Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

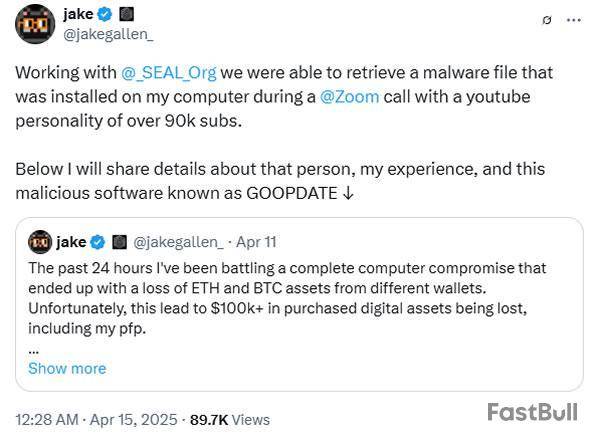

The chief executive of non-fungible token platform Emblem Vault is warning X users to be wary of the video meeting app Zoom after a nefarious threat actor known as “ELUSIVE COMET” recently stole over $100,000 of his personal assets.

On April 11, Emblem Vault CEO, podcaster and NFT collector Jake Gallen said on X that he had been battling a “complete computer compromise” that ended up with a loss of Bitcoin and Ether assets from different wallets. “Unfortunately, this led to $100k+ in purchased digital assets being lost,” he said.

Days later, Gallen said he had been working with cybersecurity firm The Security Alliance (SEAL) to track an ongoing campaign against crypto users by a threat actor identified as “ELUSIVE COMET.”

Gallen said the scam was facilitated by the video conference platform Zoom, which resulted in his crypto wallet being drained.

“We were able to retrieve a malware file that was installed on my computer during a Zoom call with a YouTube personality of over 90k subs,” said Gallen on April 14.

The malicious actor “employs sophisticated social engineering tactics with the goal of inducing victims into installing malware and ultimately stealing their crypto,” SEAL reported in late March.

Gallen said he’d arranged an interview after being contacted by “Tactical Investing,” a verified X account claiming to be the founder and CEO of Fraction Mining. However, during the interview, Tactical Investing left their screen switched off while Gallen’s was on, enabling the installation of malware called “GOOPDATE,” which stole credentials and accessed his crypto wallets.

Cointelegraph reached out to the X account for comment.

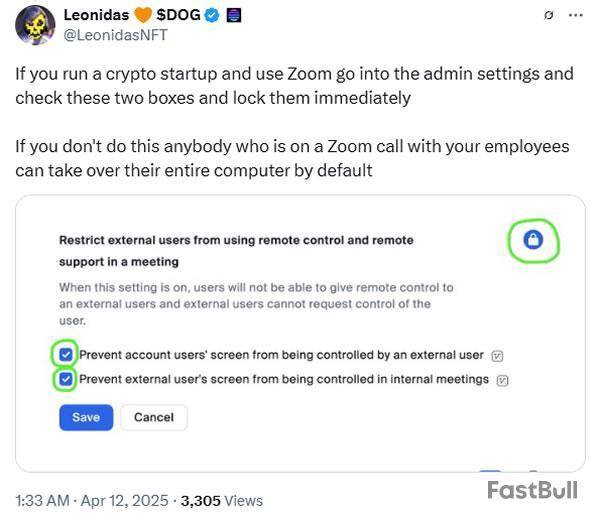

Zoom remote access threat

“For this scam to take place, its said that the guest of the Zoom video call allows remote access to the host of the call, which is a requestable feature that is DEFAULT ON for every Zoom account,” said Gallen.

NFT collector Leonidas confirmed the default settings and advised those in the crypto industry to prevent remote access.

“If you don't do this, anybody who is on a Zoom call with your employees can take over their entire computer by default,” he said.

SEAL security researcher Samczsun told Cointelegraph that Zoom, by default, allows meeting participants to request remote control access. “At this point in time we believe the victim still needs to be social engineered into granting access,” they said.

Cointelegraph reached out to Zoom for comments but did not receive an immediate response.

Gallen also stated that the hackers accessed his Ledger wallet even though he had only logged in a few times over the three years and had never written the password down anywhere digitally.

They also hacked his X account in an attempt to lure in other victims through private messages.

SEAL reported that ELUSIVE COMET is known to operate Aureon Capital, which claims to be a legitimate venture capital firm. The threat actor is responsible for “millions of dollars in stolen funds” and poses a significant risk to users due to their “carefully engineered backstory,” the firm noted.

Samczsun advised users who have interacted with Aureon Capital to contact SEAL’s emergency hotline on Telegram.

Gibraltar-based Xapo Bank, a private bank and Bitcoin custodian, reported a surge in Bitcoin trading volumes in the first quarter as its high-net-worth members scooped up Bitcoin amid market turbulence.

Xapo Bank said that Q1 trading volume grew 14.2% compared to the Q4 2024, as the Bitcoin price drop helped drive trading volume growth on its platform. It said that during the decline, its high net-worth members “actively bought the dip,” reflecting these members’ “commitment to the long-term potential of Bitcoin.”

In the first quarter of 2025, Bitcoin had its worst start to a year since 2018, closing the quarter down 13%.

The crypto-friendly bank became the first licensed bank to launch interest-bearing Bitcoin and fiat banking accounts in the UK in 2025 and launched Bitcoin-backed USD loans of up to $1 million in March 2025.

It also recorded a 50% quarter-on-quarter jump in euro deposits. “This rapid increase in volume came amidst mounting concern about the future of US dollar primacy and the threat of a US recession as markets braced for Trump’s planned ‘Liberation Day’ in April,” the bank said.

There were also significant shifts in Xapo members’ stablecoin deposit patterns, with USDC deposits up 19.8% in Q1 and Tether (USDT) deposits down 13.4%. This shift comes as European cryptocurrency exchanges moved to delist Tether in order to comply with Markets in Crypto-Assets Regulation regulations.

“Xapo Bank member data shows that despite short-term headwinds, the bigger picture for Bitcoin remains strong and current volatility does not diminish Bitcoin's importance,” said Gadi Chait, Xapo Bank’s head of investment.

Chait added that “while global events painted an erratic picture, the opportunity for Bitcoin has always been in its long-term performance, not its short-term volatility.”

Crypto exchange Bitget also sees Q1 trading volumes surge

Market turmoil also prompted a flurry of activity on digital currency exchange Bitget, according to its Q1 2025 Transparency Report.

Bitget’s total trading volume hit $2.1 trillion in the first quarter of 2025, as spot trading volume saw a quarter-on-quarter increase of 159%, rising to $387 billion.

This surge in trading volume came as Bitget’s total user base grew by almost 20%, with the exchange adding an additional 4.89 million users on its centralized exchange and 15 million users on its Bitget Wallet app — bringing its total global user count to over 120 million.

Bitget’s CEO, Gracy Chen, said the exchange will continue to “focus on institutional-grade infrastructure and double down on expanding its Web3 presence through our ecosystem.”

In February, Bitget loaned rival exchange Bybit 40,000 ETH, valued at approximately $100 million, after Bybit suffered a major hack. The loan has since been fully repaid by Bybit.

“No interest, no collateral — this was simply about supporting a peer in need. Great to see Bybit fully recovered, and we never doubted the return of the loan,” Chen said.

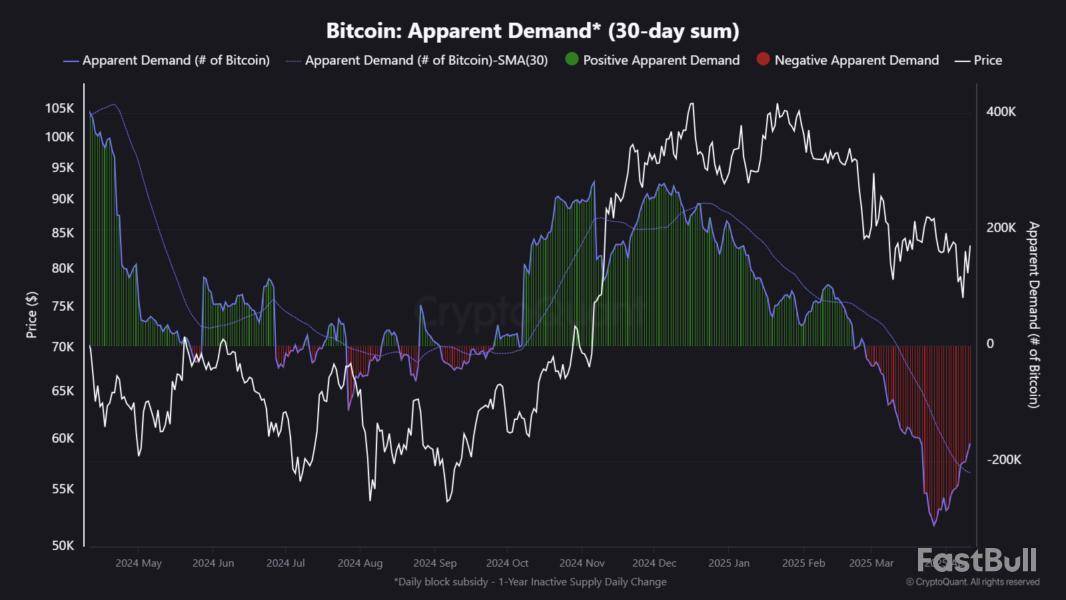

Bitcoin has shown signs of stabilization following its earlier correction this month, which saw the asset fall to as low as $74,000. Over the past week, Bitcoin has rebounded strongly, gaining nearly 10%, and now trades above $84,000.

This upward movement has reignited optimism among investors, though some analysts remain cautious about calling this a definitive trend reversal.

Apparent Demand Shows Recovery, But Trend Reversal Uncertain

According to recent on-chain data, the current recovery in BTC may be linked to improving demand indicators. However, it is suggested that the broader market structure still needs to confirm whether this bounce reflects a sustainable rally or is merely a temporary pause in the ongoing correction.

CryptoQuant contributor Kripto Mevsimi particularly drew attention to Bitcoin’s Apparent Demand metric, specifically the 30-day sum, which has started to rebound from negative territory.

This trend is being observed as a potential sign of changing market dynamics. However, Mevsimi warns against assuming this is the start of a new bullish cycle, drawing parallels to Bitcoin’s behavior during the latter part of the 2021 cycle.

During that period, demand remained suppressed for an extended timeframe, even as prices temporarily recovered. Only after a long consolidation phase did the market experience a genuine structural shift.

Mevsimi highlights that although momentum may be improving, more time and confirmation are necessary before a macro-level trend reversal can be confirmed.

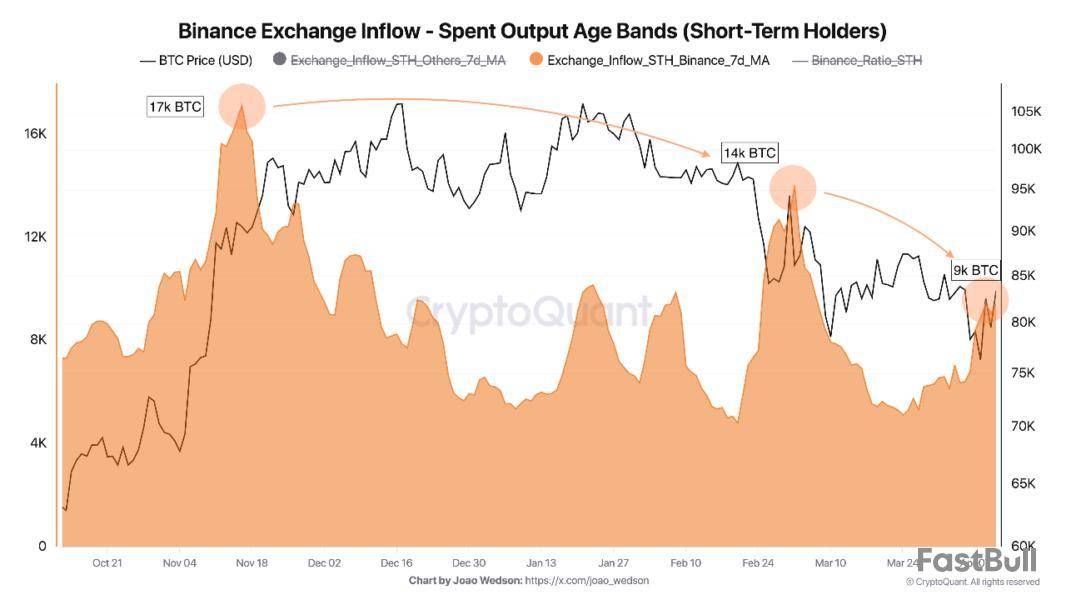

Bitcoin Short-Term Holder Selling Pressure Declines on Binance

Another market signal worth watching comes from Binance, one of the largest crypto exchanges by trading volume. CryptoQuant analyst Darkfost reports that inflows of Bitcoin from short-term holders (STHs) to Binance have been steadily decreasing, suggesting a decline in immediate selling pressure.

The data indicates that average realized prices for STHs currently hover around $92,800, meaning many recent sellers have exited at a loss.

Darkfost notes that inflows from STHs dropped from approximately 17,000 BTC in November to around 9,000 BTC more recently. This downtrend in selling could provide some support for Bitcoin’s current price levels.

Still, the analyst emphasizes the need for continued monitoring to determine if this reduction in selling pressure persists. The easing of short-term holder activity could reduce overhead resistance and contribute to market stability, but confirmation of accumulation or a broader bullish phase remains elusive.

Darkfost@Darkfost_CocApr 13, 2025STH selling pressure declining on Binance

Tracking $BTC inflows on Binance is a useful way to visualize potential selling pressure, as the platform handles significant trading volumes.

Short Term Holders have been under considerable stress recently, with many even ending up… pic.twitter.com/lwOe45H7L3

Featured image created with DALL-E, Chart from TradingView

The amount of Bitcoin held on the books of publicly traded companies rose by 16.1% in the first quarter of 2025, according to crypto fund issuer Bitwise.

Total company Bitcoin holdings rose to around 688,000 BTC by the end of Q1, with firms adding 95,431 BTC over the quarter, Bitwise reported in an April 14 X post.

The value of the combined Bitcoin stacks rose around 2.2%, reaching a total combined value of $56.7 billion with a price per BTC of $82,445, the firm added.

Bitwise noted that the number of public companies holding Bitcoin rose to 79, with 12 firms buying the cryptocurrency for the first time in Q1.

The largest first-time Bitcoin buyer was the Hong Kong construction firm Ming Shing, whose subsidiary Lead Benefit bought a total of 833 BTC over the quarter, with an initial 500 BTC buy in January and a follow-up 333 BTC buy in February.

The next largest maiden Bitcoin holder was the far-right favored YouTube alternative Rumble, which bought 188 BTC in mid-March.

One notable debut Bitcoin buyer was the Hong Kong investment firm HK Asia Holdings Limited, which only purchased a single Bitcoin in February, but the announcement caused its share price to nearly double in value in a single trading day.

Metaplanet buys the dip with 319 Bitcoin scoop

Meanwhile, Japanese investment firm Metaplanet said in an April 14 note that it purchased another 319 Bitcoin for an average price of 11.8 million yen ($82,770) per coin, bringing its total holdings to 4,525 Bitcoin, currently worth $383.2 million.

However, the company has spent a total of 58.145 billion yen, nearly $406 million, buying up its current Bitcoin stack.

Metaplanet (3350) was down 0.5% by the April 15 lunch break on the Tokyo Stock Exchange after closing trading on April 14 up 3.71%, according to Google Finance.

The Tokyo-based firm’s latest Bitcoin buy puts it firmly in tenth place among the world’s largest public companies holding Bitcoin, trailing behind Jack Dorsey’s Block, Inc., which holds 8,485 BTC, according to Coinkite data.

Bitcoin is trading around $84,440 and has traded flat over the past 24 hours, according to CoinGecko. It’s up around 2.3% since the end of Q1 on March 31, having clawed back from a low of under $75,000 on April 7 after a wider market drop due to a round of fresh global tariffs imposed by the US.

Asia Express: Bitcoiner sex trap extortion? BTS firm’s blockchain disaster

Bitcoin price started a fresh increase above the $83,500 zone. BTC is now consolidating gains and might attempt to clear the $85,500 resistance.

Bitcoin Price Eyes More Gains

Bitcoin price started a fresh increase above the $82,500 zone. BTC formed a base and gained pace for a move above the $83,000 and $83,500 resistance levels.

The bulls pumped the price above the $84,500 resistance. A high was formed at $85,850 and the price recently started a downside correction. There was a move below the $84,000 support. The price dipped below the 23.6% Fib retracement level of the upward move from the $78,600 swing low to the $85,850 high.

However, the bulls were active near the $83,000 zone and the price recovered losses. Bitcoin price is now trading above $83,500 and the 100 hourly Simple moving average. There is also a connecting bullish trend line forming with support at $84,200 on the hourly chart of the BTC/USD pair.

On the upside, immediate resistance is near the $85,000 level. The first key resistance is near the $85,500 level. The next key resistance could be $86,200. A close above the $86,200 resistance might send the price further higher. In the stated case, the price could rise and test the $87,500 resistance level. Any more gains might send the price toward the $88,000 level.

Another Rejection In BTC?

If Bitcoin fails to rise above the $85,500 resistance zone, it could start another decline. Immediate support on the downside is near the $84,200 level and the trend line. The first major support is near the $83,200 level.

The next support is now near the $82,200 zone and the 50% Fib retracement level of the upward move from the $78,600 swing low to the $85,850 high. Any more losses might send the price toward the $81,500 support in the near term. The main support sits at $80,800.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $84,200, followed by $83,500.

Major Resistance Levels – $85,500 and $85,850.

After weeks of downward price action, Bitcoin (BTC) is finally showing signs of a bullish reversal. The leading cryptocurrency’s weekly Relative Strength Index (RSI) has recently broken its trendline, fueling optimism for a potential major breakout.

Bitcoin Weekly RSI Turns Bullish

Bitcoin has struggled under the weight of escalating global tariff wars, with the flagship digital asset losing more than 10% over the past three months. However, it appears to have found some stability in the low $80,000 range after dipping as low as $74,508 on April 6.

In an X post published earlier today, crypto analyst Titan of Crypto suggested that BTC may be on the cusp of a “major breakout.” The analyst highlighted BTC’s weekly RSI breaking above its long-standing trendline – a technical development that often precedes significant momentum shifts in price action.

For the uninitiated, BTC’s weekly RSI is a momentum indicator that measures the speed and change of the digital asset’s price movements over a one-week timeframe. It helps identify whether BTC is overbought – typically above 70 – or oversold – typically below 30 – signaling potential trend reversals or continuations.

In the chart shared by Titan of Crypto, BTC’s weekly RSI can be seen breaking a downtrend for the third time since September 2024. Interestingly, the previous two breakouts in weekly RSI were followed by major rallies that pushed Bitcoin’s price significantly higher in the weeks that followed.

Using a price fractal pattern – highlighted in yellow – Titan of Crypto suggested that if BTC mirrors previous price behavior following RSI breakouts, it could climb to as high as $130,000. Such a move would mark a new all-time high (ATH) for the asset and signal renewed market enthusiasm.

Similarly, fellow crypto analyst RookieXBT pointed out that BTC is currently trading inside a falling wedge pattern on the 12-hour chart. Falling wedge formations typically resolve to the upside, and RookieXBT suggests that a breakout could drive BTC’s price to around $140,575.

BTC Could Be Showing A False Bullish Momentum

However, not all analysts share the same bullish outlook. Seasoned crypto analyst Ali Martinez offered a contrasting view, warning that BTC may be forming a rising wedge pattern – a bearish technical signal that could lead to downside pressure. If this pattern plays out, Martinez believes BTC could fall back to the critical support level at $79,000.

In addition to chart patterns, macroeconomic tensions continue to loom large. The ongoing tariff disputes are putting pressure on risk assets, including BTC.

Adding to the concerns, Bitcoin recently formed a “death cross” – a bearish technical signal where the 50-day moving average crosses below the 200-day moving average – which may result in further losses. At press time, BTC trades at $85,577, up 1.9% in the past 24 hours.

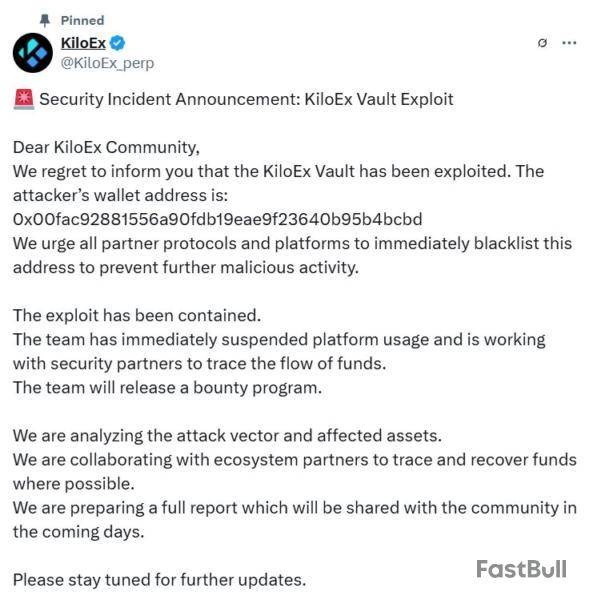

Decentralized exchange KiloEX has confirmed it has suspended usage of its platform and is tracing stolen funds after suffering a $7.5 million exploit.

The exploit has been contained, with use of the platform suspended and an investigation underway, the KiloEX team said in an April 14 statement to X.

“The team has immediately suspended platform usage and is working with security partners to trace the flow of funds,” KiloEX said.

“We are analyzing the attack vector and affected assets. We are collaborating with ecosystem partners to trace and recover funds where possible.”

A bounty program and a full report on how the exploit occurred is also in the works, according to KiloEX.

In an update, the KiloEX team said it was collaborating with BNB Chain, Manta Network, and cybersecurity firms Seal-911, SlowMist and Sherlock in an effort spanning “multiple ecosystems.”

“Our investigation has confirmed that the stolen assets are currently being routed through zkBridge and Meson,” KiloEX said.

“We are urgently attempting to engage with both protocols to halt ongoing transactions and prevent additional losses.”

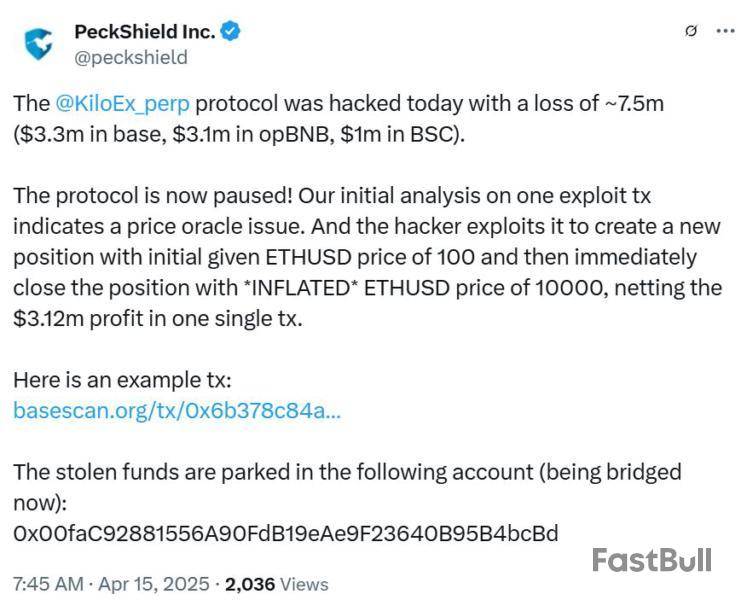

KiloEX attacker exploited price oracle issue, say analysts

Cybersecurity firm PeckShield said in an April 14 post to X the exploiter looted $7.5 million in total, $3.3 million Base, $3.1m opBNB and $1m BSC.

The firm has speculated the exploit is likely a “price oracle issue,” where the information used by a smart contract to determine the price of an asset is manipulated or inaccurate, leading to the exploit.

“Our initial analysis on one transaction exploit indicates a price oracle issue,” PeckShield said.

“The hacker exploits it to create a new position with initial given price of 100 and then immediately close the position with inflated price of 10000, netting the $3.12m profit in one single transaction.”

Chaofan Shou, co-founder of blockchain analytics firm Fuzzland, also weighed in, speculating the exploit was likely due to a price oracle issue.

“Anyone can change the Kilo’s price oracle. They did verify that the caller shall be a trusted forwarder, though, but didn’t verify the forwarded caller,” Shou said.

Shou added it was a “very simple vulnerability” when a user asked about the complexity of the exploit.

The news has sent the KiloEX’s native token, Kilo, plunging over 27% to trade at $0.03596, according to CoinGecko. It’s still down over 78% from its all-time high of $0.1648, which it hit on March 27.

KiloEx was established in 2023 and is backed by Binance Labs, which is a lead investor and strategic partner.

This exploit comes just days after the exchange announced a partnership with Dubai-based Web3 venture capitalist firm DWF Labs on April 13, which promised to expand KiloEx's market presence and accelerate growth.

On March 25, DWF Labs launched a $250 million Liquid Fund to accelerate the growth of mid- and large-cap blockchain projects and drive real-world adoption of Web3 technologies.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up