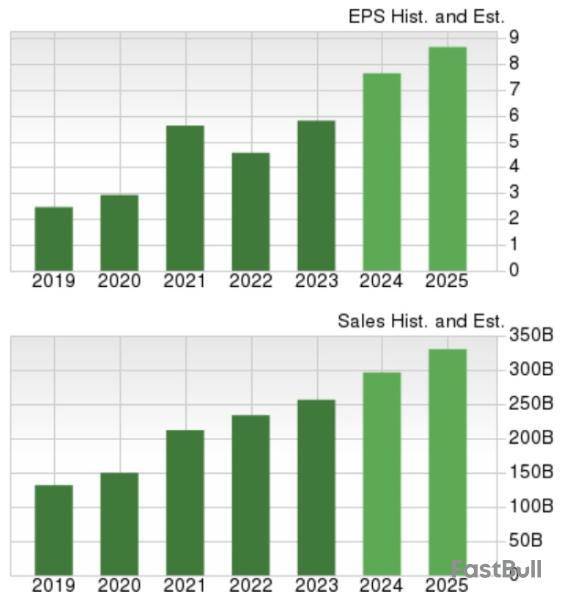

Based on Zacks estimates, Alphabet’s total sales are now projected to rise 15% in fiscal 2024 and are slated to increase another 11% in FY25 to $330.36 billion. Annual earnings are expected to soar 31% this year to $7.63 per share versus EPS of $5.80 in 2023. Alphabet’s bottom line is projected to expand another 13% in FY25 to $8.64 per share.

Alphabet’s Dividend

Alphabet recently paid its first-ever dividend in June, which it plans to pay out quarterly with a current yield of 0.48%.

Monitoring Alphabet’s Valuation

At current levels, Alphabet’s stock trades at 21.9X forward earnings which is slightly beneath its Zacks Internet-Services Industry average of 23.2X and the S&P 500’s 23.6X. Notably, Alphabet trades nicely beneath its decade-long high of 37X forward earnings and at a discount to the median of 26X during this period.

Recent Headwinds & Average Zacks Price Target

Attributed to its dominance, some of the headwinds Alphabet has faced pertain to regulatory issues. Recently, the U.S. Department of Justice (DOJ) ruled that Google has illegally monopolized the online search and text advertising markets. Implementations of such could potentially lead to forcible actions against Alphabet to break up its businesses or the restriction of certain services.

Still, the Average Zacks Price Target of $204.71 a share suggests 22% upside in Alphabet’s stock from current levels.

Conclusion

Over the years, Alphabet’s stock has taken it shareholders on a wonderful ride and has certainly been a millionaire maker for early investors. That said, GOOGL currently lands a Zacks Rank #3 (Hold) as the next wave of gains may take some time considering potential antitrust headwinds from the DOJ although Alphabet remains one of the most innovative companies to invest in.

Zacks Investment Research

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up