Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)A:--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

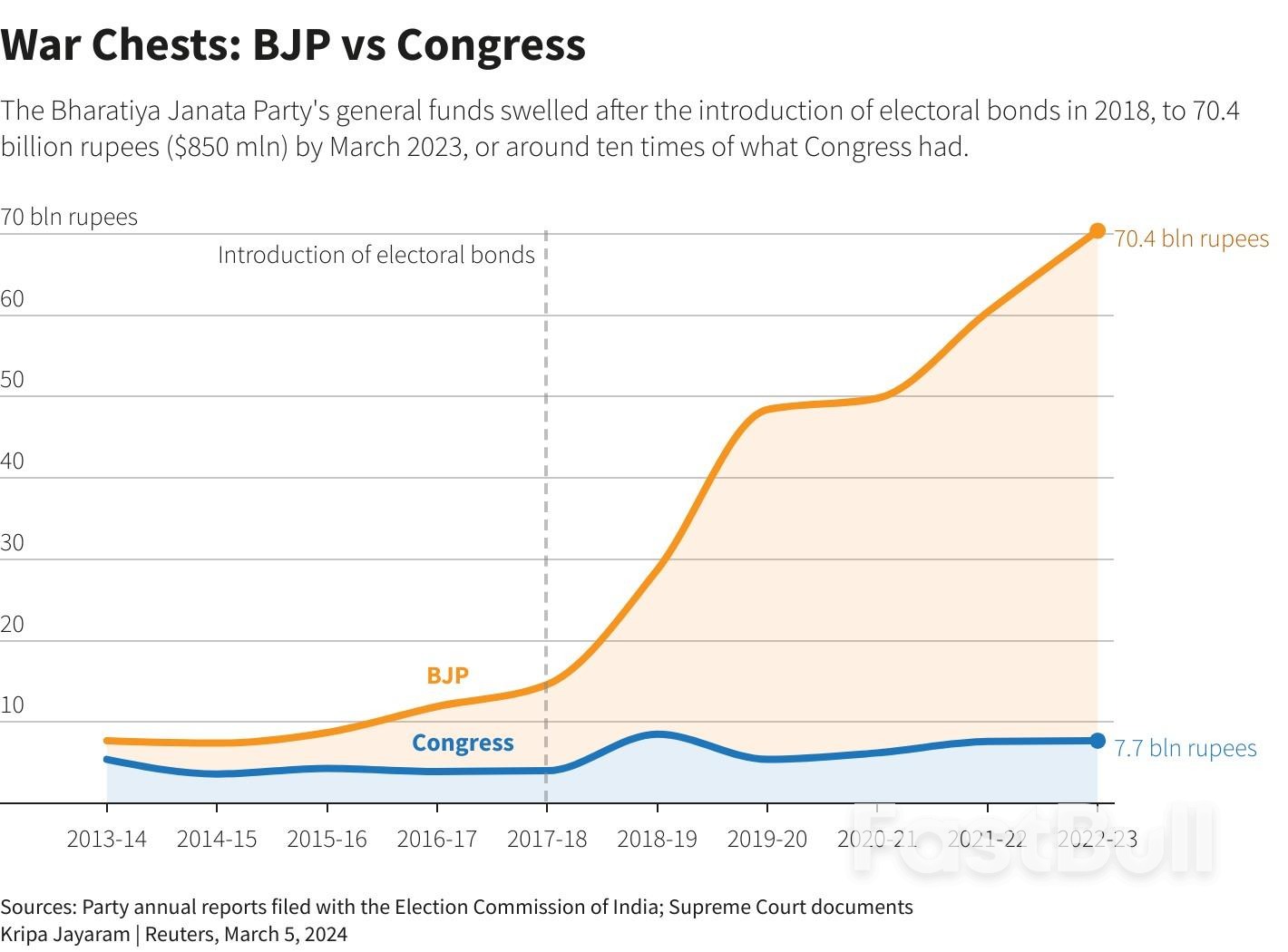

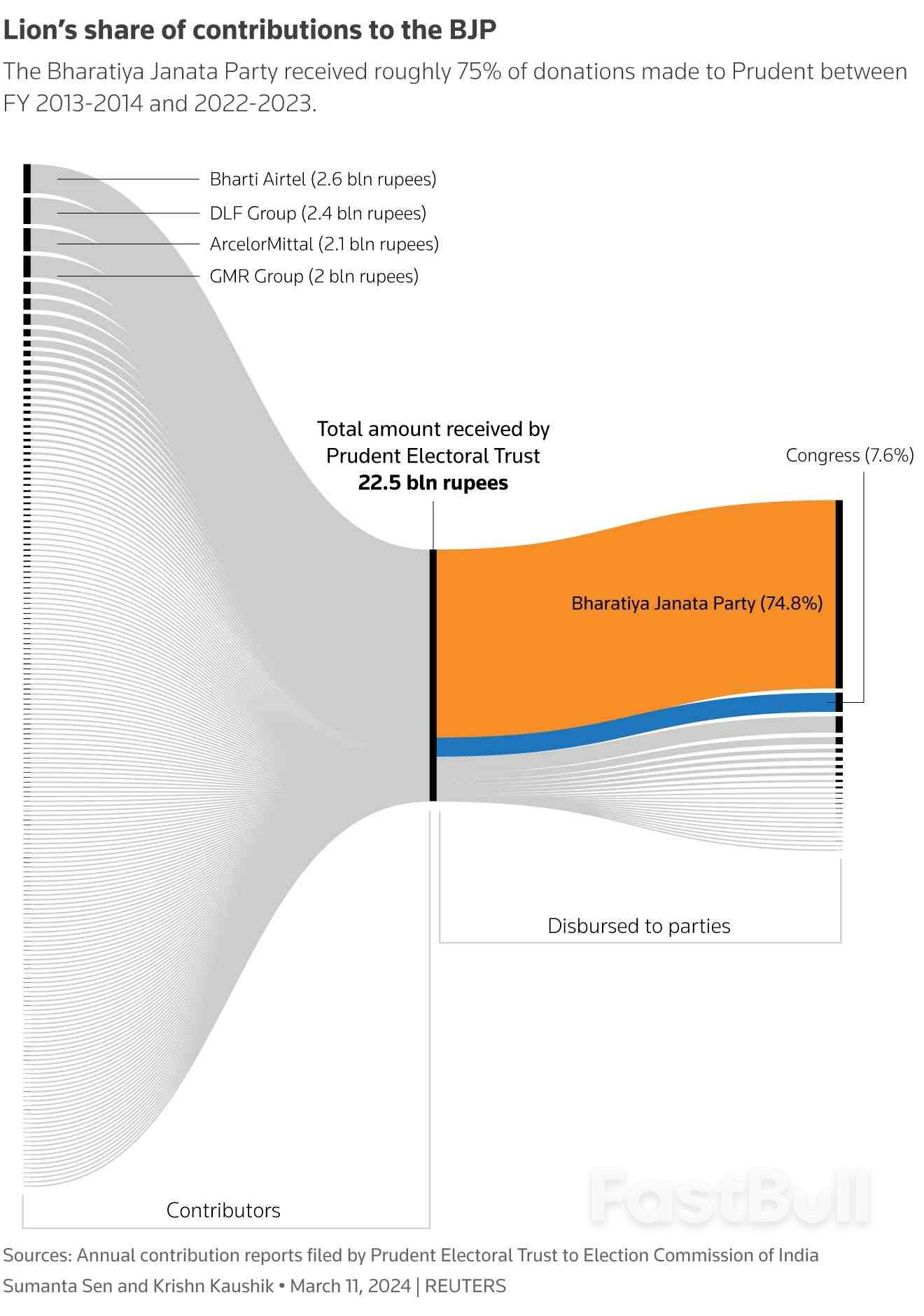

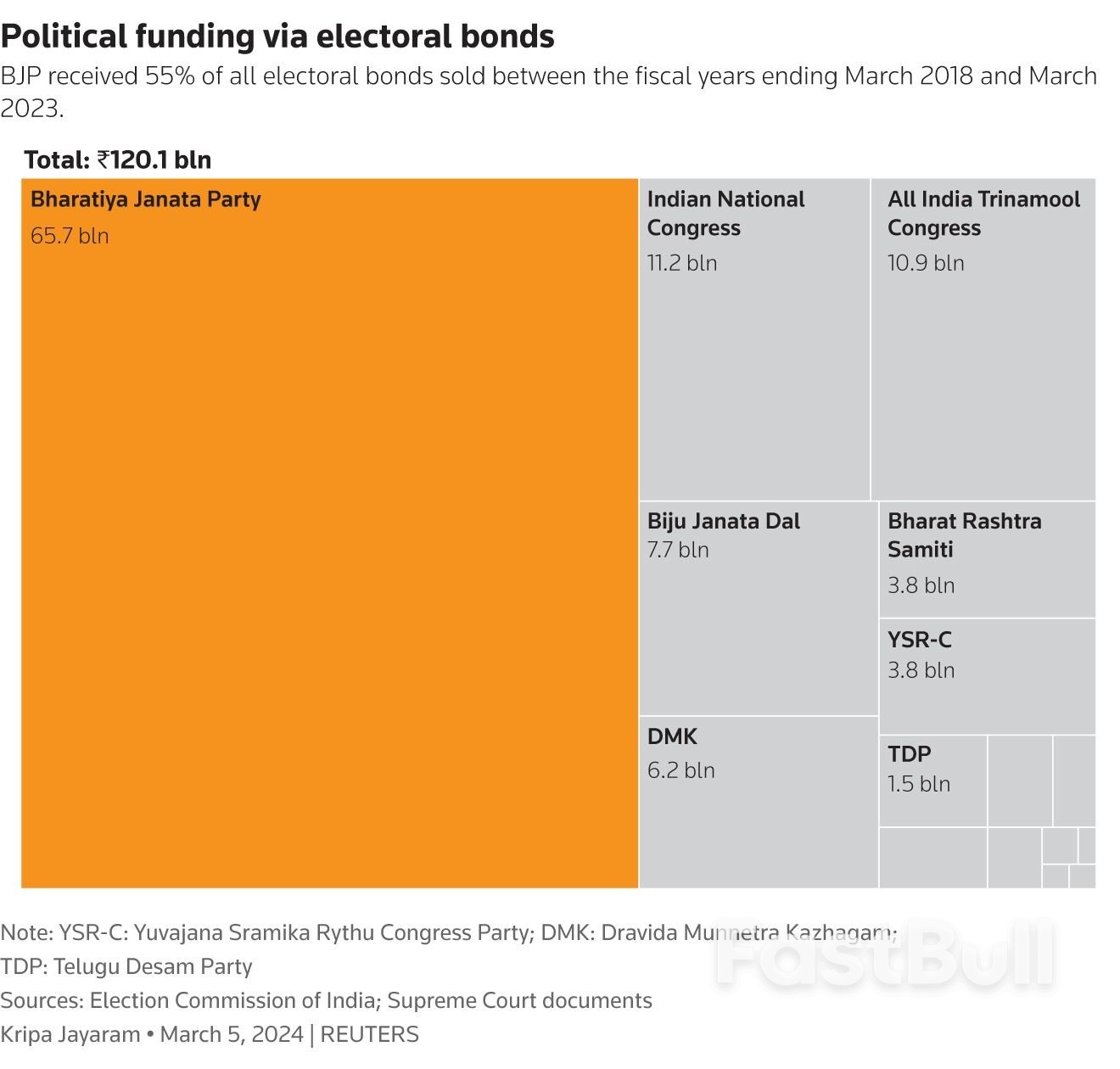

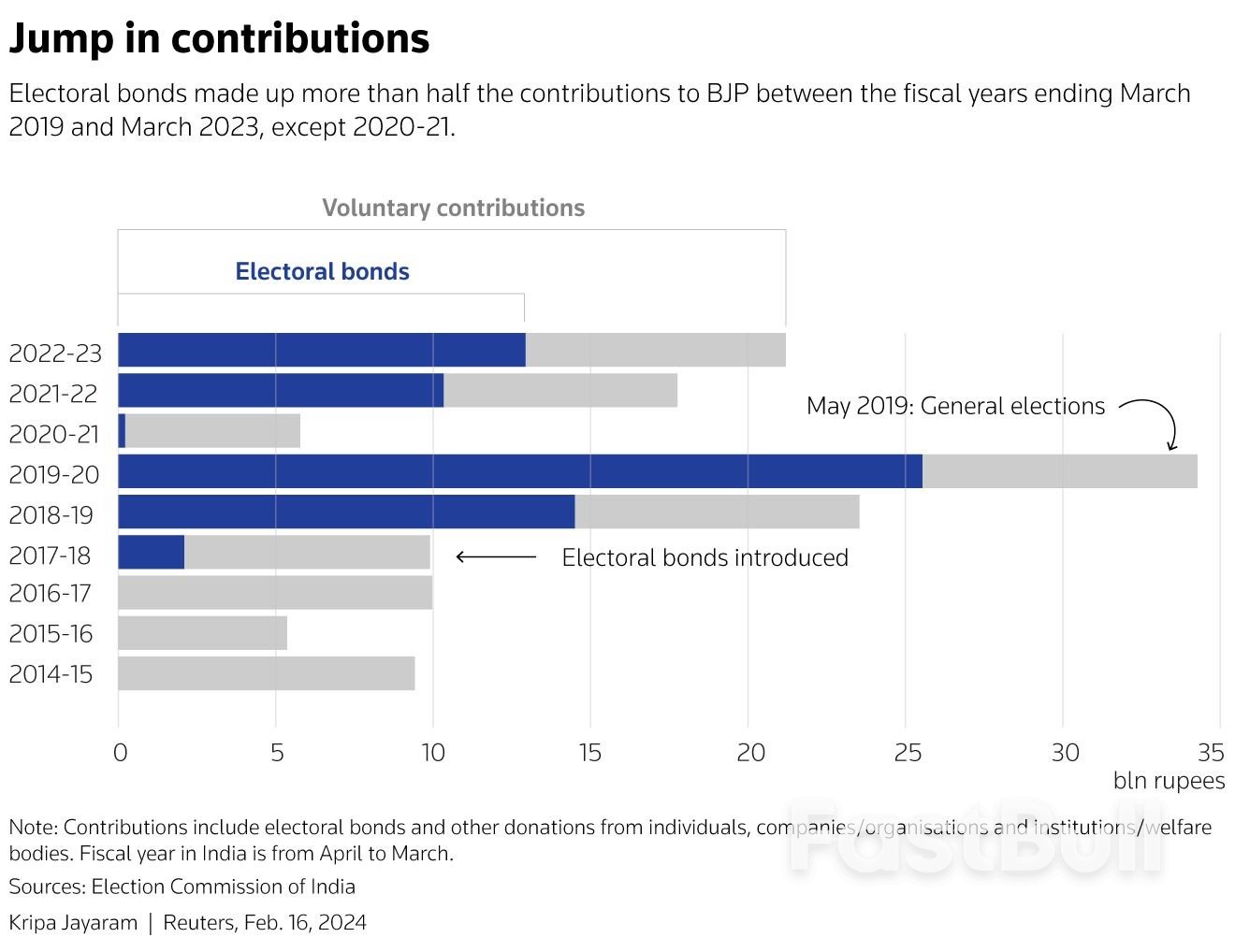

The Prudent Electoral Trust has raised $272 million since its creation in 2013, funnelling roughly 75% of that to Prime Minister Narendra Modi's party...

Layer of Separation

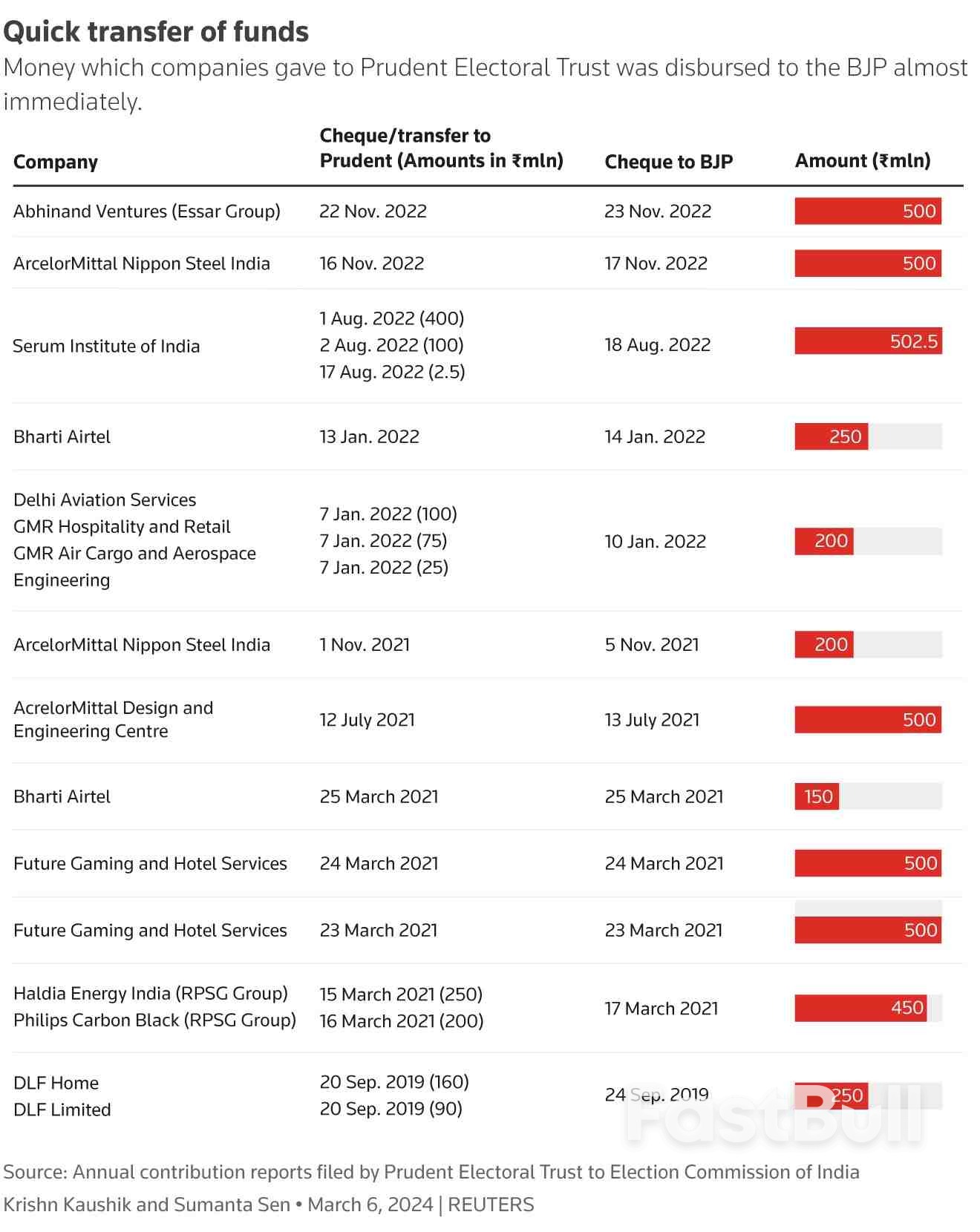

Layer of Separation Near-Instant Transfers

Near-Instant Transfers Donations from Serum Institute and companies in GMR Group, DLF Ltd and Essar Group moved to BJP immediately after Prudent received them.

Donations from Serum Institute and companies in GMR Group, DLF Ltd and Essar Group moved to BJP immediately after Prudent received them. Cause of concern?

Cause of concern?

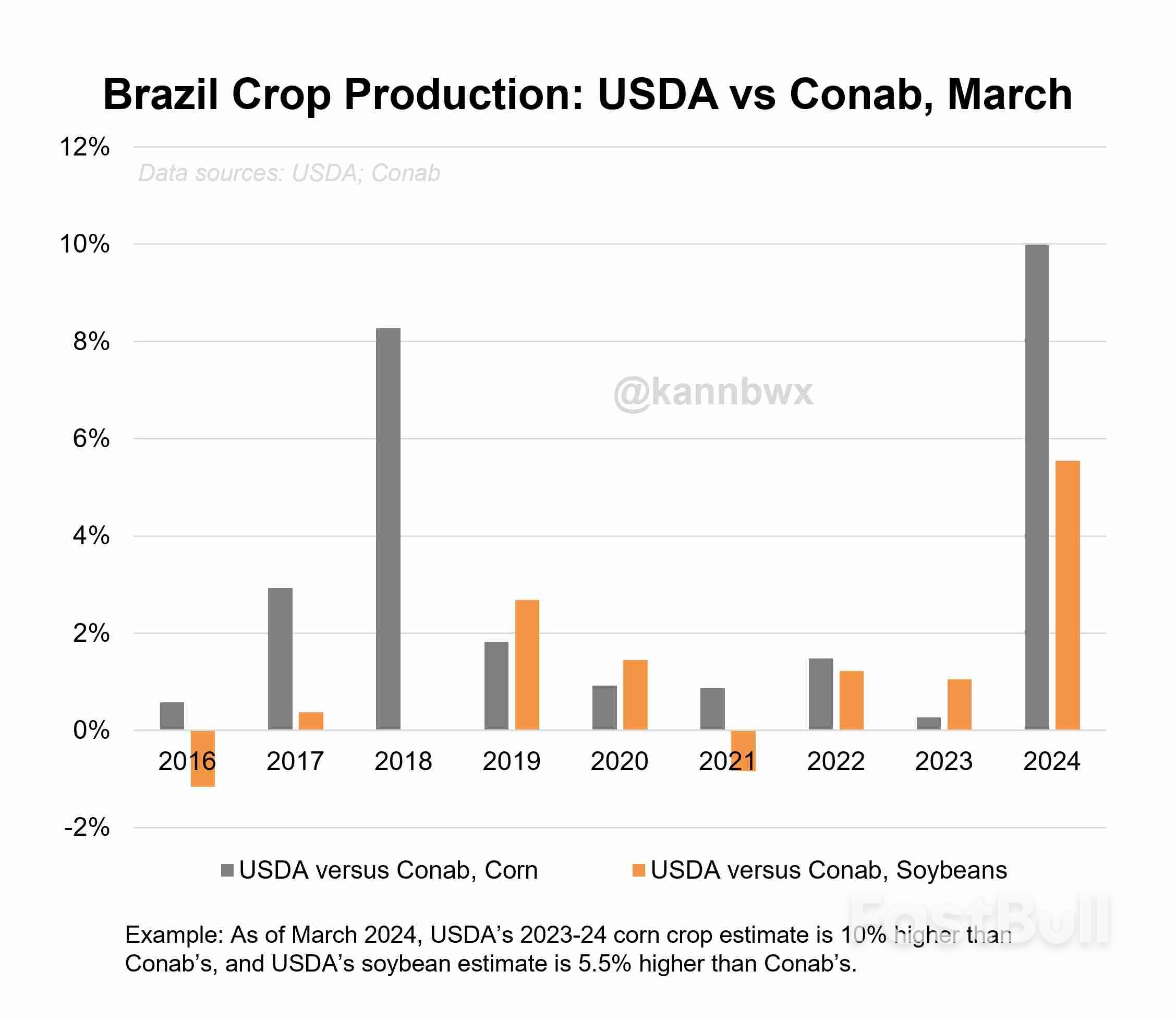

The year-on-year implications are more consistent, suggesting some overlapping assumptions. USDA sees Brazil’s 2023-24 bean harvest down 4.3% on the year while Conab’s figures suggest a 5% decline.

The year-on-year implications are more consistent, suggesting some overlapping assumptions. USDA sees Brazil’s 2023-24 bean harvest down 4.3% on the year while Conab’s figures suggest a 5% decline.

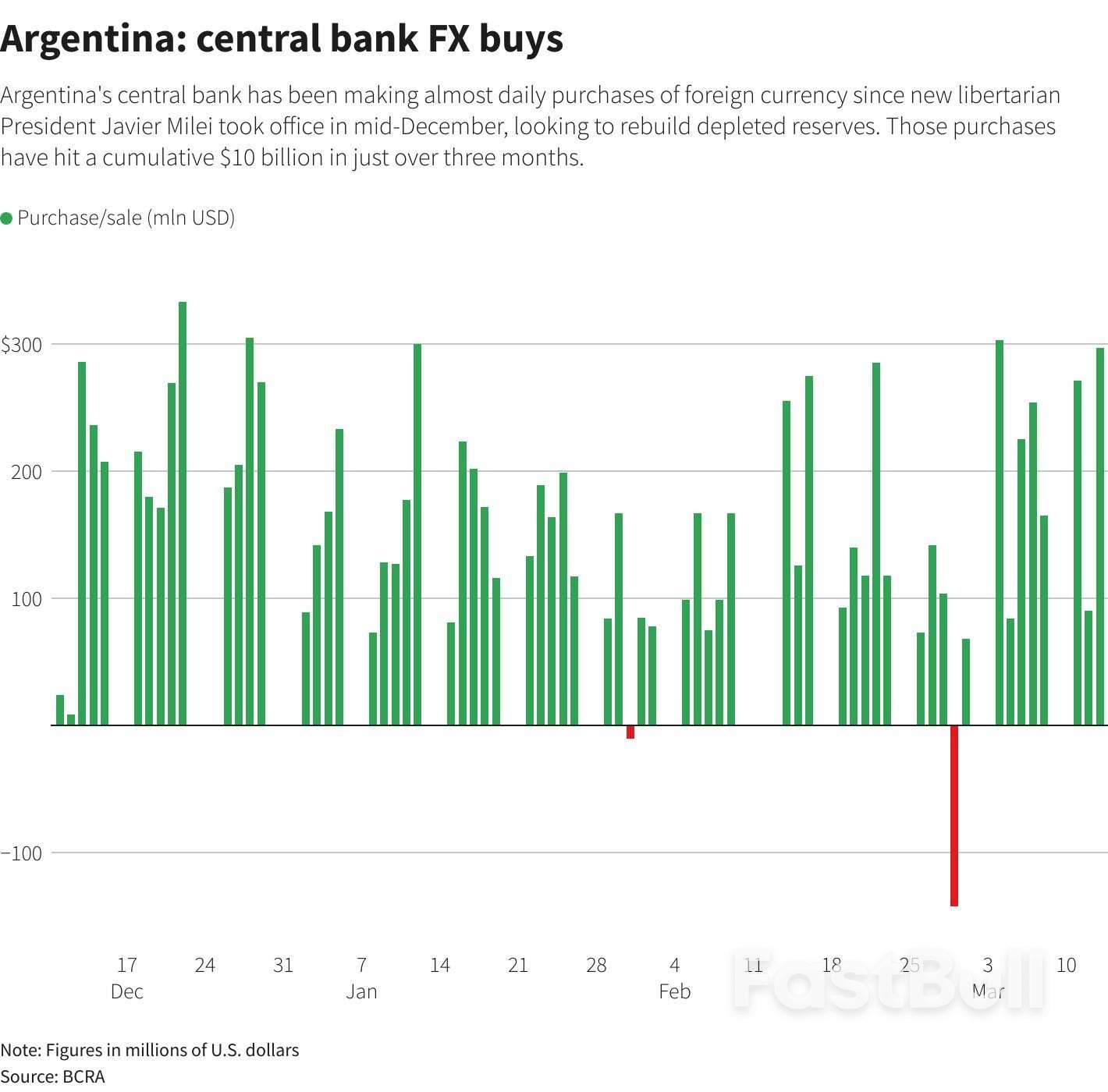

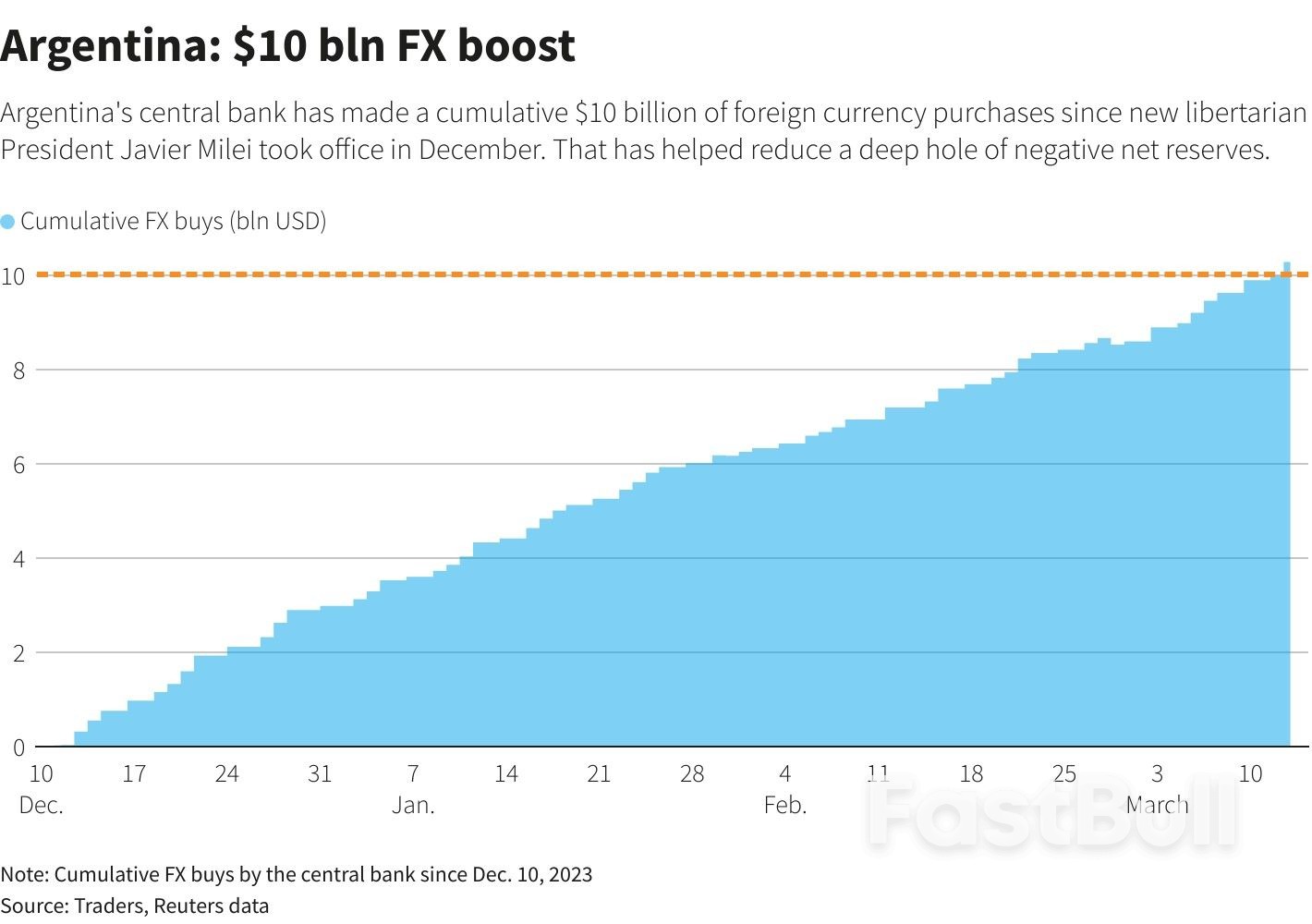

That accumulation has also come amid a tough austerity and cost-cutting drive by Milei, which has dampened economic activity, growth and production, weighing on demand for dollars from companies and individuals. Inflation is also over 275%.

That accumulation has also come amid a tough austerity and cost-cutting drive by Milei, which has dampened economic activity, growth and production, weighing on demand for dollars from companies and individuals. Inflation is also over 275%. Mediterranean Foundation said the improvement in reserves and calmer markets had pushed up dollar deposits at banks, which fell last year during election uncertainty. They have climbed to $16.5 billion from $14.1 billion when Milei took office.

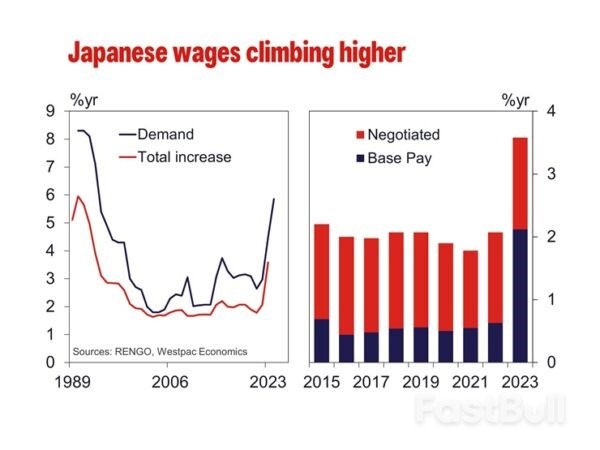

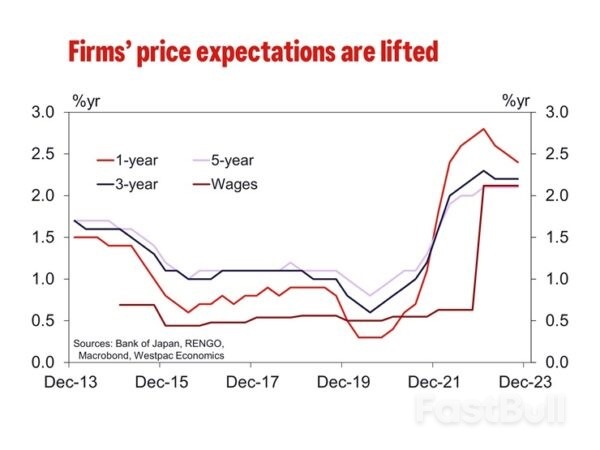

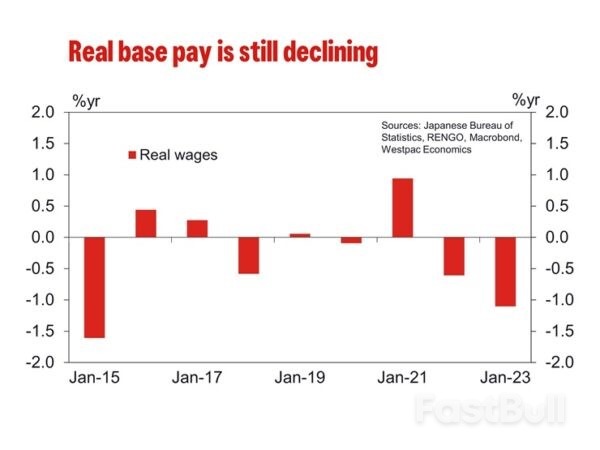

Mediterranean Foundation said the improvement in reserves and calmer markets had pushed up dollar deposits at banks, which fell last year during election uncertainty. They have climbed to $16.5 billion from $14.1 billion when Milei took office. As of 2023 Q4, the inflation outlook for 1, 3 and 5 years came to 2.4%, 2.2% and 2.1% respectively. While still above the circa 1% average for all three time periods 2014 to 2019, it is also materially below where inflation has been. Still-elevated current inflation expectations may support wage growth in the near-term, but this effect looks set to dissipate as actual inflation prints come in weaker.

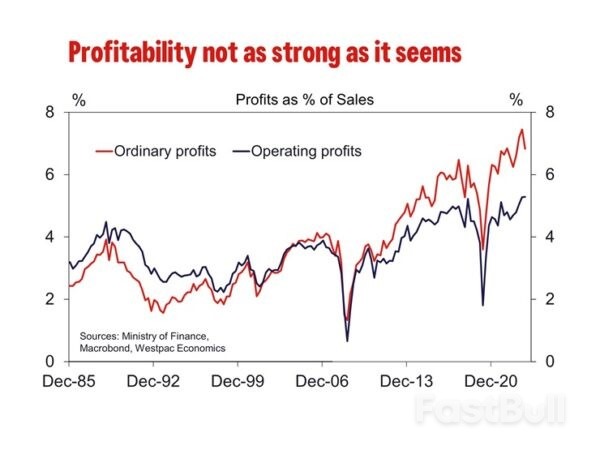

As of 2023 Q4, the inflation outlook for 1, 3 and 5 years came to 2.4%, 2.2% and 2.1% respectively. While still above the circa 1% average for all three time periods 2014 to 2019, it is also materially below where inflation has been. Still-elevated current inflation expectations may support wage growth in the near-term, but this effect looks set to dissipate as actual inflation prints come in weaker. Rising profitability has also been used to argue for stronger wage growth in 2024 with a focus on strength in ordinary profits. However, operating profits are only slightly above the pre-COVID peak and below the 10-year pre-COVID trend. Operating profit as a share of sales are also relatively unimpressive, hovering around pre-COVID rates. The disparity between operating profits, which do not include investment-related income, and ordinary profits implies profitability is being flattered by financial investment returns not firms' underlying profitability. It is only the latter that would given businesses confidence to increase wages at or above the rate of inflation.

Rising profitability has also been used to argue for stronger wage growth in 2024 with a focus on strength in ordinary profits. However, operating profits are only slightly above the pre-COVID peak and below the 10-year pre-COVID trend. Operating profit as a share of sales are also relatively unimpressive, hovering around pre-COVID rates. The disparity between operating profits, which do not include investment-related income, and ordinary profits implies profitability is being flattered by financial investment returns not firms' underlying profitability. It is only the latter that would given businesses confidence to increase wages at or above the rate of inflation. Rather than being a support for wage growth, beyond 2024, we expect structural factors to act at a headwind for sustained wages growth. In Japan, wage increases depend on seniority, so job mobility is low and companies typically find it unnecessary to raise wages to retain staff. This also disincentivises employees from reskilling or making career changes into higher growth areas. In 2016, then Govenor Kuroda outlined low job mobility as a key challenge for the labour market and the country's growth potential.

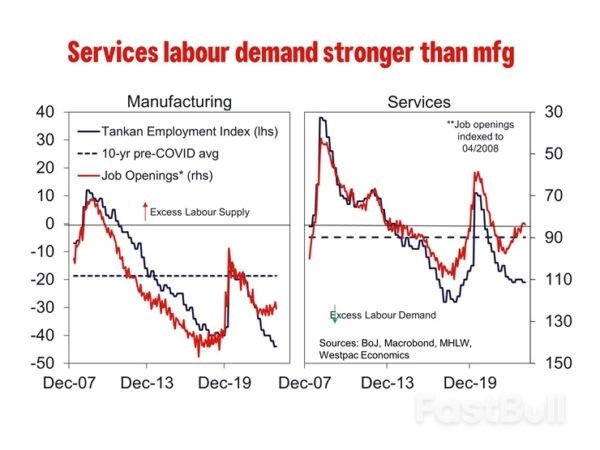

Rather than being a support for wage growth, beyond 2024, we expect structural factors to act at a headwind for sustained wages growth. In Japan, wage increases depend on seniority, so job mobility is low and companies typically find it unnecessary to raise wages to retain staff. This also disincentivises employees from reskilling or making career changes into higher growth areas. In 2016, then Govenor Kuroda outlined low job mobility as a key challenge for the labour market and the country's growth potential. Further, participation has recently been rising thanks to a growing cohort of part-time workers, primarily women and those aged 65 and above. Wage growth is slower for part time workers, and the loss of tax and social benefits for secondary income earners dissaude many from labour market and the country's growth potential.

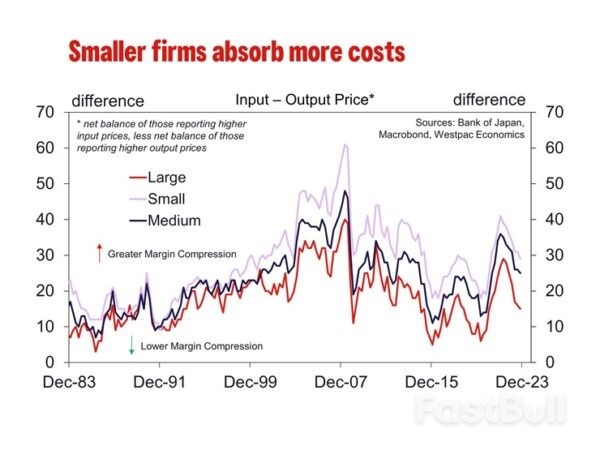

Further, participation has recently been rising thanks to a growing cohort of part-time workers, primarily women and those aged 65 and above. Wage growth is slower for part time workers, and the loss of tax and social benefits for secondary income earners dissaude many from labour market and the country's growth potential. Small businesses have been particularly unenthusiastic about raising wages. As an example, a survey completed by Johnan Shinkin Bank and the Tokyo Shimbun daily reported 72.8% of small and medium-sized businesses in the Tokyo metropolitan area said they ” have no plans to raise wages this year”. Smaller employers tend to make up the bulk of employers and so can have a significant effect on aggregate outcomes. Their reluctance is arguably principally due to an inability to pass on higher costs to consumers, particularly when households are price sensitive as they are now, but also as they are much less able to scale up and therefore benefit from efficiency and large markets.

Small businesses have been particularly unenthusiastic about raising wages. As an example, a survey completed by Johnan Shinkin Bank and the Tokyo Shimbun daily reported 72.8% of small and medium-sized businesses in the Tokyo metropolitan area said they ” have no plans to raise wages this year”. Smaller employers tend to make up the bulk of employers and so can have a significant effect on aggregate outcomes. Their reluctance is arguably principally due to an inability to pass on higher costs to consumers, particularly when households are price sensitive as they are now, but also as they are much less able to scale up and therefore benefit from efficiency and large markets. One segment of the labour market that is showing increasing wages is younger Japanese workers. They are more likely to have in demand skills, particularly for high-skill work, and are also more likely to job hop being early in their careers. As such, wage gains are thought to be skewed towards younger workers. BoJ research also shows that wages for high skill workers are increasing. However given Japan's ageing population and weak immigration program, young people make up a small fraction of the labour force, so wage gains in this cohort is unlikely to drive aggregate wage gains or consumption.

One segment of the labour market that is showing increasing wages is younger Japanese workers. They are more likely to have in demand skills, particularly for high-skill work, and are also more likely to job hop being early in their careers. As such, wage gains are thought to be skewed towards younger workers. BoJ research also shows that wages for high skill workers are increasing. However given Japan's ageing population and weak immigration program, young people make up a small fraction of the labour force, so wage gains in this cohort is unlikely to drive aggregate wage gains or consumption.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up