Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)A:--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

China is considering scrapping a price cap for local governments buying unsold apartments, according to people familiar with the matter, as Beijing seeks to speed up the clearance of millions of empty homes and stem the property downturn.

China is considering scrapping a price cap for local governments buying unsold apartments, according to people familiar with the matter, as Beijing seeks to speed up the clearance of millions of empty homes and stem the property downturn.

Under the proposal, local authorities across the country will no longer be subject to a price ceiling equivalent to the cost of affordable homes in the same neighbourhood, the people said, asking not to be identified discussing a private matter.

The move, which has yet to be finalised, may give city and provincial officials greater autonomy in offering competitive prices and ease the financial burden of developers, the people said. For China’s affordable housing, local governments can only sell them to qualified buyers at no more than 5% profit after taking into account land and construction costs.

The Housing Ministry didn’t respond to a request for comment. A Bloomberg gauge of Chinese real estate stocks rose extended gains on Thursday after the report, rising as much as 4.6%.

Chinese Premier Li Qiang on Wednesday vowed to give regional governments more say in how they purchase unsold residential units, after a challenging start for the high-profile initiative. The changes could improve some of the plan’s unattractive economics for both developers and state buyers.

Officials will be given more leeway in setting standards on which unsold homes to purchase and deciding how to use such properties, Li said at the National People’s Congress. Investor expectations of further policy easing has spurred a rally in property shares in recent weeks.

“The news, if true, is positive, as it should help speed up local governments’ implementation of buying unsold units from distressed developers,” Raymond Cheng, the head of China property research at CGS International Securities Hong Kong, wrote in a note. “We expect to see more policies implementation this year, which will help to improve developers’ sales and address their liquidity issue.”

China has been trying to put a floor under the years-long real estate meltdown amid weak domestic demand and a worsening job situation. While the housing sector has picked up modestly on the back of government support, upticks are mostly happening in the resale market, as buyers remain concerned about developers’ ability to finish projects on time.

New apartment prices have tanked in the past three years, though they stabilised in January after a raft of stimulus measures in 2024.

Challenges remain

China was trying to deal with 382 million square metres of excess inventory, equivalent to the size of Detroit, as of July last year.

The latest consideration also comes as Beijing pledged to “effectively prevent debt defaults by real estate companies”, signalling a further shift towards aiding more players in the industry. Previously, it had singled out “quality top developers” for support.

It’s unclear whether the newest proposal will be enough. Last year, a few city governments suggested resorting to heavy bargaining to minimise their risks when buying unsold property, raising doubts on whether distressed developers would be willing to sell their inventory.

The initiative adds stress to local finances that are already on shaky ground. Regional governments’ ability to boost growth has been undermined by a record drop of income from land sales, with their budget spending shrinking in the first seven months last year. Among all 31 provinces and municipalities, only Shanghai recorded a fiscal surplus in the first half in 2024.

The government said on Wednesday it would push forward policies on using special local bonds to fund purchases of idle land and unsold homes.

Risk sentiment is mildly positive in Asian session today, as investors digest the latest developments in US trade policy and Chinese economic measures. Markets welcomed the news that the US has granted a one-month exemption for imports from Mexico and Canada for auto makers. The decision came after US President Donald Trump met with executives from Ford, General Motors, and Stellantis, who urged him to delay the levies to avoid disruptions in the industry.

Meanwhile, Hong Kong stocks surged to a three-month high, with optimism fueled by hints from China’s National People’s Congress about looser monetary policies, along with expectations for further stimulus. Adding to the bullish momentum, tech giant Alibaba saw its stock soar after unveiling a new AI model, which it claims is competitive with DeepSeek, a major player in the artificial intelligence race. The rally in Chinese markets is adding to overall risk appetite in Asia, though uncertainties remain around US-China trade tensions.

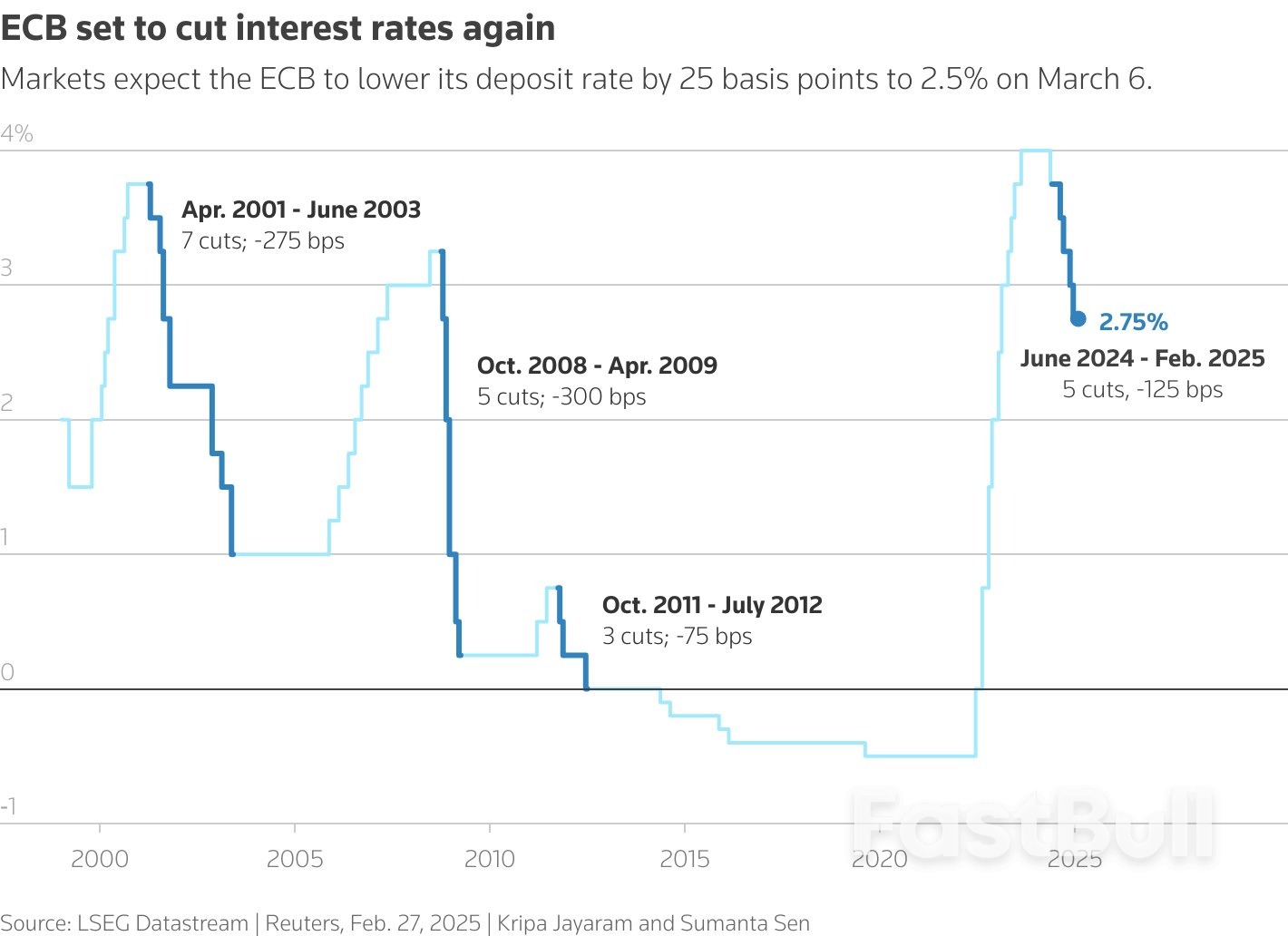

In the currency markets, Euro continues to lead gains for the week as investors anticipate today’s ECB policy decision. The central bank is widely expected to deliver a 25-basis-point rate cut, but the outlook for further easing is more uncertain than ever. A trade war with the US is adding downside risks to growth, while Europe’s major economies are making historic shifts in fiscal policy, particularly in Germany, where new spending initiatives could support economic expansion. These conflicting factors make it challenging to predict ECB’s path beyond today’s meeting.

ECB President Christine Lagarde’s press conference is unlikely to provide strong forward guidance, as policymakers will want to maintain flexibility amid rising geopolitical and trade uncertainties. However, despite the upcoming rate cut, Euro’s rally looks well-supported in the near term, particularly as markets focus on Europe’s growing fiscal momentum and rearmament plans.

Sterling is the second strongest performer, followed by New Zealand Dollar. In contrast, Dollar remains at the bottom of the performance ladder, looking increasingly vulnerable ahead of tomorrow’s Non-Farm Payrolls report. Canadian Dollar is the second-worst performer of the week and Japanese Yen is also under pressure. Swiss Franc and Australian Dollar are positioned in the middle of the pack.

In Asia, at the time of writing, Nikkei is up 0.82%. Hong Kong HSI is up 3.03%. China Shanghai SSE is up 0.78%. Singapore Strait Times is up 0.72%. Japan 10-year JGB yield is up 0.053 at 1.499, hitting a 16-year high. Overnight, DOW rose 1.14%. S&P 500 rose 1.12%. NASDAQ rose 1.46%. 10-year yield rose 0.055 to 4.265.

ECB to cut rates, but trade war and fiscal shifts cloud outlook

ECB is widely expected to continue its “regular, gradual” easing cycle today, reducing the deposit rate by 25bps to 2.50%. Markets are still pricing in two more cuts this year, but the path forward has become murkier in light of recent geopolitical and economic shifts. Also, interest rates are approaching neutral levels, making further easing a more delicate decision.

On one hand, trade tensions with the US loom large, and the fallout from fresh tariffs and retaliatory measures could weigh on Eurozone’s already fragile economic recovery. On the other hand, the announcement of transformational fiscal changes in both Germany and at the European Commission level—aimed at boosting defense and infrastructure spending—could have a significant long-term impact on growth, partially offsetting the headwinds from a trade war.

ECB’s new economic projections, to be released alongside today’s decision, are expected to show weaker growth and marginally higher inflation. However, data collection for these forecasts took place weeks ago, rendering them less reflective of the rapidly evolving environment. Thus, their usefulness for predicting medium-term policy moves may be limited, with markets keeping an even closer eye on the ECB’s forward guidance instead.

Euro has been exceptionally strong this week, with recent optimism boosted by developments in European fiscal policy. It’s rally is unlikely to be deter by today’s ECB outcome.

Technically, EUR/CHF has surged aggressively, now pressing long-term falling channel resistance (at around 0.9620), after decisively breaking above 55 W EMA. Sustained break above this resistance would suggest that the downtrend from 1.2004 (2018 high) has finally bottomed at 0.9204.

Sustained trading above the channel resistance will be argue that whole down trend from 1.2004 (2018 high) has completed at 0.9204, on bullish convergence condition in W MACD.

In this bullish case, further rise should be seen to 0.9928 structural resistance at least, with prospect of stronger rally, even still as a medium term corrective move.

Fed’s Beige Book: Modest growth, rising price pressures, and tariff concerns

Fed’s Beige Book report indicated that “economic activity rose slightly” since mid-January, with mixed regional performances. While four Districts saw modest or moderate growth, six reported no change, and two experienced slight contractions.

Consumer spending was generally lower, with essential goods seeing steady demand but discretionary spending weakening, particularly among lower-income consumers. However, business expectations remained “slightly optimistic” for the coming months.

On the labor front, employment “nudged slightly higher” overall, though wage growth slowed modestly compared to the previous report.

While price pressures remained moderate, several Districts noted an uptick in the pace of increase, particularly in manufacturing and construction. Many firms struggled to pass higher input costs onto customers, but expectations of tariffs on imports were already prompting preemptive price hikes in some sectors.

On the data front

Swiss unemployment rate, UK PMI construction and Eurozone retail sales will be released in European session. Later in the day, Canada will release trade balance and Ivey PMI. US will publish jobless claims, trade balance, and non-farm productivity.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.0662; (P) 1.0729; (R1) 1.0857;

Intraday bias in EUR/USD remains on the upside as current rally from 1.0176 is still in progress. Next target is 161.8% projection of 1.0176 to 1.0531 from 1.0358 at 1.0932 On the downside, below 1.0721 minor support will turn intraday bias neutral and bring consolidations first, before staging another rise.

In the bigger picture, the strong break of 55 W EMA (now at 1.0668) suggests that fall from 1.1274 (2024 high) has completed as a three wave correction to 1.0176. That came after drawing support from 0.9534 (2022 low) to 1.1274 at 1.0199. Rise from 0.9534 is still intact, and might be ready to resume through 1.1274. This will now be the favored case as long as 1.0531 resistance turned support holds.

Economic Indicators Update

| GMT | CCY | EVENTS | ACT | F/C | PP | REV |

|---|---|---|---|---|---|---|

| 00:30 | AUD | Building Permits M/M Jan | 6.30% | -0.10% | 0.70% | 1.70% |

| 00:30 | AUD | Trade Balance (AUD) Jan | 5.62B | 5.68B | 5.09B | 4.92B |

| 06:45 | CHF | Unemployment Rate Feb | 2.70% | 2.70% | ||

| 09:30 | GBP | Construction PMI Feb | 49.8 | 48.1 | ||

| 10:00 | EUR | Eurozone Retail Sales M/M Jan | 0.10% | -0.20% | ||

| 12:30 | USD | Challenger Job Cuts Y/Y Feb | -39.50% | |||

| 13:15 | EUR | ECB Deposit Rate | 2.50% | 2.75% | ||

| 13:15 | EUR | ECB Main Refinancing Rate | 2.65% | 2.90% | ||

| 13:30 | CAD | Trade Balance (CAD) Jan | 1.4B | 0.7B | ||

| 13:30 | USD | Initial Jobless Claims (Feb 28) | 236K | 242K | ||

| 13:30 | USD | Trade Balance (USD) Jan | -93.1B | -98.4B | ||

| 13:30 | USD | Nonfarm Productivity Q4 | 1.20% | 1.20% | ||

| 13:30 | USD | Unit Labor Costs Q4 | 3% | 3% | ||

| 13:45 | EUR | ECB Press Conference | ||||

| 15:00 | USD | Wholesale Inventories Jan F | 0.70% | 0.70% | ||

| 15:00 | CAD | Ivey PMI Feb | 50.6 | 47.1 | ||

| 15:30 | USD | Natural Gas Storage | -96B | -261B |

Malaysia is discussing with chip companies based in the country whether they can absorb the impact of potential US tariffs on semiconductors, its trade minister said, as it looks to hedge against risks to its export-driven economy.

The Southeast Asian nation is home to a large semiconductor industry, including top US multinationals such as Intel and GlobalFoundries, and is one of the top exporters of chips to the United States.

US President Donald Trump said in February that he intended to impose tariffs on semiconductors starting at "25% or higher", though it is unclear when this decision could be made.

Malaysia would need to see the magnitude and quantum of the tariffs, Trade Minister Tengku Zafrul Aziz said in an interview with Reuters on Wednesday, as they could have a significant impact on its exports.

"We're discussing with the companies... whether the tariffs will be absorbed by the consumers," Tengku Zafrul said.

"Exports will continue to happen but someone has to pay for the higher cost, whether it be the consumers or the companies that absorbs."

Tengku Zafrul said the government has not discussed what it will do or whether it will provide financial support to offset tariffs.

Last year, Malaysia shipped US$16.2 billion worth of chips to the US, accounting for nearly 20% of all US semiconductor imports, US trade data reviewed by Reuters show.

Resilient data centre growth

Tengku Zafrul also said Malaysian data centres were unlikely to be affected by export restrictions imposed on advanced chips by the previous U.S. administration as demand for artificial intelligence remains strong.

Malaysia is fast becoming a major hub for data centres and AI factories in Southeast Asia, with investments from US technology giants including Microsoft, Google, Amazon and Oracle, mainly in cloud services and data centres.

However, this investment boom may be hampered by new restrictions adopted in the final days of Joe Biden's administration in January on the use of US chips overseas, in a bid to further restrict China's access to AI semiconductors.

It remains unclear how Trump will enforce the new rules but the two administrations share similar views on the competitive threat from China.

Under the new rules, which are set to take effect in May, US cloud service providers, such as Microsoft, Google and Amazon, will be allowed to deploy only 50% of their total AI computing power outside the United States, and no more than 7% in Malaysia and other countries that have not been granted privileged access to US chips.

Tengku Zafrul said Malaysia's data centres will not be impacted given the sector's growth trajectory accounted for the limits of the restrictions.

The sector's prospects will be further boosted by the fact that the big data centre companies in Malaysia are U.S. companies, he added.

"When we talk to the data centre players, Microsoft, Google, AWS ... there is not a concern because the allocation (under the restrictions) is adequate," Tengku Zafrul said.

"There will be no impact on the growth in data centres because AI will be used by many."

Vietnam posted a rare monthly trade deficit in February as imports surged during the month, government data showed on Thursday, though the country's surplus with the United States increased in the opening months of 2025.

The Southeast Asian nation, a regional manufacturing hub, is heavily dependent on export-driven economic growth and faces risks from global trade disputes, including the potential imposition of tariffs by the US.

Vietnam posted a trade deficit of US$1.55 billion (RM6.86 billion) in February, after a US$3.02 billion surplus in January, the General Statistics Office (GSO) said. It was only the third monthly deficit since the start of 2023, as per GSO and London Stock Exchange Group data.

February's exports rose by 25.7% from a year earlier, while imports surged by 40%, primarily due to increased imports of dairy products, automobiles and metal products, the GSO said.

Over the January-February period, the GSO said there was a trade surplus of US$1.47 billion, aligning with figures published by the government on its portal the previous day.

Combining data for the two months can smooth out distortions from the timing of Lunar New Year holidays, which fell in January this year and February last year.

The GSO data showed that for the January-February period, exports rose by an annual 8.4%, and imports were up by 15.9%.

US surplus, China deficit

In the first two months of 2025, Vietnam's trade surplus with the US reached US$17 billion, up 16.3% from a year earlier, while its deficit with China widened by 36.9% to US$15.4 billion.

Vietnam is worried about being hit with reciprocal tariffs by the US government. The US is Vietnam's largest export market, while China is its biggest source of imports.

Vietnam has long been suspected of being a transshipment hub for Chinese goods to the US, given the huge volumes of intermediate goods it imports from China.

Other data released by the GSO showed industrial production rose by 17.2% in February from a year earlier, picking up from January's 0.6% growth, and retail sales rose 9.4%.

Foreign investment inflows rose 5.4% in the January-February period from a year earlier to about US$3 billion, and foreign investment pledges rose by an annual 35.5% to US$6.9 billion.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up