Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Syscoin’s “Codename Nexus” governance proposal has passed with a 95% approval rating from sentry node operator voters, following extensive community discussions on Discord.

The critical Syscoin 5 upgrade is scheduled to activate at block 2,010,345 on April 8th at 00:30 UTC. The upgrade introduces decentralized sequencing with AI-powered sentry nodes, trustless Bitcoin interoperability, and dynamic governance to the Syscoin blockchain.

SYS Info

Syscoin is a dual-layer blockchain that integrates Bitcoin’s Proof of Work (PoW) consensus mechanism for security and a modified Ethereum Virtual Machine (EVM) for high scalability and smart contract capabilities. It allows the creation of highly scalable Web 3 decentralized applications (DApps) with nearly zero fees.

Syscoin was created through a Bitcoin hard fork and utilizes merged mining with Bitcoin, enabling miners to mine both BTC and Syscoin simultaneously without extra cost. This setup enhances Syscoin’s security by leveraging Bitcoin’s hash power, which mitigates the risk of 51% attacks and prevents double-spending. Syscoin’s UTXO Token Platform, powered by the Z-DAG Protocol, facilitates instant low-fee token transactions with high throughput (30,000 to 145,000 TPS) validated by Bitcoin’s PoW miners.

SYS is the native token of the Syscoin platform, existing in both UTXO and account-based forms. It can be converted into Syscoin Platform Tokens (SPTs) for high throughput transactions via Z-DAG or into ERC-20 tokens via the SYSX Bridge for utilizing NEVM functionalities. SYS is used for paying transaction fees, minting, and transferring SPTs. SYS holders with 100,000 SYS can host masternodes, participating in network governance and earning additional rewards.

GMX will host a community call on March 31st from 13:30 to 15:00 UTC. The session will feature the presentations of proposals by potential bridging and messaging partners for GMX Multichain.

GMX Info

GMX is a decentralized spot and perpetual exchange that supports low swap fees and zero price impact trades.

Trading is supported by a unique multi-asset pool that earns liquidity providers fees from market making, swap fees, leverage trading (spreads, funding fees & liquidations) and asset rebalancing.

Dynamic pricing is supported by Chainlink Oracles along with TWAP pricing from leading volume DEXs.

Arbitrum will host a panel discussion on the intersection of AI and Blockchain on April 10th in Tokyo. The event aims to connect with the local community of developers and discuss advancements in technology.

ARB Info

Arbitrum is a layer 2 scaling solution designed for the Ethereum network. Its goal is to increase the scalability of Ethereum while preserving its decentralization and security.

Arbitrum operates by batching many transactions together off-chain and then submitting a single, combined proof of all these transactions to the Ethereum base layer. This greatly reduces the amount of computation and storage that the Ethereum network has to handle, allowing it to support a much higher throughput of transactions.

It has been an unpredictable few months for the price of Bitcoin and the cryptocurrency market since the start of the year, and even as far back as the election of Donald Trump for his second term as US president. According to data from CoinGecko, the premier cryptocurrency is down by a little over 2% in the past month.

While the monthly record suggests that the price of BTC had a relatively stable past 30 days, March was far from calm, as prices fell deeply at the beginning before somewhat stabilizing around the middle of the month. This level of chaos explains why a group of Bitcoin investors is approaching the market with extra caution.

BTC Short-Term Holders Exiting The Market In Distress?

In a recent Quicktake post on the CryptoQuant platform, crypto analyst IbrahimCosar revealed a shift in the sentiment of a key group of Bitcoin investors over the past few weeks. According to the trader, BTC’s short-term holders (STH) are showing an extreme level of panic and fear in the market.

This on-chain observation is based on the Short-Term Holder Spent Output Profit Ratio (STH-SOPR) metric, which measures the profitability ratio of spent outputs (held for more than 1 hour but less than 155 days). This indicator offers insight into the profitability of the holdings of short-term investors.

The STH-SOPR metric shows if short-term holders are selling at a profit, breakeven, or a loss. A value greater than one means that the short-term investors are selling at a profit, while a value less than one for the metric suggests that most short-term holders are selling at a loss. It is worth noting that when STH-SOPR’s value is one, it implies that investors are moving their coins at neither a profit nor a loss.

According to recent data from CryptoQuant, the STH-SOPR metric has been below the 1 threshold, indicating that short-term holders are offloading their assets at a loss. As highlighted in red in the chart below, this trend of selling at a loss has persisted since the end of January 2025.

Historically, this significant level of loss realization is correlated with periods of extreme panic and fear amongst the Bitcoin investors. Periods of extreme panic have been associated with market bottoms, as it means that weak hands (impulsive traders) exit the market and allow long-term investors to accumulate.

Ultimately, this means that short-term investors selling their coins could be good for the premier cryptocurrency in the long term.

Bitcoin Price At A Glance

As of this writing, the price of BTC stands at around $83,200, reflecting an over 2% increase in the past 24 hours.

Top Stories of The Week

Market is underestimating how quickly Bitcoin will hit new ATH: Analyst

Bitcoin will break past its $109,000 all-time high sooner than expected despite recent volatile US macroeconomic conditions, according to a crypto analyst.

The market may be underestimating how quickly Bitcoin could surge potentially hitting new all-time highs before Q2 is out, Real Vision chief crypto analyst Jamie Coutts told Cointelegraph.

He said this forecast stands regardless of whether or not there is more clarity on US President Donald Trumps tariffs and potential recession concerns.

Trump pardons 3 BitMEX co-founders Report

US President Donald Trump reportedly issued pardons to three co-founders of the cryptocurrency exchange BitMEX, who had pleaded guilty to felony charges.

According to a March 28 CNBC report, Trump granted pardons to Arthur Hayes, Benjamin Delo and Samuel Reed, who were facing a range of criminal charges related to money laundering or violations of the Bank Secrecy Act.

Hayes and Delo pleaded guilty in February 2022, admitting they willfully fail[ed] to establish, implement and maintain an Anti-Money Laundering program at BitMEX, while Reed entered a plea a few weeks later.

Ex-FTX CEO moved to transit facility after interview

Officials with the Federal Bureau of Prisons have moved former FTX CEO Sam Bankman-Fried to a transit facility days after political commentator Tucker Carlson interviewed him.

As of March 27, the bureaus website showed Bankman-Fried was being housed at the Federal Transfer Center in Oklahoma City, suggesting he may be moved from the facility where he was incarcerated while awaiting trial and then moving forward with an appeal of his conviction.

Carlson remotely interviewed Bankman-Fried, commonly known as SBF, from the Metropolitan Detention Center in Brooklyn, New York, on March 5 a reportedly unsanctioned event that resulted in the former FTX CEO being sent to solitary confinement.

UAE expects digital dirham rollout in Q4 2025

The United Arab Emirates expects its digital dirham central bank digital currency to roll out in the fourth quarter of 2025.

According to a report in the Khaleej Times, Central Bank of the UAE Governor Khaled Mohamed Balama said that the blockchain-based currency could improve financial stability and help combat financial crime. According to the report, the retail sector could expect the issuance of a digital dirham in the last quarter of 2025.

It [digital dirham] will further enable the development of innovative digital products, services, and new business models while reducing cost and increasing access to international markets, Balama said.

Onchain sleuth ZachXBT accuses Crypto.com of CRO supply manipulation

Crypto.com is facing criticism from the crypto community after reissuing 70 billion Cronos tokens burned in 2021. Critics said the move undermines the principles of decentralization and transparency in the cryptocurrency space.

The controversy erupted on March 25 after pseudonymous onchain investigator ZachXBT posted on X, accusing Crypto.com of reissuing Cronos tokens that had been declared permanently removed from circulation. CRO is no different from a scam, ZachXBT said, claiming the reissued amount represented 70% of the total supply and contradicted the communitys expectations.

Your team just reissued 70B CRO a week ago that was previously burned forever in 2021 (70% total supply) and went against the community wishes as you control majority of the supply, he added.

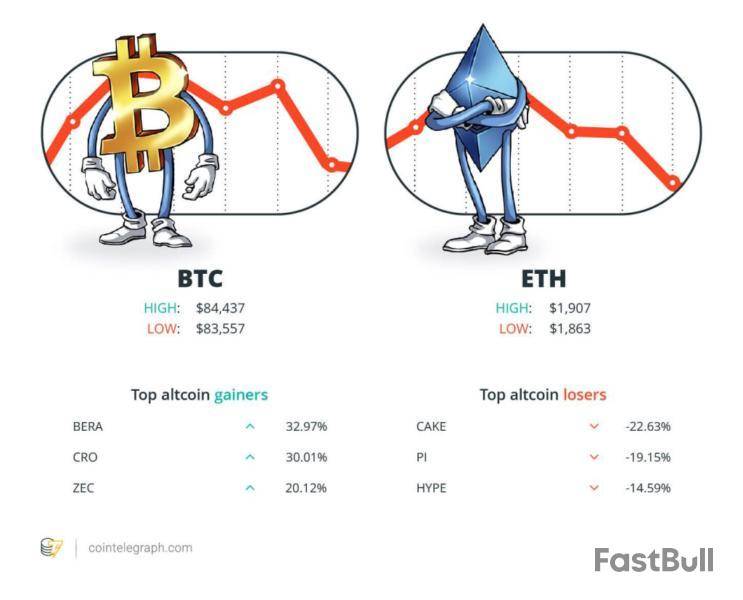

Winners and Losers

At the end of the week, Bitcoin (BTC) is at $84,437, Ether (ETH) at $1,907 and XRP at $2.21. The total market cap is at $2.74 trillion, according to CoinMarketCap.

Among the biggest 100 cryptocurrencies, the top three altcoin gainers of the week are Berachain (BERA) at 32.97%, Cronos (CRO) at 30.01% and ZCash (ZEC) at 20.12%.

The top three altcoin losers of the week are PancakeSwap (CAKE) at 22.63%, Pi (PI) at 19.15% and Hyperliquid (HYPE) at 14.59%. For more info on crypto prices, make sure to read Cointelegraphs market analysis.

Most Memorable Quotations

They used every tool available to attempt to stifle us, restricting access to banking, auditors, investors, and beyond. It was a calculated attempt to put an end to the industry.

Kris Marszalek, CEO of Crypto.com

Hyperliquid may be on track to become FTX 2.0.

Gracy Chen, CEO of Bitget

After a year of fighting, this threat to digital ownership rights has finally been put to rest.

Robbie Ferguson, co-founder of Immutable

I bet $BTC hits $110k before it retests $76.5k. Y? The Fed is going from QT to QE for treasuries. And tariffs dont matter cause of transitory inflation.

Arthur Hayes, co-founder and former CEO of BitMEX

Ethereum’s holders have now brought the available supply on exchanges down to 8.97M, the lowest amount in nearly 10 years (November, 2015).

Santiment

Its super fun seeing people love images in ChatGPT but our GPUs are melting. We are going to temporarily introduce some rate limits while we work on making it more efficient.

Sam Altman, CEO of OpenAI

Prediction of The Week

XRP price may drop another 40% as Trump tariffs spook risk traders

The XRP market is flashing warning signs as a bearish technical pattern emerges on its weekly chart, coinciding with macroeconomic pressures from anticipated US tariffs in April.

Since its late 2024 rally, the XRP price chart has been forming a potential triangle pattern on its weekly chart, characterized by a flat support level mixed with a downward-sloping resistance line.

Read also Features Can Crypto be Swedens Savior? Features Comeback 2025: Is Ethereum poised to catch up with Bitcoin and Solana?A descending triangle pattern forming after a strong uptrend is seen as a bearish reversal indicator. As a rule, the setup resolves when the price breaks below the flat support level and falls by as much as the triangles maximum height.

As of March 28, XRP was testing the triangles support for a potential breakdown move. In this case, the price may fall toward the downside target at around $1.32 by April, down 40% from current price levels.

FUD of The Week

Lazarus Groups 2024 pause was repositioning for $1.4B Bybit hack

North Korea-affiliated hackers may have scaled back their operations in the second half of 2024 while preparing for what became the largest crypto hack in history.

The crypto industry was rocked by the enormous hack on Feb. 21 when Bybit lost over $1.4 billion to the infamous North Korean Lazarus Group, which seems to have prepared the attack months in advance.

According to blockchain analytics firm Chainalysis, illicit activity tied to North Korean cyber actors sharply declined after July 1, 2024, despite a surge in attacks earlier that year.

The slowdown in crypto hacks by North Korean agents had raised significant red flags, according to Eric Jardine, Chainalysis cybercrimes research lead.

Coffeezilla shouldnt duck Logan Paul suit over CryptoZoo claims: Judge

Influencer Logan Paul should be allowed to continue a lawsuit accusing YouTuber Stephen Findeisen, also known as Coffeezilla, of making defamatory remarks about Pauls failed CryptoZoo project, a Texas magistrate judge said.

Read also Features Could a financial crisis end cryptos bull run? Features THORChain founder and his plan to vampire attack all of DeFiIn a March 26 report filed in a San Antonio federal court, Magistrate Judge Henry Bemporad recommended that Federal Judge Orlando Garcia, overseeing the case, deny Findeisens bid to toss Pauls lawsuit, as Findeisen presented his claims more akin to facts than mere opinion.

At the pleading stage, Plaintiff [Paul] has sufficiently alleged that the statements at issue in this case are reasonably capable of defamatory meaning and are not unactionable opinions, Bemporad wrote.

Darkweb actors claim to have over 100K of Gemini, Binance user info

Darkweb threat actors claim to have hundreds of thousands of user records including names, passwords and location data of Gemini and Binance users, putting the apparent lists up for sale on the internet.

The Dark Web Informer, a Darkweb cyber news site, said in a March 27 blog post that the latest sale is from a threat actor operating under the handle AKM69, who purportedly has an extensive list of private user information from users of crypto exchange Gemini.

The database for sale reportedly includes 100,000 records, each containing full names, emails, phone numbers, and location data of individuals from the United States and a few entries from Singapore and the UK, the Dark Web Informer said.

Top Magazine Stories of The Week

Arbitrum co-founder skeptical of move to based and native rollups: Steven Goldfeder

Despite reports to the contrary, Arbitrum doesnt sound as if it will embrace based or native rollups any time soon, according to co-founder Steven Goldfeder.

Chernobyl needed to wake people to AI risks, Studio Ghibli memes: AI Eye

A Chernobyl-level event might alert humans to the risks of AGI, humanoid robots tested in homes, and Indian call centers get an American accent makeover with AI.

Bitcoiner sex trap extortion? BTS firms blockchain disaster: Asia Express

Viral crypto influencers Bitcoin seduction campaign draws heat, BTS firms embarrassing blockchain flop shuttered, and more.

Subscribe The most engaging reads in blockchain. Delivered once a week.Email address

SUBSCRIBE

A crypto analyst predicts that the popular meme coin, Dogecoin, could be up for a potential price surge, seeing the token reach $1.

Market expert Henry said the meme coin could be gearing up for a possible “huge breakout” as shown in recent chart patterns.

Breakout Might Be Coming

Henry declared in an X post that Dogecoin could experience a price rally any time soon after the analyst examined the meme coin’s price movement.

There is so much uncertainty and negative sentiment in the broader cryptocurrency market today, but many investors have maintained their positive outlook on the coin as it showed some flashes of strength this week.

Henry@LordOfAltsMar 26, 2025$DOGE huge breakout starting imo.

Last time It did similar thing was at Sep 24.

50¢ next, then $1.00

Trust the cycle pic.twitter.com/q7oiQTkOjg

The crypto analyst forecasts that recent chart patterns revealed that the popular meme coin is up for a potential surge. “$DOGE huge breakout starting,” Henry said in a post, a prediction that can bring a great deal of excitement among traders. The analyst added that the last time Doge was in a similar situation was on September 24.

Dogecoin Could Hit $1

Henry presented a chart in a post that illustrates the price movement of Dogecoin, saying that the meme coin could be heading for a huge breakout.

According to the crypto analyst, if investors would look closely in the chart, they will observe that DOGE has broken out of a triangle flag pattern on the daily candle chart, noting that the meme coin has been locked in the triangle flag pattern since December 2024.

Henry interpreted this pattern as an indication that Dogecoin could be up for a price increase, saying that the coin might be moving towards the $0.50 mark.

The crypto analyst suggested that after DOGE reaches the $0.50 mark, the meme coin could surge further to hit the all-time high of $1, noting that the coin needs to hold above the top of the pattern to achieve this milestone.

At the time of writing, Dogecoin is traded at $0.173 per coin, down by 4.6% in the last 24 hours. It seems the meme coin could be retesting this pattern.A Similar Pattern In September

The crypto analyst said that historically, DOGE experienced a similar price action in September 2024, noting that it broke out of an extended correction that started in March 2024.

Henry emphasized that investors saw during the September 2024 breakout over a 400% surge in the coin’s price that it went above $0.48.

For DOGE to hit $1, it needs to have a 450% increase.

Featured image from Gemini Imagen, chart from TradingView

Maya Protocol's recent sharding upgrade could significantly impact its price by improving network performance. Sharding allows the blockchain to manage more transactions simultaneously, increasing speed and security. This change can attract more users and developers, boosting demand for CACAO. Better scalability and safer cross-chain trading are potential catalysts for price gains. Nonetheless, the actual market response will depend on user adoption and blockchain activity following the upgrade. Watch how this impacts transaction efficiency in the coming months. source

Maya Protocol@Maya_ProtocolMar 29, 2025Maya’s Sharding Upgrade is Here!

But first, what is sharding?

It’s a blockchain scaling technique that splits the network into smaller, parallel pieces, enhancing speed and security.

For us this means: 2 Asgards per chain, more validators, better scalability, and faster,…

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up